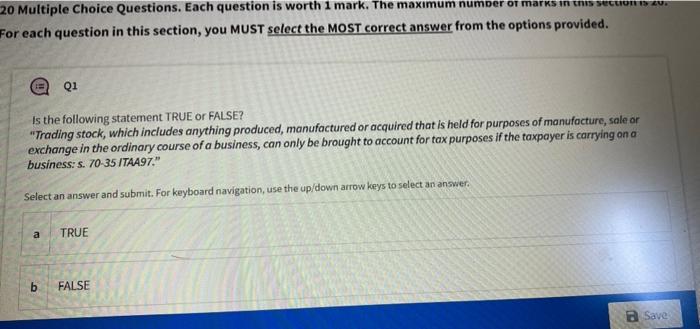

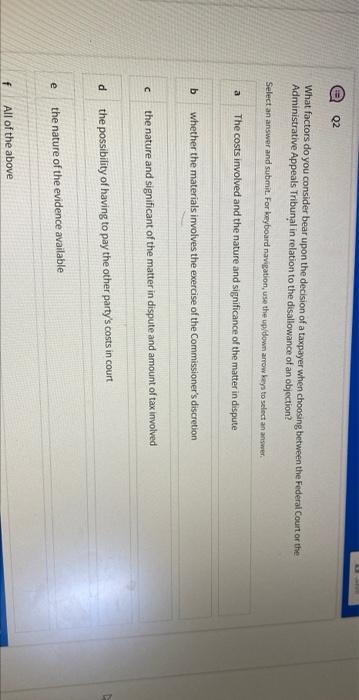

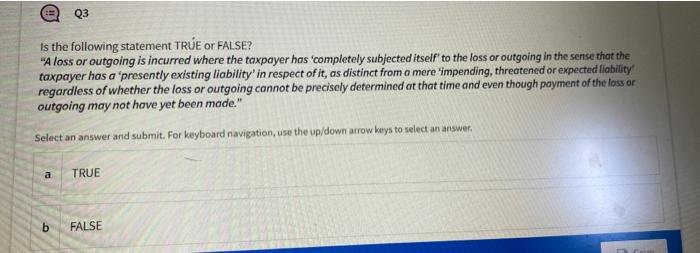

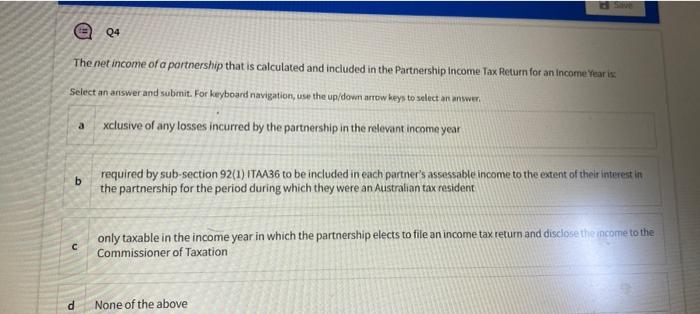

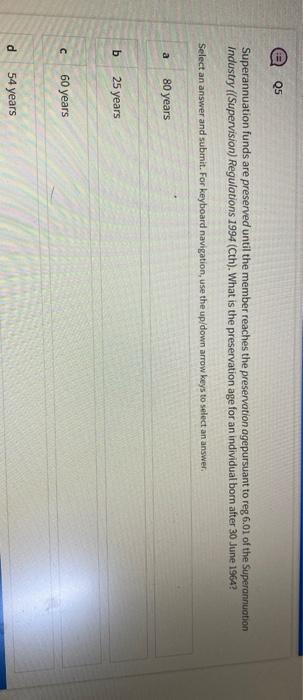

Question: 20 Multiple Choice Questions. Each question is worth 1 mark. The maximum number of marks in this sections 20. For each question in this section,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock