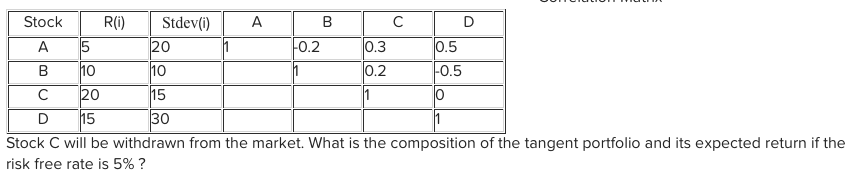

Question: 20 Fo.2 Stock R(0) Stdev(i) A B C D A 5 0.3 0.5 B 10 10 C 2015 D 15 30 Stock C will be

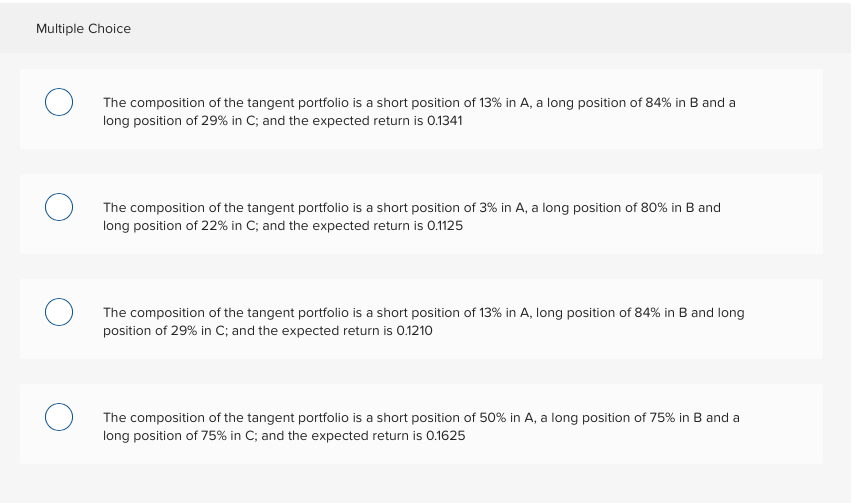

20 Fo.2 Stock R(0) Stdev(i) A B C D A 5 0.3 0.5 B 10 10 C 2015 D 15 30 Stock C will be withdrawn from the market. What is the composition of the tangent portfolio and its expected return if the risk free rate is 5%? Multiple Choice The composition of the tangent portfolio is a short position of 13% in A, a long position of 84% in B and a long position of 29% in C; and the expected return is 0.1341 0 The composition of the tangent portfolio is a short position of 3% in A, a long position of 80% in B and long position of 22% in C; and the expected return is 0.1125 0 The composition of the tangent portfolio is a short position of 13% in A, long position of 84% in B and long position of 29% in C; and the expected return is 0.1210 0 The composition of the tangent portfolio is a short position of 50% in A, a long position of 75% in B and a long position of 75% in C; and the expected return is 0.1625 20 Fo.2 Stock R(0) Stdev(i) A B C D A 5 0.3 0.5 B 10 10 C 2015 D 15 30 Stock C will be withdrawn from the market. What is the composition of the tangent portfolio and its expected return if the risk free rate is 5%? Multiple Choice The composition of the tangent portfolio is a short position of 13% in A, a long position of 84% in B and a long position of 29% in C; and the expected return is 0.1341 0 The composition of the tangent portfolio is a short position of 3% in A, a long position of 80% in B and long position of 22% in C; and the expected return is 0.1125 0 The composition of the tangent portfolio is a short position of 13% in A, long position of 84% in B and long position of 29% in C; and the expected return is 0.1210 0 The composition of the tangent portfolio is a short position of 50% in A, a long position of 75% in B and a long position of 75% in C; and the expected return is 0.1625

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts