Question: 20. MACRS and ADS, Real Property. (Obj. 1) Drew operates a business as a sole proprietorship. On January 3, 2018, Drew placed in service a

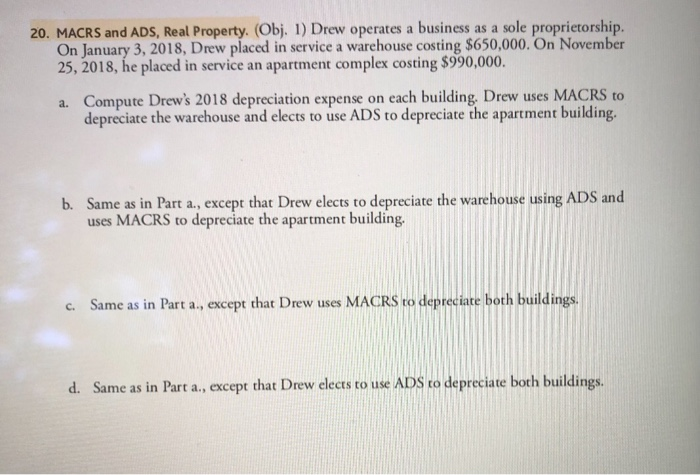

20. MACRS and ADS, Real Property. (Obj. 1) Drew operates a business as a sole proprietorship. On January 3, 2018, Drew placed in service a warehouse costing $650,000. On November 25, 2018, he placed in service an apartment complex costing $990,000. a. Compute Drew's 2018 depreciation expense on each building. Drew uses MACRS to depreciate the warehouse and elects to use ADS to depreciate the apartment building. b. Same as in Part a., except that Drew elects to depreciate the warehouse using ADS and uses MACRS to depreciate the apartment building. C. Same as in Part a., except that Drew uses MACRS to depreciate both buildings. d. Same as in Part a., except that Drew elects to use ADS to depreciate both buildings. 20. MACRS and ADS, Real Property. (Obj. 1) Drew operates a business as a sole proprietorship. On January 3, 2018, Drew placed in service a warehouse costing $650,000. On November 25, 2018, he placed in service an apartment complex costing $990,000. a. Compute Drew's 2018 depreciation expense on each building. Drew uses MACRS to depreciate the warehouse and elects to use ADS to depreciate the apartment building. b. Same as in Part a., except that Drew elects to depreciate the warehouse using ADS and uses MACRS to depreciate the apartment building. C. Same as in Part a., except that Drew uses MACRS to depreciate both buildings. d. Same as in Part a., except that Drew elects to use ADS to depreciate both buildings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts