Question: 2. Yield modeling on a debt security Suppose Green Energy Corporation is planning to massively expand inventory and will issue 13-week commercial paper to obtain

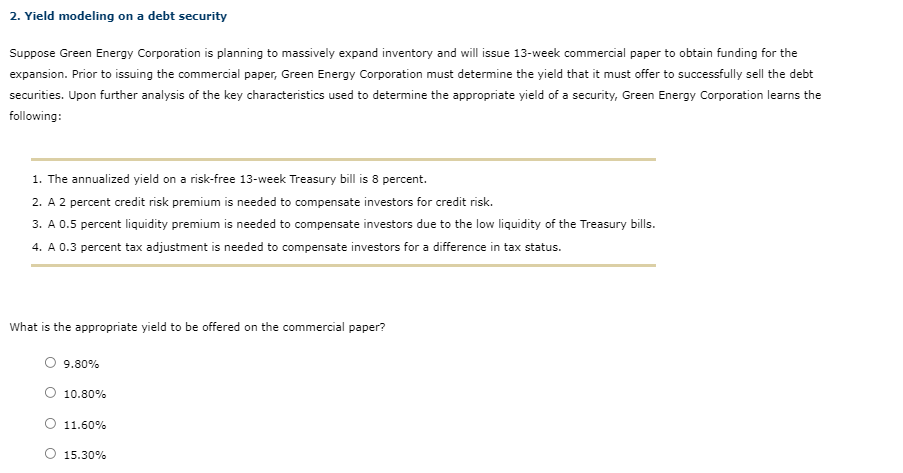

2. Yield modeling on a debt security Suppose Green Energy Corporation is planning to massively expand inventory and will issue 13-week commercial paper to obtain funding for the expansion. Prior to issuing the commercial paper, Green Energy Corporation must determine the yield that it must offer to successfully sell the debt securities. Upon further analysis of the key characteristics used to determine the appropriate yield of a security, Green Energy Corporation learns the following: 1. The annualized yield on a risk-free 13-week Treasury bill is 8 percent. 2. A 2 percent credit risk premium is needed to compensate investors for credit risk. 3. A 0.5 percent liquidity premium is needed to compensate investors due to the low liquidity of the Treasury bills. 4. A 0.3 percent tax adjustment is needed to compensate investors for a difference in tax status. What is the appropriate yield to be offered on the commercial paper? 9.80% 10.80% O 11.60% O 15.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts