Question: 2. Using the information in Table 4.1 and the financial statement information for Avon Products below, calculate the following ratios for Avon for both 2008

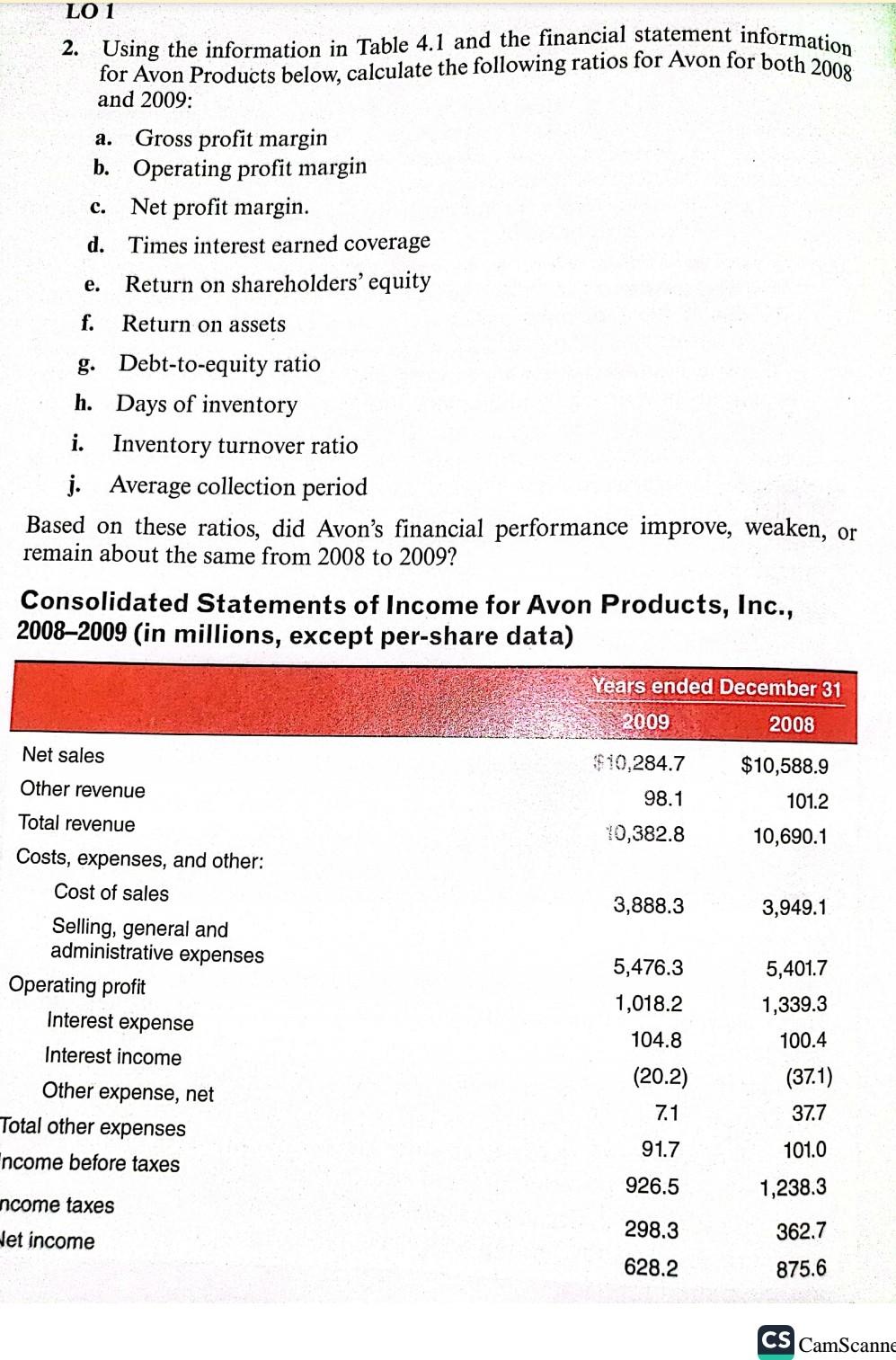

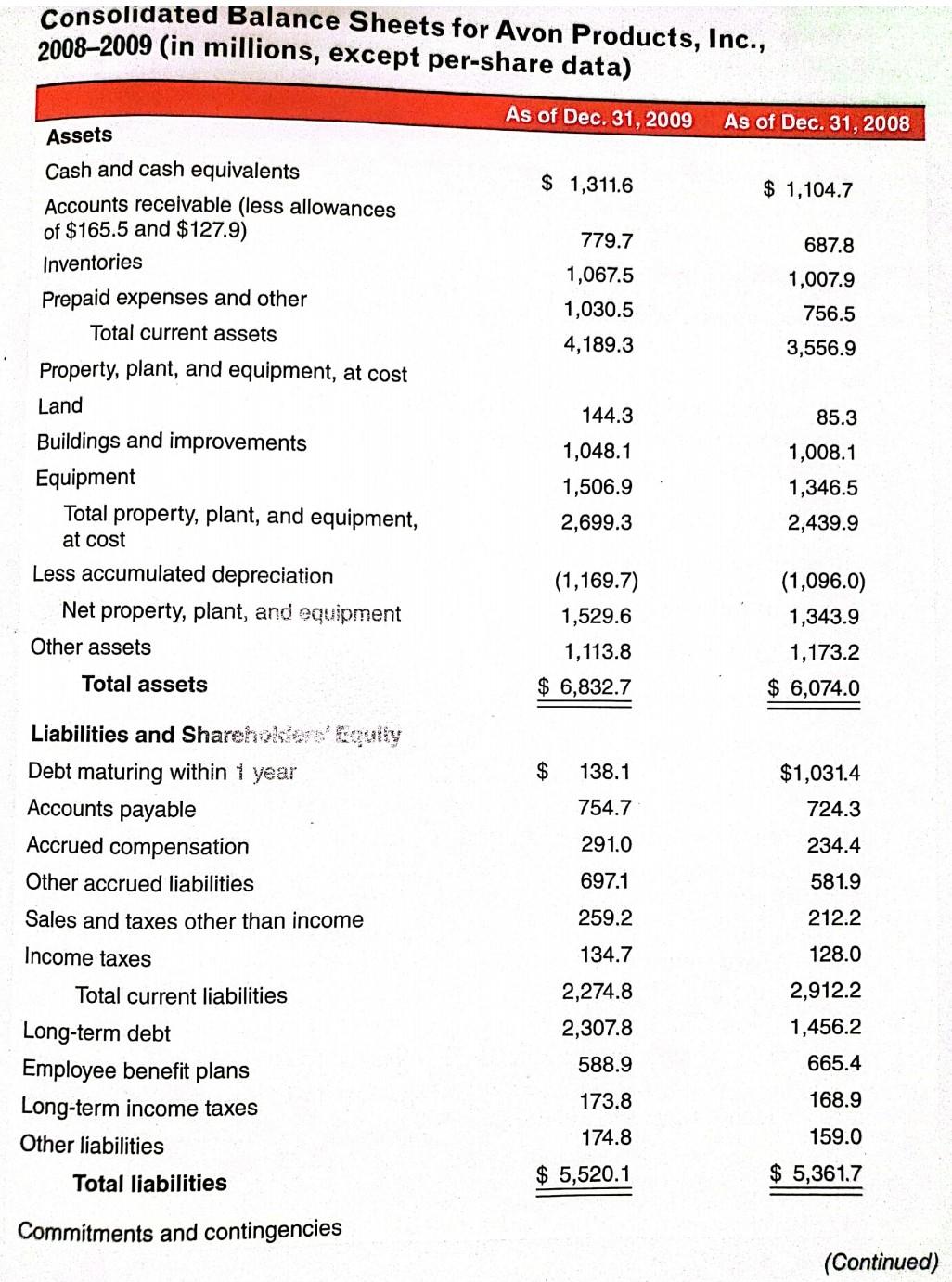

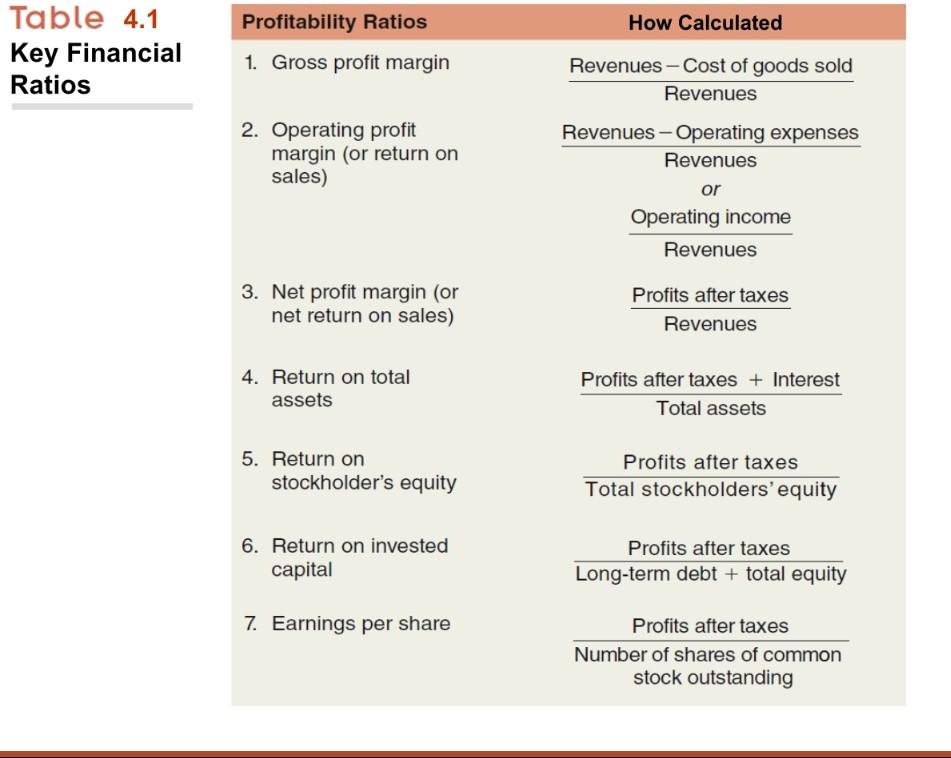

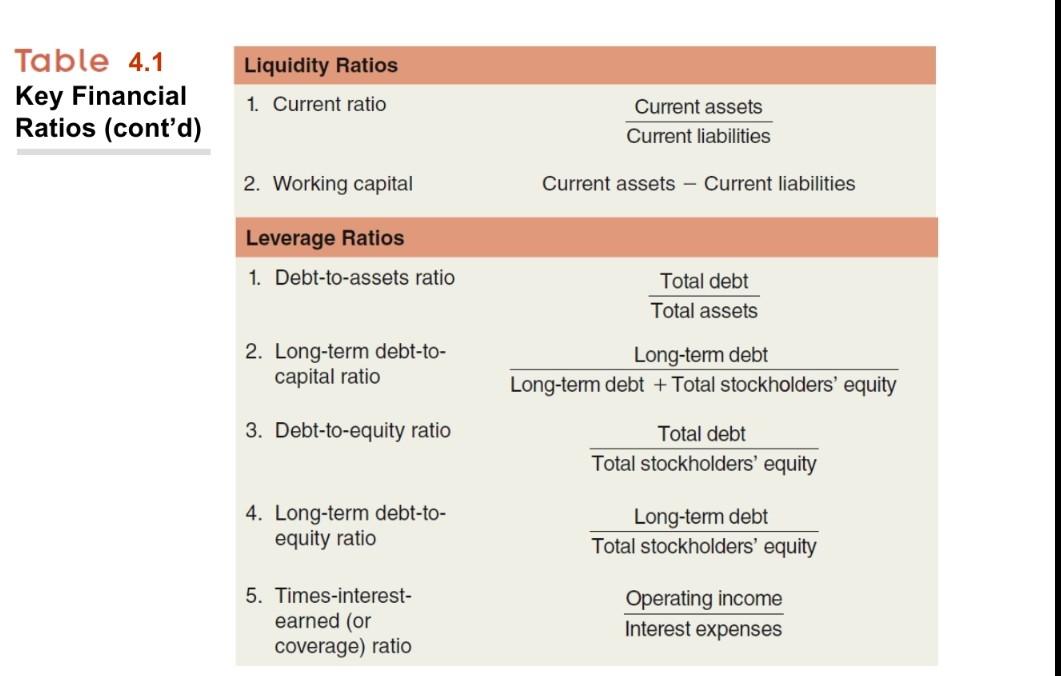

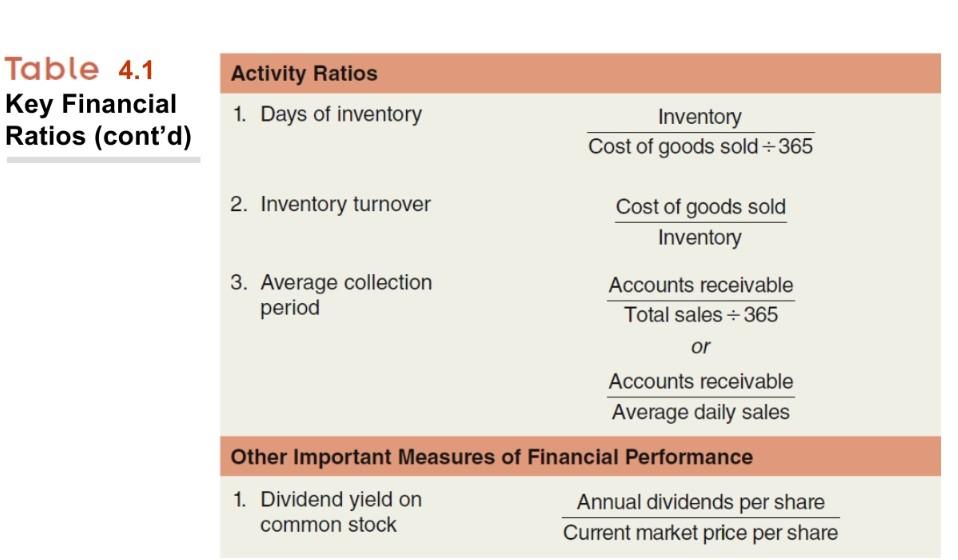

2. Using the information in Table 4.1 and the financial statement information for Avon Products below, calculate the following ratios for Avon for both 2008 and 2009: a. Gross profit margin b. Operating profit margin c. Net profit margin. d. Times interest earned coverage e. Return on shareholders' equity f. Return on assets g. Debt-to-equity ratio h. Days of inventory i. Inventory turnover ratio j. Average collection period Based on these ratios, did Avon's financial performance improve, weaken, or remain about the same from 2008 to 2009? Consolidated Statements of Income for Avon Products, Inc., 2008-2009 (in millions, except per-share data) Consolidated Balance Sheets for Avon Products, Inc., 2008-2009 (in millions, except per-share data) Table 4.1 Key Financial Ratios Table 4.1 Key Financial Ratios (cont'd) Table 4.1 Key Financial Ratios (cont'd)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts