Question: QUESTION 29 25 points Save Answer Shown below are the following: (1) capital budgeting information for Miami Publishing Company, (2) MACRS depreciation schedule information, and

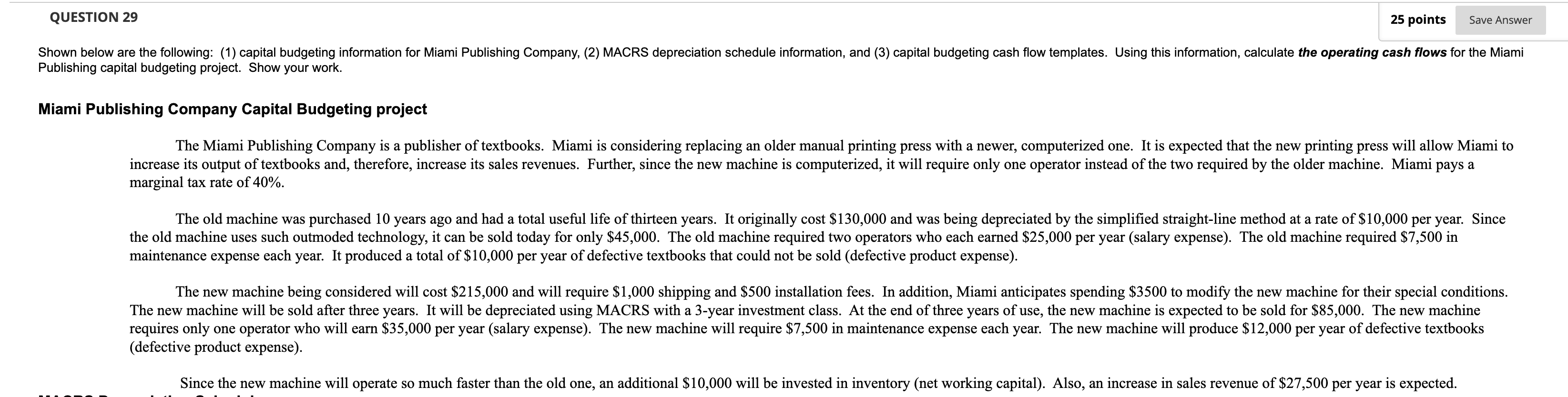

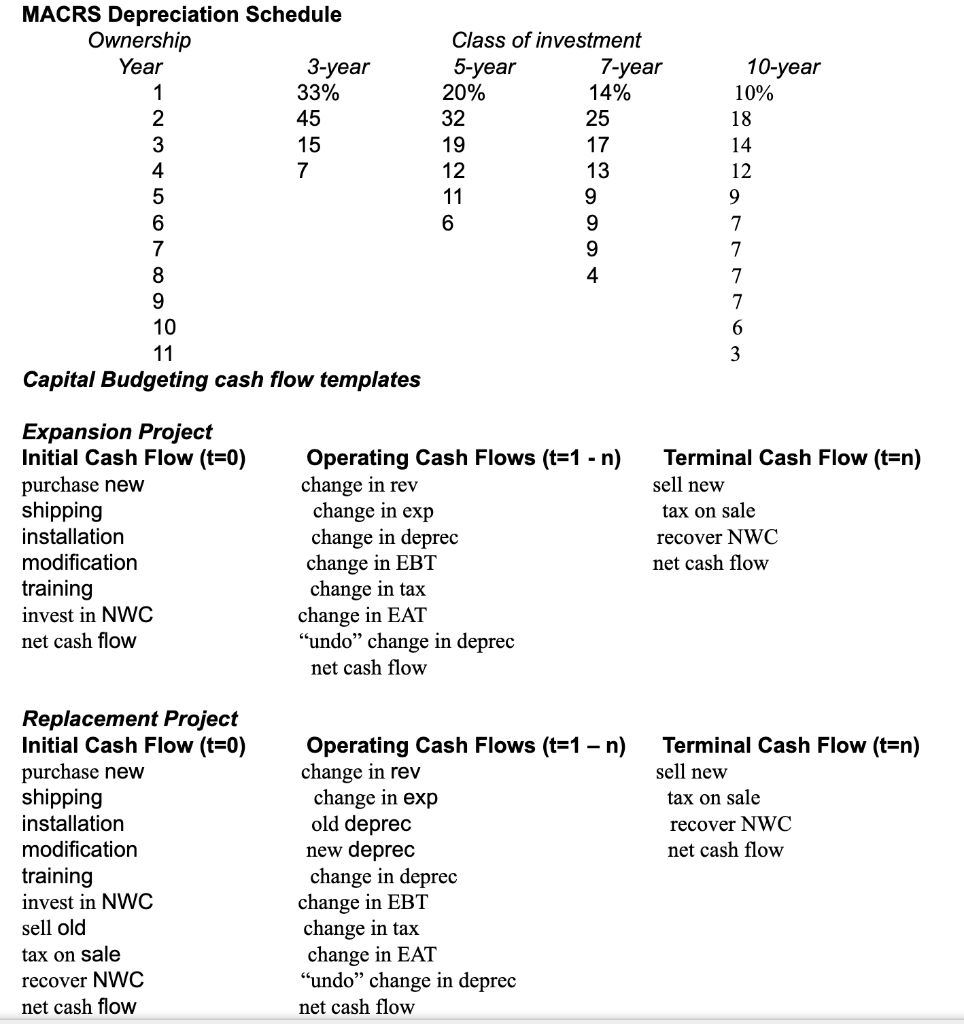

QUESTION 29 25 points Save Answer Shown below are the following: (1) capital budgeting information for Miami Publishing Company, (2) MACRS depreciation schedule information, and (3) capital budgeting cash flow templates. Using this information, calculate the operating cash flows for the Miami Publishing capital budgeting project. Show your work. Miami Publishing Company Capital Budgeting project The Miami Publishing Company is a publisher of textbooks. Miami is considering replacing an older manual printing press with a newer, computerized one. It is expected that the new printing press will allow Miami to increase its output of textbooks and, therefore, increase its sales revenues. Further, since the new machine is computerized, it will require only one operator instead of the two required by the older machine. Miami pays a marginal tax rate of 40%. The old machine was purchased 10 years ago and had a total useful life of thirteen years. It originally cost $130,000 and was being depreciated by the simplified straight-line method at a rate of $10,000 per year. Since the old machine uses such outmoded technology, it can be sold today for only $45,000. The old machine required two operators who each earned $25,000 per year (salary expense). The old machine required $7,500 in maintenance expense each year. It produced a total of $10,000 per year of defective textbooks that could not be sold (defective product expense). The new machine being considered will cost $215,000 and will require $1,000 shipping and $500 installation fees. In addition, Miami anticipates spending $3500 to modify the new machine for their special conditions. The new machine will be sold after three years. It will be depreciated using MACRS with a 3-year investment class. At the end of three years of use, the new machine is expected to be sold for $85,000. The new machine requires only one operator who will earn $35,000 per year (salary expense). The new machine will require $7,500 in maintenance expense each year. The new machine will produce $12,000 per year of defective textbooks (defective product expense). Since the new machine will operate so much faster than the old one, an additional $10,000 will be invested in inventory (net working capital). Also, an increase in sales revenue of $27,500 per year is expected. MACRS Depreciation Schedule Ownership Year 3-year 1 33% 2 45 3 15 4 7 5 6 7 8 9 10 11 Capital Budgeting cash flow templates Class of investment 5-year 7-year 20% 14% 32 25 19 17 12 13 11 9 6 9 9 4 10-year 10% 18 14 12 9 7 7 7 7 6 3 Expansion Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp change in deprec change in EBT change in tax change in EAT "undo change in deprec net cash flow Terminal Cash Flow (t=n) sell new tax on sale recover NWC net cash flow Terminal Cash Flow (trn) sell new tax on sale recover NWC net cash flow Replacement Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC sell old tax on sale recover NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp old deprec new deprec change in deprec change in EBT change in tax change in EAT "undo change in deprec net cash flow QUESTION 29 25 points Save Answer Shown below are the following: (1) capital budgeting information for Miami Publishing Company, (2) MACRS depreciation schedule information, and (3) capital budgeting cash flow templates. Using this information, calculate the operating cash flows for the Miami Publishing capital budgeting project. Show your work. Miami Publishing Company Capital Budgeting project The Miami Publishing Company is a publisher of textbooks. Miami is considering replacing an older manual printing press with a newer, computerized one. It is expected that the new printing press will allow Miami to increase its output of textbooks and, therefore, increase its sales revenues. Further, since the new machine is computerized, it will require only one operator instead of the two required by the older machine. Miami pays a marginal tax rate of 40%. The old machine was purchased 10 years ago and had a total useful life of thirteen years. It originally cost $130,000 and was being depreciated by the simplified straight-line method at a rate of $10,000 per year. Since the old machine uses such outmoded technology, it can be sold today for only $45,000. The old machine required two operators who each earned $25,000 per year (salary expense). The old machine required $7,500 in maintenance expense each year. It produced a total of $10,000 per year of defective textbooks that could not be sold (defective product expense). The new machine being considered will cost $215,000 and will require $1,000 shipping and $500 installation fees. In addition, Miami anticipates spending $3500 to modify the new machine for their special conditions. The new machine will be sold after three years. It will be depreciated using MACRS with a 3-year investment class. At the end of three years of use, the new machine is expected to be sold for $85,000. The new machine requires only one operator who will earn $35,000 per year (salary expense). The new machine will require $7,500 in maintenance expense each year. The new machine will produce $12,000 per year of defective textbooks (defective product expense). Since the new machine will operate so much faster than the old one, an additional $10,000 will be invested in inventory (net working capital). Also, an increase in sales revenue of $27,500 per year is expected. MACRS Depreciation Schedule Ownership Year 3-year 1 33% 2 45 3 15 4 7 5 6 7 8 9 10 11 Capital Budgeting cash flow templates Class of investment 5-year 7-year 20% 14% 32 25 19 17 12 13 11 9 6 9 9 4 10-year 10% 18 14 12 9 7 7 7 7 6 3 Expansion Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp change in deprec change in EBT change in tax change in EAT "undo change in deprec net cash flow Terminal Cash Flow (t=n) sell new tax on sale recover NWC net cash flow Terminal Cash Flow (trn) sell new tax on sale recover NWC net cash flow Replacement Project Initial Cash Flow (t=0) purchase new shipping installation modification training invest in NWC sell old tax on sale recover NWC net cash flow Operating Cash Flows (t=1 - n) change in rev change in exp old deprec new deprec change in deprec change in EBT change in tax change in EAT "undo change in deprec net cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts