Question: 2.) You are writing an Excel program to project a firm's Free Cash Flow to Equity (FCFE) into the future based on the firm's financial

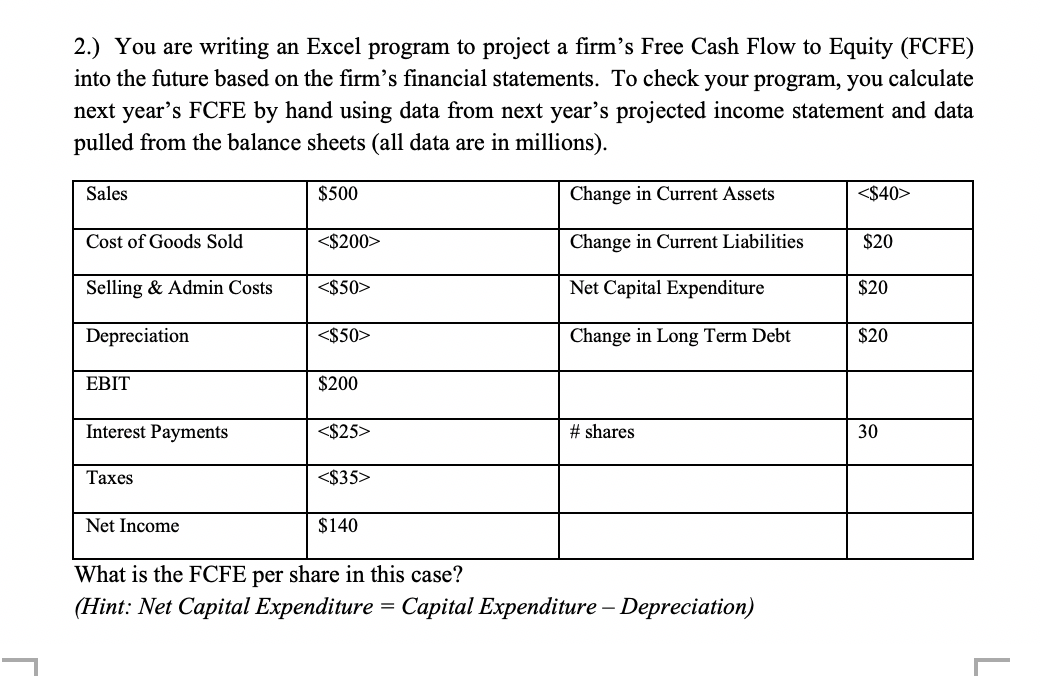

2.) You are writing an Excel program to project a firm's Free Cash Flow to Equity (FCFE) into the future based on the firm's financial statements. To check your program, you calculate next year's FCFE by hand using data from next year's projected income statement and data pulled from the balance sheets (all data are in millions). Sales $500 Change in Current Assets Cost of Goods Sold Change in Current Liabilities $20 Selling & Admin Costs | Net Capital Expenditure $20 Depreciation Change in Long Term Debt $20 EBIT $200 Interest Payments # shares Taxes Net Income $140 What is the FCFE per share in this case? (Hint: Net Capital Expenditure = Capital Expenditure - Depreciation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts