Question: Answer all the questions Given the discussions we had during lecture one, use your understanding and knowledge gained from such lecture and answer the following

Answer all the questions

Given the discussions we had during lecture one, use your understanding and knowledge gained from such lecture and answer the following questions. Kindly submit online, your appropriate answers

1) There is a conflict of interest between stockholders and managers. In theory, stockholders are expected to exercise control over managers through the annual meeting or the board of directors. In practice, why might these disciplinary mechanisms not work?

2. Stockholders can transfer wealth from bondholders through a variety of actions. How would the following actions by stockholders transfer wealth from bondholders?

? a. An increase in dividends

? b. A leveraged buyout

? c. Acquiring a risky business

? How would bondholders protect themselves against these actions?

3) There are some corporate strategists who have suggested that firms focus on maximizing market share rather than market prices. When might this strategy work, and when might it fail?

4) It is often argued that managers, when asked to maximize stock price, have to choose between being socially responsible and carrying out their fiduciary duty. Do you agree? Can you provide an example where social responsibility and firm value maximization go hand in hand?

CORPORATE FINANCE

Week Two-Four Lecture Assignments

Instruction

Given the discussions we had during lecture one, use your understanding and knowledge gained from such lecture and answer the following questions. Kindly submit online, your appropriate answers

Question 1

Aluworks Co. is expected to pay a $21.00 dividend next year. The dividend will decline by 10 percent annually for the following three years. In year 5, Aluworks will sell off assets worth $100 per share. The year 5 dividend, which includes a distribution of some of the proceeds of the asset sale, is expected to be $60. In year 6, the dividend is expected to decrease to $40 and will be maintained at $40 for one additional year. The dividend is then expected to grow by 5 percent annually thereafter. If the required rate of return is 12 percent, what is the value of one share of Aluworks?

Question 2

Baggai Enterprises has an ROA of 10 percent, retains 30 percent of earnings, and has an equity multiplier of 1.25. Mondale Enterprises also has an ROA of 10 percent, but it retains two-thirds of earnings and has an equity multiplier of 2.00.

1. What are the sustainable dividend growth rates for (A) Baggai Enterprises and (B)

Mondale Enterprises?

2. Identify the drivers of the difference in the sustainable growth rates of Baggai Enterprises and Mondale Enterprises.

Question 3 (Relative Valuation Approach)

Company A's EPS is $1.50. Its closest competitor, Company B, is trading at a P/E of

22. Assume the companies have a similar operating and financial profile.

a). If Company A's stock is trading at $37.50, what does that indicate about its value relative to Company B?

b). If we assume that Company A's stock should trade at about the same P/E as Company

B's stock, what will we estimate as an appropriate price for Company A's stock?

Question 4

Toyota Motor Corporation (TYO: 7203; NYSE: TM) is one of the world's largest vehicle manufacturers. The company's most recent fiscal year ended on 31 March 2008. In early May 2008, you are valuing Toyota stock, which closed at 5,480 on the previous day. You have used a free cash flow to equity (FCFE) model to value the company stock and have obtained a value of 6,122 for the stock. For ease of communication, you want to express your valuation in terms of a forward P/E based on your forecasted fiscal year 2009 EPS of 580. Toyota's fiscal year 2009 is from April 2008 through March 2009.

1. What is Toyota's justified P/E based on forecasted fundamentals?

2. Based on a comparison of the current price of 5,480 with your estimated intrinsic value of 6,122, the stock appears to be slightly undervalued. Use your answer to question 1 to state this evaluation in terms of P/Es.

Question 5

Joel Williams follows Sonoco Products Company (NYSE: SON), a manufacturer of paper and plastic packaging for both consumer and industrial use. SON appears to have a dividend policy of recognizing sustainable increases in the level of earnings with increases in dividends, keeping the dividend payout ratio within a range of 40 percent to 60 percent. Williams also notes: SON's most recent quarterly dividend (ex-dividend date: 15 August 2007) was $0.26, consistent with a current annual dividend of 4x $0.26 =$1.04 per year. SON's forecasted dividend growth rate is 6.0 percent per year. With a beta of 1.13, given an equity risk premium (expected excess return of equities over the risk-free rate, E [RM] - RF) of 4.5 percent and a risk-free rate (RF)of 5 percent, SON's required return on equity is r= RF + beta[E(RM) - RF]=5.0+1.13(4.5)=10.1 percent, using the capital asset pricing model (CAPM).

Williams believes the Gordon growth model may be an appropriate model for valuing SON.

1. Calculate the Gordon growth model value for SON stock.

2. The current market price of SON stock is $30.18. Using your answer to question 1, judge whether SON stock is fairly valued, undervalued, or overvalued.

Question 6

Vincent Nguyen, an analyst, is examining the stock of British Airways (London Stock Exchange: BAY) as of the beginning of 2008. He notices that the consensus forecast by analysts is that the stock will pay a ? 4 dividend per share in 2009 (based on 21 analysts) and a ? 5 dividend in 2010 (based on 10 analysts). Nguyen expects the price of the stock at the end of 2010 to be ? 250. He has estimated that the required rate of return on the stock is 11 percent. Assume all dividends are paid at the end of the year.

Required:

a) Using the DDM, estimate the value of BAY stock at the end of 2009.

b) Using the DDM, estimate the value of BAY stock at the end of 2008.

Section B.

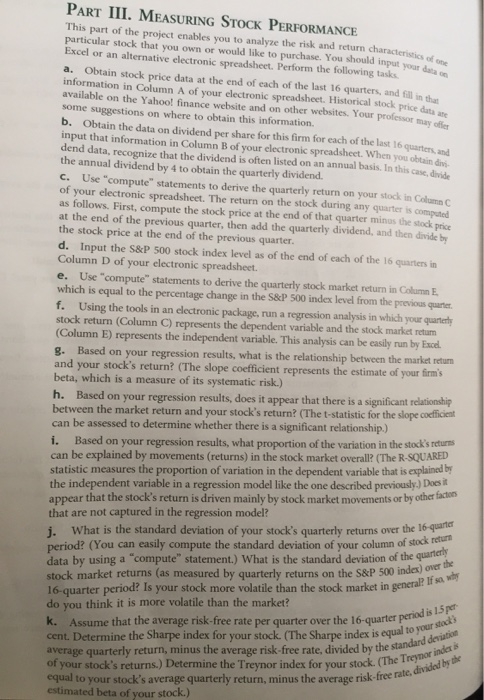

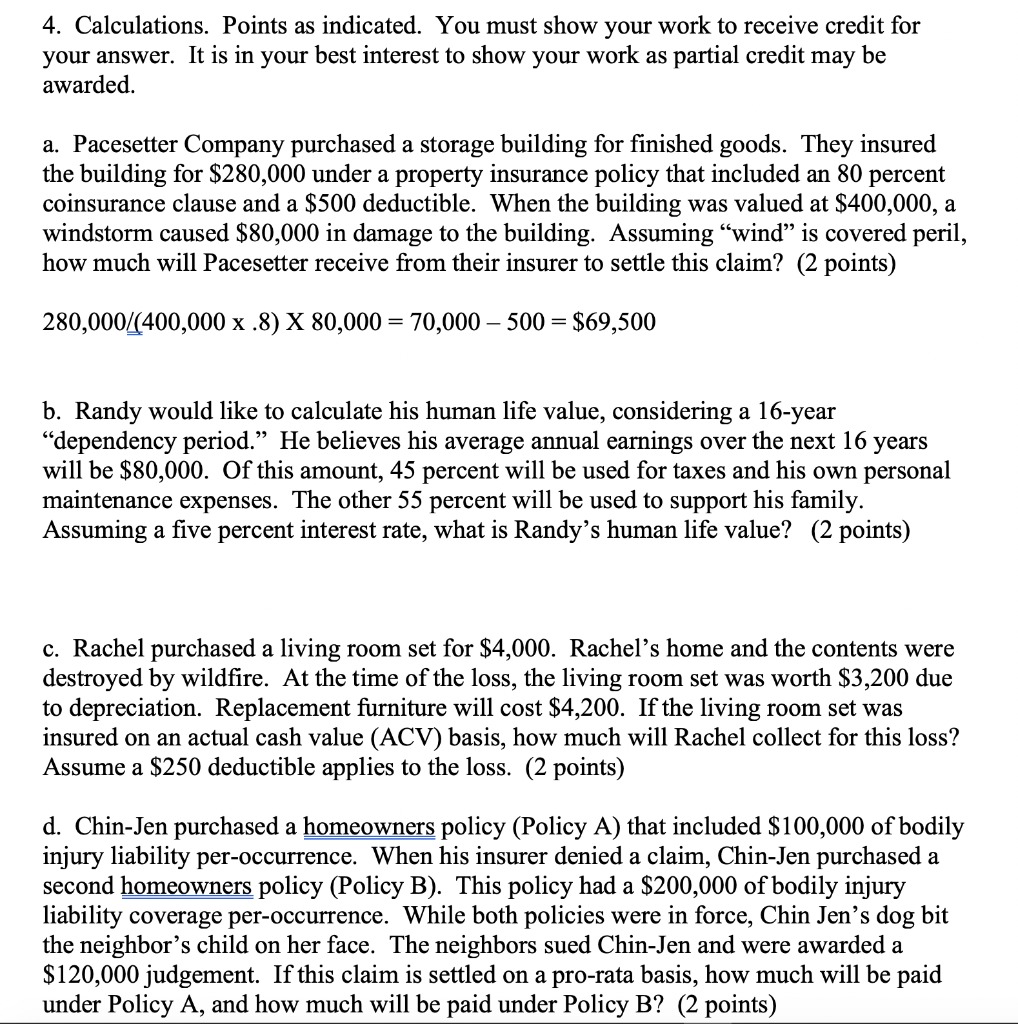

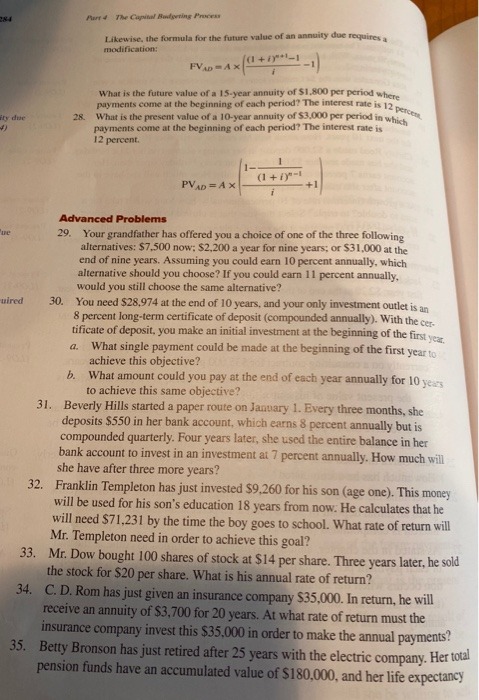

PART III. MEASURING STOCK PERFORMANCE This part of the project enables you to analyze the risk and return characteristics of one particular stock that you own or would like to purchase. You should input your data on Excel or an alternative electronic spreadsheet. Perform the following tasks. a. Obtain stock price data at the end of each of the last 16 quarters, and fill in that information in Column A of your electronic spreadsheet. Historical stock price data are available on the Yahoo! finance website and on other websites. Your professor may offer some suggestions on where to obtain this information. b. Obtain the data on dividend per share for this firm for each of the last 16 quarters, and input that information in Column B of your electronic spreadsheet. When you obtain dini- dend data, recognize that the dividend is often listed on an annual basis. In this case, divide the annual dividend by 4 to obtain the quarterly dividend. C. Use "compute" statements to derive the quarterly return on your stock in Column C of your electronic spreadsheet. The return on the stock during any quarter is computed as follows. First, compute the stock price at the end of that quarter minus the stock price at the end of the previous quarter, then add the quarterly dividend, and then divide by the stock price at the end of the previous quarter. d. Input the S&P 500 stock index level as of the end of each of the 16 quarters in Column D of your electronic spreadsheet. e. Use "compute" statements to derive the quarterly stock market return in Column E which is equal to the percentage change in the S&P 500 index level from the previous quarter. f. Using the tools in an electronic package, run a regression analysis in which your quarterly stock return (Column C) represents the dependent variable and the stock market return (Column E) represents the independent variable. This analysis can be easily run by Excel g. Based on your regression results, what is the relationship between the market return and your stock's return? (The slope coefficient represents the estimate of your firm's beta, which is a measure of its systematic risk.) h. Based on your regression results, does it appear that there is a significant relationship between the market return and your stock's return? (The t-statistic for the slope coefficient can be assessed to determine whether there is a significant relationship.) i. Based on your regression results, what proportion of the variation in the stock's returns can be explained by movements (returns) in the stock market overall? (The R-SQUARED statistic measures the proportion of variation in the dependent variable that is explained by the independent variable in a regression model like the one described previously.) Does it appear that the stock's return is driven mainly by stock market movements or by other faction that are not captured in the regression model? j. What is the standard deviation of your stock's quarterly returns over the 16-quarter period? (You can easily compute the standard deviation of your column of stock return data by using a "compute" statement.) What is the standard deviation of the quarterly stock market returns (as measured by quarterly returns on the S&P 500 index) over the 16-quarter period? Is your stock more volatile than the stock market in general? If so why do you think it is more volatile than the market? K. Assume that the average risk-free rate per quarter over the 16-quarter period is 15 Pe cent. Determine the Sharpe index for your stock. (The Sharpe index is equal to your stocks average quarterly return, minus the average risk-free rate, divided by the standard deviation of your stock's returns.) Determine the Treynor index for your stock. (The Treynor inder equal to your stock's average quarterly return, minus the average risk-free rate, divided by the estimated beta of your stock.)4. Calculations. Points as indicated. You must show your work to receive credit for your answer. It is in your best interest to show your work as partial credit may be awarded. a. Pacesetter Company purchased a storage building for nished goods. They insured the building for $280,000 under a property insurance policy that included an 80 percent coinsurance clause and a $500 deductible. When the building was valued at $400,000, a Windstorm caused $80,000 in damage to the building. Assuming \"wind\" is covered peril, how much will Pacesetter receive from their insurer to settle this claim? (2 points) 280,000400,000 x .8) X 80,000 = 70,000 500 = $69,500 b. Randy would like to calculate his human life value, considering a 16-year \"dependency period." He believes his average annual earnings over the next 16 years will be $80,000. Of this amount, 45 percent will be used for taxes and his own personal maintenance expenses. The other 55 percent will be used to support his family. Assuming a ve percent interest rate, what is Randy's human life value? (2 points) c. Rachel purchased a living room set for $4,000. Rachel's home and the contents were destroyed by wildre. At the time of the loss, the living room set was worth $3,200 due to depreciation. Replacement furniture will cost $4,200. If the living room set was insured on an actual cash value (ACV) basis, how much will Rachel collect for this loss? Assume a $250 deductible applies to the loss. (2 points) d. Chin-Jen purchased a homeowners policy (Policy A) that included $100,000 of bodily injury liability per-occurrence. When his insurer denied a claim, Chin-Jen purchased a second homeowners policy (Policy B). This policy had a $200,000 of bodily injury liability coverage per-occurrence. While both policies were in force, Chin Jen's dog bit the neighbor's child on her face. The neighbors sued Chin-J en and were awarded a $120,000 judgement. If this claim is settled on a pro-rata basis, how much will be paid under Policy A, and how much will be paid under Policy B? (2 points) Furr 4 The Capital Badgering Process Likewise. the formula for the future value of an annuity due requires ; modification: FVADAX (+1)"-1 2-1 What is the future value of a 15-year annuity of $1.800 per period where Payments come at the beginning of each period? The interest rate is 12 percy ity dur 28. What is the present value of a 10-year annuity of $3,000 per period in which payments come at the beginning of each period? The interest rate is 12 percent. PVAD = A X +1 Advanced Problems 29. Your grandfather has offered you a choice of one of the three following alternatives: $7.500 now: $2,200 a year for nine years; or $31,000 at the end of nine years. Assuming you could earn 10 percent annually, which alternative should you choose? If you could earn 11 percent annually, would you still choose the same alternative? wired 30. You need $28,974 at the end of 10 years, and your only investment outlet is an 8 percent long-term certificate of deposit (compounded annually). With the cer- tificate of deposit. you make an initial investment at the beginning of the first year. 4. What single payment could be made at the beginning of the first year to achieve this objective? b. What amount could you pay at the end of each year annually for 10 years to achieve this same objective? 31. Beverly Hills started a paper route on January 1. Every three months, she deposits $550 in her bank account, which earns 8 percent annually but is compounded quarterly. Four years later, she used the entire balance in her bank account to invest in an investment at 7 percent annually. How much will she have after three more years? 32. Franklin Templeton has just invested $9,260 for his son (age one). This money will be used for his son's education 18 years from now. He calculates that he will need $71,231 by the time the boy goes to school. What rate of return will Mr. Templeton need in order to achieve this goal? 33. Mr. Dow bought 100 shares of stock at $14 per share. Three years later, he sold the stock for $20 per share. What is his annual rate of return? 34. C. D. Rom has just given an insurance company $35,000. In return, he will receive an annuity of $3,700 for 20 years. At what rate of return must the insurance company invest this $35,000 in order to make the annual payments? 35. Betty Bronson has just retired after 25 years with the electric company. Her total pension funds have an accumulated value of $180,000, and her life expectancy