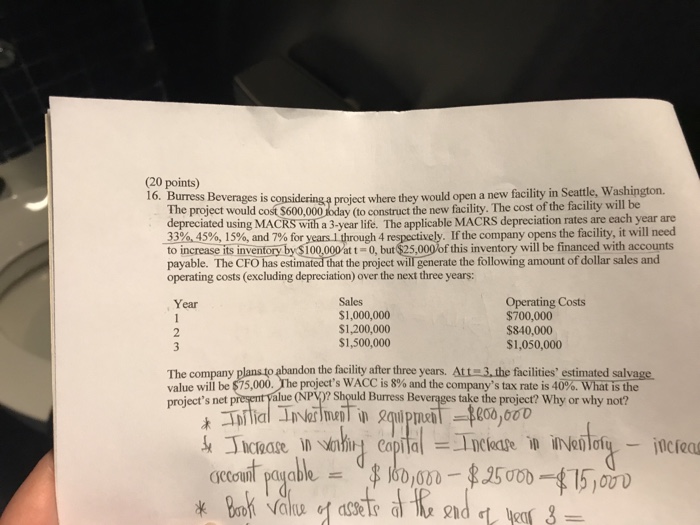

Question: (20 points) erages is considering a project where they would open a new facility in Seattle, Washington. The project would cost 600,000 depreciated using MACRS

(20 points) erages is considering a project where they would open a new facility in Seattle, Washington. The project would cost 600,000 depreciated using MACRS with a 3-year life. The applicable MACRS depreciation rates are each year are (to construct the new facility. The cost of the facility will be % 45% 15% and 7% fory an lthrough 4 spectively. Ifthe company opens the facility, it will need to increase its inventory by $100,000 at but $25,000of this inventory will be financed with accounts payable. The CFO has estimated that the project will generate the following amount of dollar sales and operating costs (excluding depreciation) over the next three years: Sales $1,000,000 $1,200,000 $1,500,000 Operating Costs $700,000 $840,000 $1,050,000 Year 2 The company value will be s 75,000 bandon the facility after three years. Att 3, the facilities' estimated salvage nie project's WACC is 8% and the company's tax rate is 40 alue (NPV)? Should Burress Beverages take the project? Why or why not? Whatis project's net account payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts