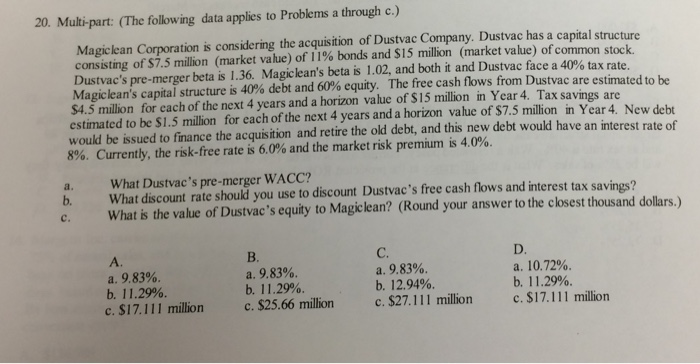

Question: 20. Multi-part: (The following data applies to Problems a through c.) Magiclean Corporation is considering the acquisition of Dustvac Company. Dustvac has a capital structure

20. Multi-part: (The following data applies to Problems a through c.) Magiclean Corporation is considering the acquisition of Dustvac Company. Dustvac has a capital structure consisting ofS75 million (market value) of11% bonds and $15 millon (market value) o Dustvac's pre-merger beta is 1.36. Magic lean's beta is 1.02, and both it and Dustvac face a 40% tax rate. Magic ean's capital structure is 40% debt and 60% equity. The free cash flows from ustvac are estimated to be $4.5 million for each of the next 4 years and a horizon value of S15 million in Year 4. Tax savin estimated to be S1.5 million for each of the next 4 years and a horizon value of $7.5 million in Year 4. New debt would be issued to finance the acquisition and retire the old debt, and this new debt w f common stock. ould have an interest rate of 8%. Currently, the risk-free rate is 6.0% and the market risk premium is 40%. a. What Dustvac's pre-merger WACC? b. What discount rate shoukd you use to discount Dustvac's free cash flows and interest tax savings? c. What is the value of Dustvac's equity to Magiclean? (Round your answer to the closest thousand dollars.) A. a. 9.83%. b. 11.29%. c. S17.111 million B. a. 9.83%. b. 11.29% c. $25.66 million C. a. 9.83%. b. 12.94%. c. $27.111 million D. a. 10.72% b. 11.29%. c.$17.111 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts