Question: LO 1 2. Using the information in Table 4.1 and the financial statement information for Avon Products below, calculate the following ratios for Avon for

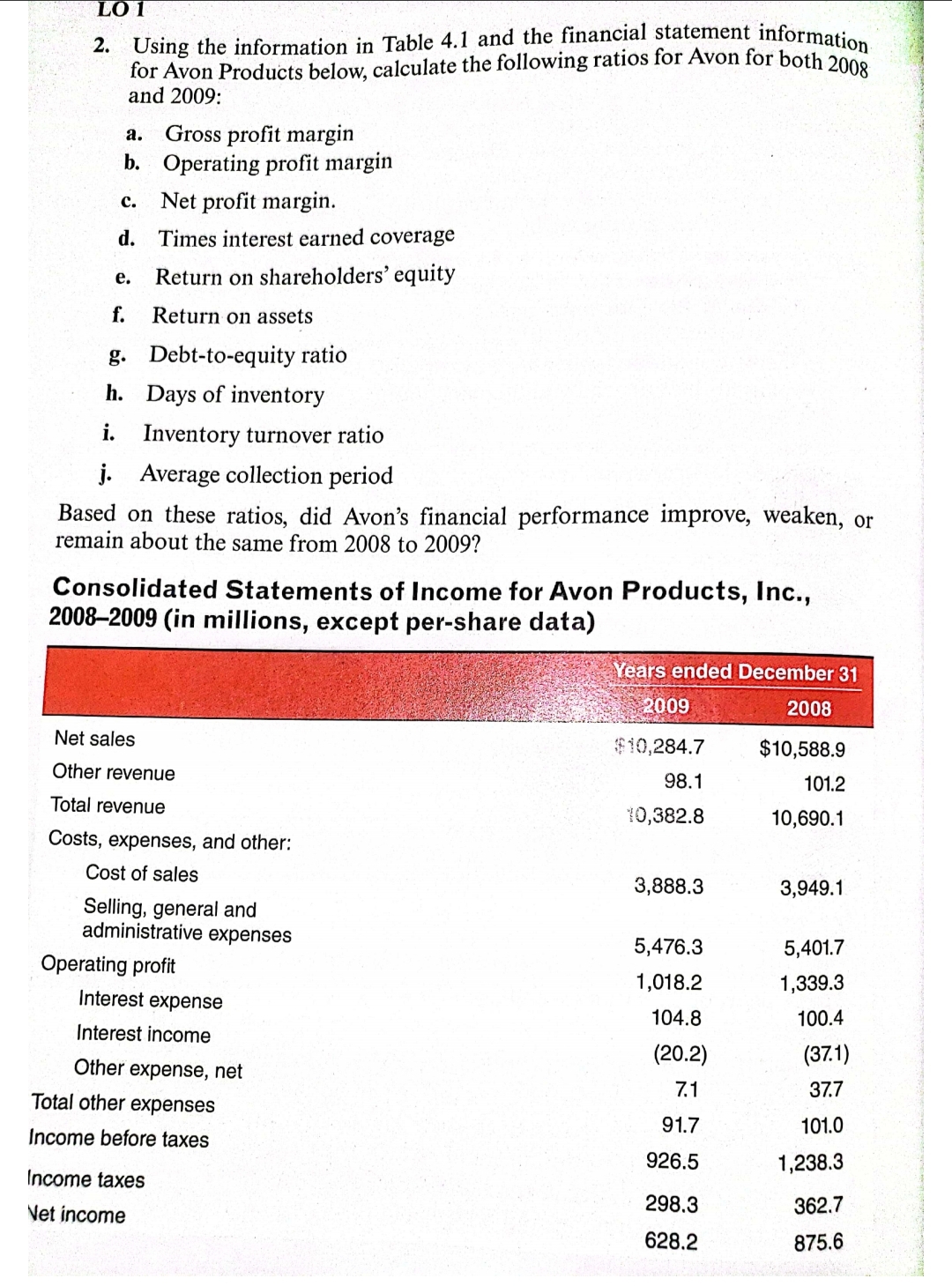

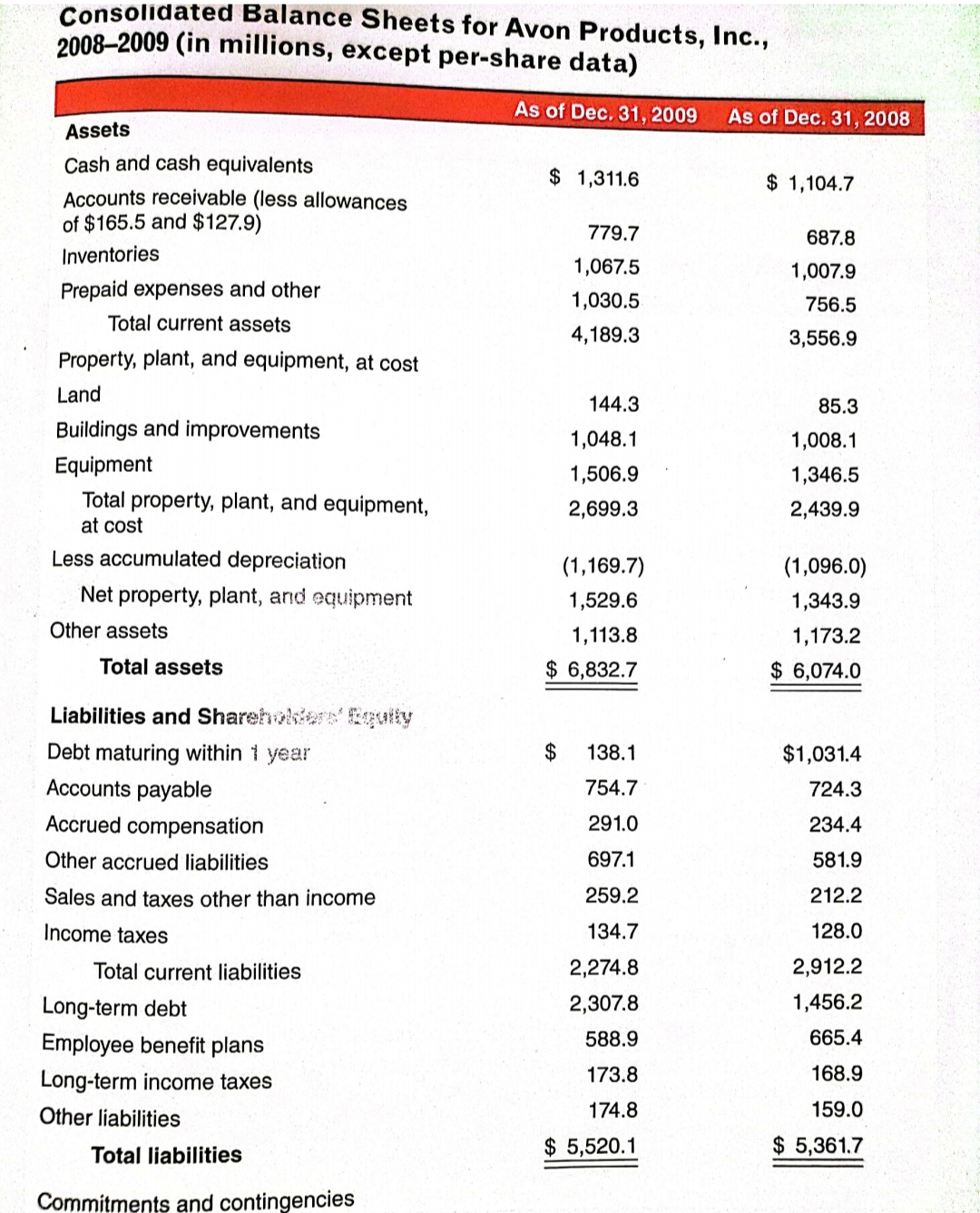

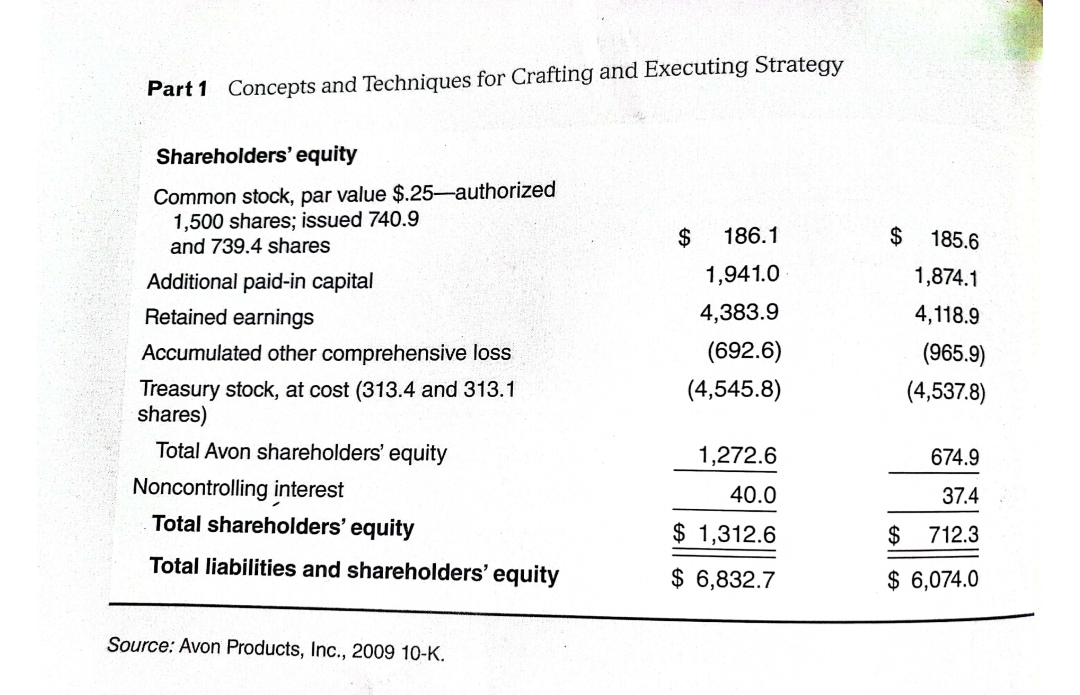

LO 1 2. Using the information in Table 4.1 and the financial statement information for Avon Products below, calculate the following ratios for Avon for both 2008 and 2009: a. Gross profit margin b. Operating profit margin c. Net profit margin. d. Times interest earned coverage e. Return on shareholders' equity f. Return on assets g. Debt-to-equity ratio h. Days of inventory i. Inventory turnover ratio j. Average collection period Based on these ratios, did Avon's financial performance improve, weaken, or remain about the same from 2008 to 2009? Consolidated Statements of Income for Avon Products, Inc., 2008-2009 (in millions, except per-share data) Years ended December 31 2009 2008 Net sales $ 10,284.7 $10,588.9 Other revenue 98.1 101.2 Total revenue 10,382.8 10,690.1 Costs, expenses, and other: Cost of sales 3,888.3 3,949.1 Selling, general and administrative expenses 5,476.3 5,401.7 Operating profit 1,018.2 1,339.3 Interest expense 104.8 100.4 Interest income (20.2) (37.1) Other expense, net 7.1 37.7 Total other expenses 91.7 101.0 Income before taxes 926.5 1,238.3 Income taxes 298.3 362.7 Net income 628.2 875.6Consolidated Balance Sheets for Avon Products, Inc., 2008-2009 (in millions, except per-share data) As of Dec. 31, 2009 As of Dec. 31, 2008 Assets Cash and cash equivalents $ 1,311.6 $ 1, 104.7 Accounts receivable (less allowances of $165.5 and $127.9) 779.7 687.8 Inventories 1,067.5 1,007.9 Prepaid expenses and other 1,030.5 756.5 Total current assets 4,189.3 3,556.9 Property, plant, and equipment, at cost Land 144.3 85.3 Buildings and improvements 1,048.1 1,008.1 Equipment 1,506.9 1,346.5 Total property, plant, and equipment, 2,699.3 2,439.9 at cost Less accumulated depreciation (1, 169.7) (1,096.0) Net property, plant, and equipment 1,529.6 1,343.9 Other assets 1, 113.8 1,173.2 Total assets $ 6,832.7 $ 6,074.0 Liabilities and Shareholders' Bqully Debt maturing within 1 year $ 138.1 $1,031.4 Accounts payable 754.7 724.3 Accrued compensation 291.0 234.4 Other accrued liabilities 697.1 581.9 Sales and taxes other than income 259.2 212.2 Income taxes 134.7 128.0 Total current liabilities 2,274.8 2,912.2 Long-term debt 2,307.8 1,456.2 Employee benefit plans 588.9 665.4 Long-term income taxes 173.8 168.9 Other liabilities 174.8 159.0 Total liabilities $ 5,520.1 $ 5,361.7 Commitments and contingenciesPart 1 Concepts and Techniques for Crafting and Executing Strategy Shareholders' equity Common stock, par value $.25-authorized 1,500 shares; issued 740.9 $ 186.1 $ 185.6 and 739.4 shares Additional paid-in capital 1,941.0 1,874.1 Retained earnings 4,383.9 4, 118.9 Accumulated other comprehensive loss (692.6) (965.9) Treasury stock, at cost (313.4 and 313.1 (4,545.8) (4,537.8) shares) Total Avon shareholders' equity 1,272.6 674.9 Noncontrolling interest 40.0 37.4 Total shareholders' equity $ 1,312.6 $ 712.3 Total liabilities and shareholders' equity $ 6,832.7 $ 6,074.0 Source: Avon Products, Inc., 2009 10-K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts