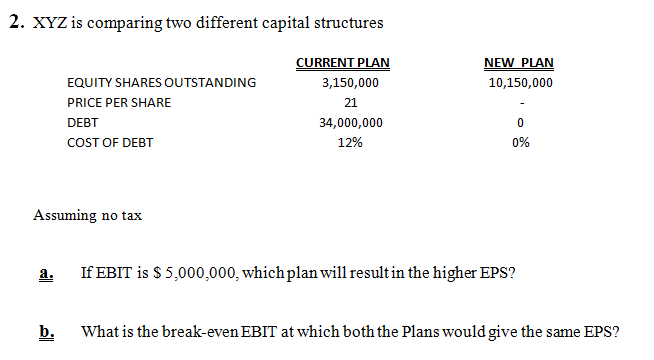

Question: 2. XYZ is comparing two different capital structures NEW PLAN 10,150,000 EQUITY SHARES OUTSTANDING PRICE PER SHARE DEBT COST OF DEBT CURRENT PLAN 3,150,000 21

2. XYZ is comparing two different capital structures NEW PLAN 10,150,000 EQUITY SHARES OUTSTANDING PRICE PER SHARE DEBT COST OF DEBT CURRENT PLAN 3,150,000 21 34,000,000 12% 0% Assuming no tax a. If EBIT is $5,000,000, which plan will result in the higher EPS? b. What is the break-even EBIT at which both the Plans would give the same EPS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock