Question: Problem Solving Questions (10 marks*2 = 20 marks) 1. Using the information below, find the following: (a) Tier 1 risk-based capital ratio and total risk

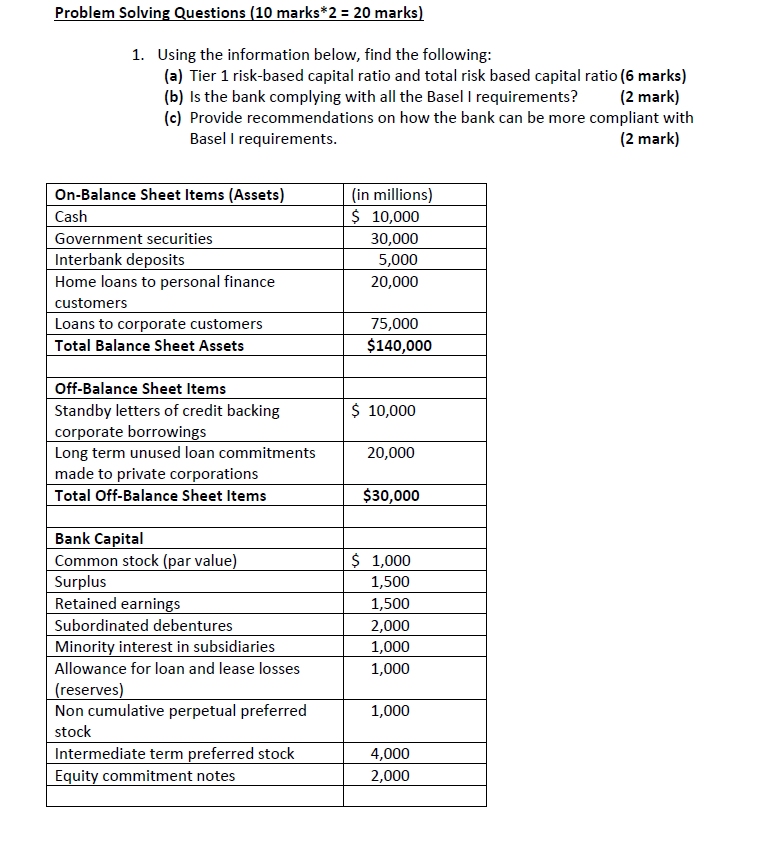

Problem Solving Questions (10 marks*2 = 20 marks) 1. Using the information below, find the following: (a) Tier 1 risk-based capital ratio and total risk based capital ratio (6 marks) (b) is the bank complying with all the Basel I requirements? (2 mark) (c) Provide recommendations on how the bank can be more compliant with Basel I requirements. (2 mark) On-Balance Sheet Items (Assets) Cash Government securities Interbank deposits Home loans to personal finance customers Loans to corporate customers Total Balance Sheet Assets (in millions) $ 10,000 30,000 5,000 20,000 75,000 $140,000 $ 10,000 Off-Balance Sheet Items Standby letters of credit backing corporate borrowings Long term unused loan commitments made to private corporations Total Off-Balance Sheet Items 20,000 $30,000 Bank Capital Common stock (par value) Surplus Retained earnings Subordinated debentures Minority interest in subsidiaries Allowance for loan and lease losses (reserves) Non cumulative perpetual preferred stock Intermediate term preferred stock Equity commitment notes $ 1,000 1,500 1,500 2,000 1,000 1,000 1,000 4,000 2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts