Question: 20 13. (25 points) You work for a mechanical contractor that provides specialized welding services to the nuclear energy industry in the Carolinas. You are

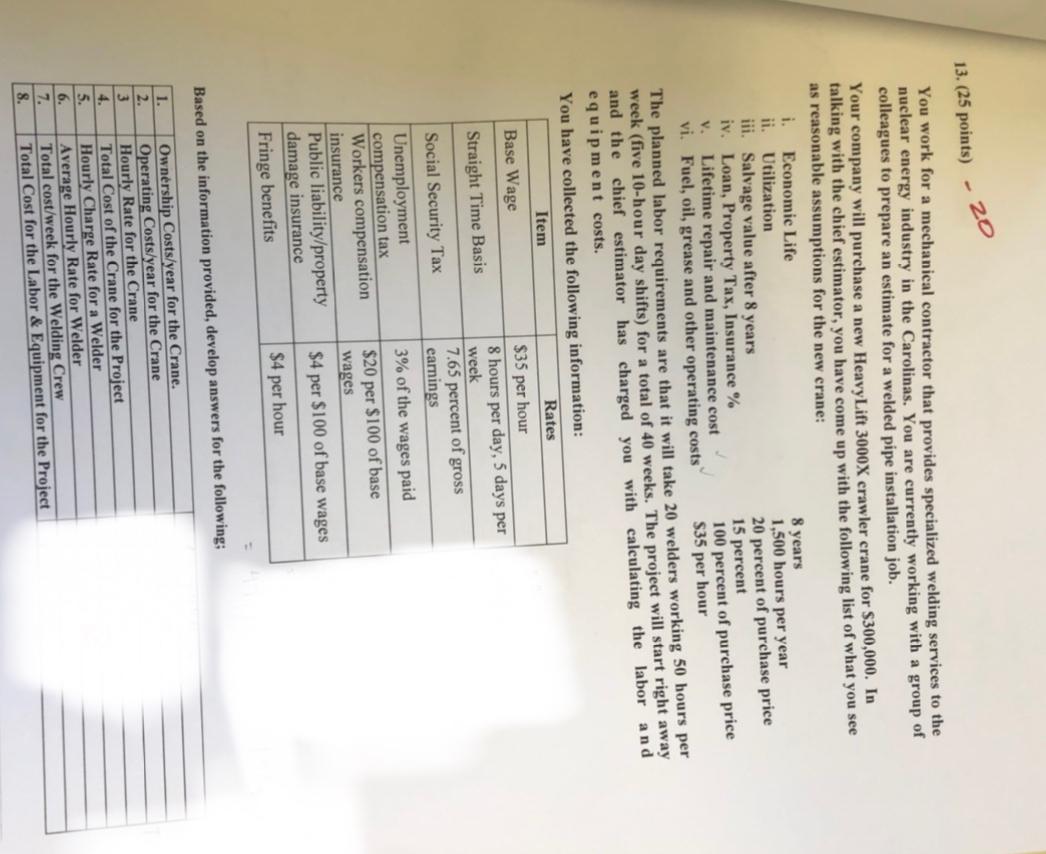

20 13. (25 points) You work for a mechanical contractor that provides specialized welding services to the nuclear energy industry in the Carolinas. You are currently working with a group of colleagues to prepare an estimate for a welded pipe installation job. Your company will purchase a new Heavy Lift 3000X crawler crane for $300,000. In talking with the chief estimator, you have come up with the following list of what you see as reasonable assumptions for the new crane: i. Economic Life 8 years ii. Utilization 1,500 hours per year iii. Salvage value after 8 years 20 percent of purchase price iv. Loan, Property Tax, Insurance % 15 percent v. Lifetime repair and maintenance cost 100 percent of purchase price vi. Fuel, oil, grease and other operating costs $35 per hour The planned labor requirements are that it will take 20 welders working 50 hours per week (five 10-hour day shifts) for a total of 40 weeks. The project will start right away and the chief estimator has charged you with calculating the labor and equipment costs. You have collected the following information: Item Rates Base Wage $35 per hour 8 hours per day, 5 days per Straight Time Basis week 7.65 percent of gross Social Security Tax earnings Unemployment 3% of the wages paid compensation tax Workers compensation $20 per $100 of base insurance wages Public liability/property $4 per $100 of base wages damage insurance Fringe benefits $4 per hour Based on the information provided, develop answers for the following: 1. 2. 3 4. 5. 6. 7. 8. Ownership Costs/year for the Crane. Operating Costs/year for the Crane Hourly Rate for the Crane Total Cost of the Crane for the Project Hourly Charge Rate for a Welder Average Hourly Rate for Welder Total cost/week for the Welding Crew Total Cost for the Labor & Equipment for the Project 20 13. (25 points) You work for a mechanical contractor that provides specialized welding services to the nuclear energy industry in the Carolinas. You are currently working with a group of colleagues to prepare an estimate for a welded pipe installation job. Your company will purchase a new Heavy Lift 3000X crawler crane for $300,000. In talking with the chief estimator, you have come up with the following list of what you see as reasonable assumptions for the new crane: i. Economic Life 8 years ii. Utilization 1,500 hours per year iii. Salvage value after 8 years 20 percent of purchase price iv. Loan, Property Tax, Insurance % 15 percent v. Lifetime repair and maintenance cost 100 percent of purchase price vi. Fuel, oil, grease and other operating costs $35 per hour The planned labor requirements are that it will take 20 welders working 50 hours per week (five 10-hour day shifts) for a total of 40 weeks. The project will start right away and the chief estimator has charged you with calculating the labor and equipment costs. You have collected the following information: Item Rates Base Wage $35 per hour 8 hours per day, 5 days per Straight Time Basis week 7.65 percent of gross Social Security Tax earnings Unemployment 3% of the wages paid compensation tax Workers compensation $20 per $100 of base insurance wages Public liability/property $4 per $100 of base wages damage insurance Fringe benefits $4 per hour Based on the information provided, develop answers for the following: 1. 2. 3 4. 5. 6. 7. 8. Ownership Costs/year for the Crane. Operating Costs/year for the Crane Hourly Rate for the Crane Total Cost of the Crane for the Project Hourly Charge Rate for a Welder Average Hourly Rate for Welder Total cost/week for the Welding Crew Total Cost for the Labor & Equipment for the Project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts