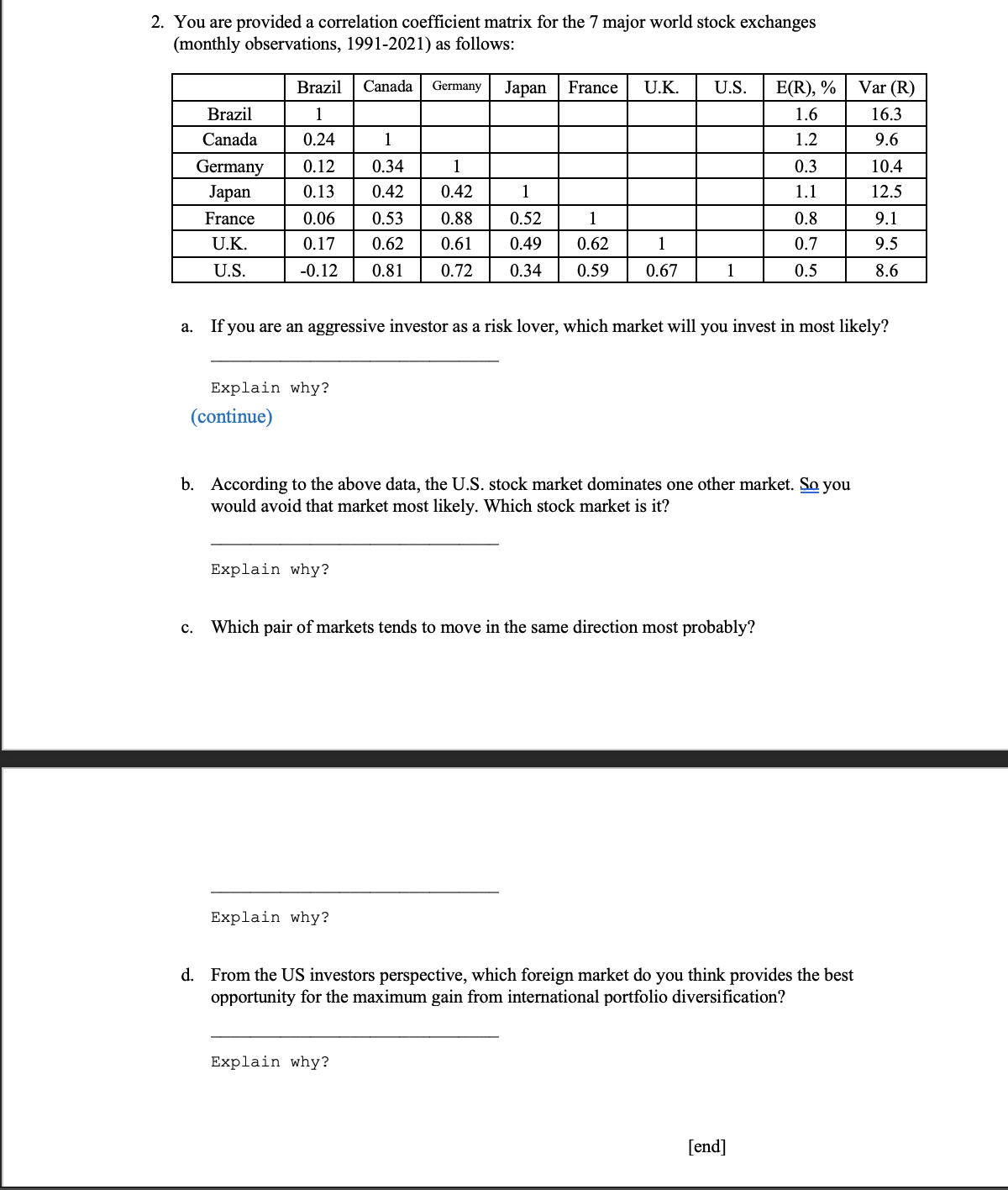

Question: 2. You are provided a correlation coefficient matrix for the 7 major world stock exchanges (monthly observations, 1991-2021) as follows: Brazil Canada Germany Japan

2. You are provided a correlation coefficient matrix for the 7 major world stock exchanges (monthly observations, 1991-2021) as follows: Brazil Canada Germany Japan France U.K. U.S. 1 0.24 1 Germany 0.12 0.34 Japan 0.13 0.42 France U.K. U.S. Brazil Canada C. 1 0.88 0.52 1 0.62 0.61 0.49 0.62 1 -0.12 0.81 0.72 0.34 0.59 0.67 0.06 0.53 0.17 Explain why (continue) 1 0.42 Explain why? 1 a. If you are an aggressive investor as a risk lover, which market will you invest in most likely? Explain why? b. According to the above data, the U.S. stock market dominates one other market. So you would avoid that market most likely. Which stock market is it? Which pair of markets tends to move in the same direction most probably? Explain why? E(R), % 1.6 1.2 0.3 1.1 0.8 0.7 0.5 [end] d. From the US investors perspective, which foreign market do you think provides the best opportunity for the maximum gain from international portfolio diversification? Var (R) 16.3 9.6 10.4 12.5 9.1 9.5 8.6

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Answer a As a risk loving investor I would invest in the ... View full answer

Get step-by-step solutions from verified subject matter experts