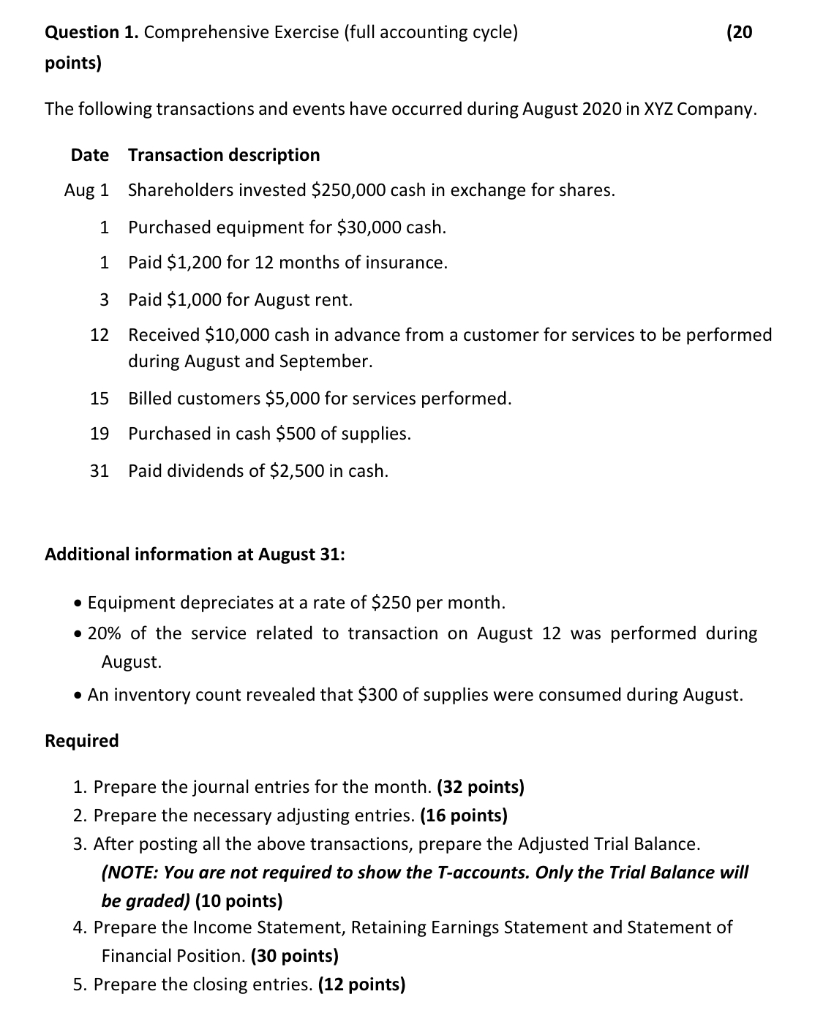

Question: (20 Question 1. Comprehensive Exercise (full accounting cycle) points) The following transactions and events have occurred during August 2020 in XYZ Company. Date Transaction description

(20 Question 1. Comprehensive Exercise (full accounting cycle) points) The following transactions and events have occurred during August 2020 in XYZ Company. Date Transaction description Aug 1 Shareholders invested $250,000 cash in exchange for shares. 1 Purchased equipment for $30,000 cash. 1 Paid $1,200 for 12 months of insurance. 3 Paid $1,000 for August rent. 12 Received $10,000 cash in advance from a customer for services to be performed during August and September. 15 Billed customers $5,000 for services performed. 19 Purchased in cash $500 of supplies. 31 Paid dividends of $2,500 in cash. Additional information at August 31: Equipment depreciates at a rate of $250 per month. 20% of the service related to transaction on August 12 was performed during August An inventory count revealed that $300 of supplies were consumed during August. Required 1. Prepare the journal entries for the month. (32 points) 2. Prepare the necessary adjusting entries. (16 points) 3. After posting all the above transactions, prepare the Adjusted Trial Balance. (NOTE: You are not required to show the T-accounts. Only the Trial Balance will be graded) (10 points) 4. Prepare the Income Statement, Retaining Earnings Statement and Statement of Financial Position. (30 points) 5. Prepare the closing entries. (12 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts