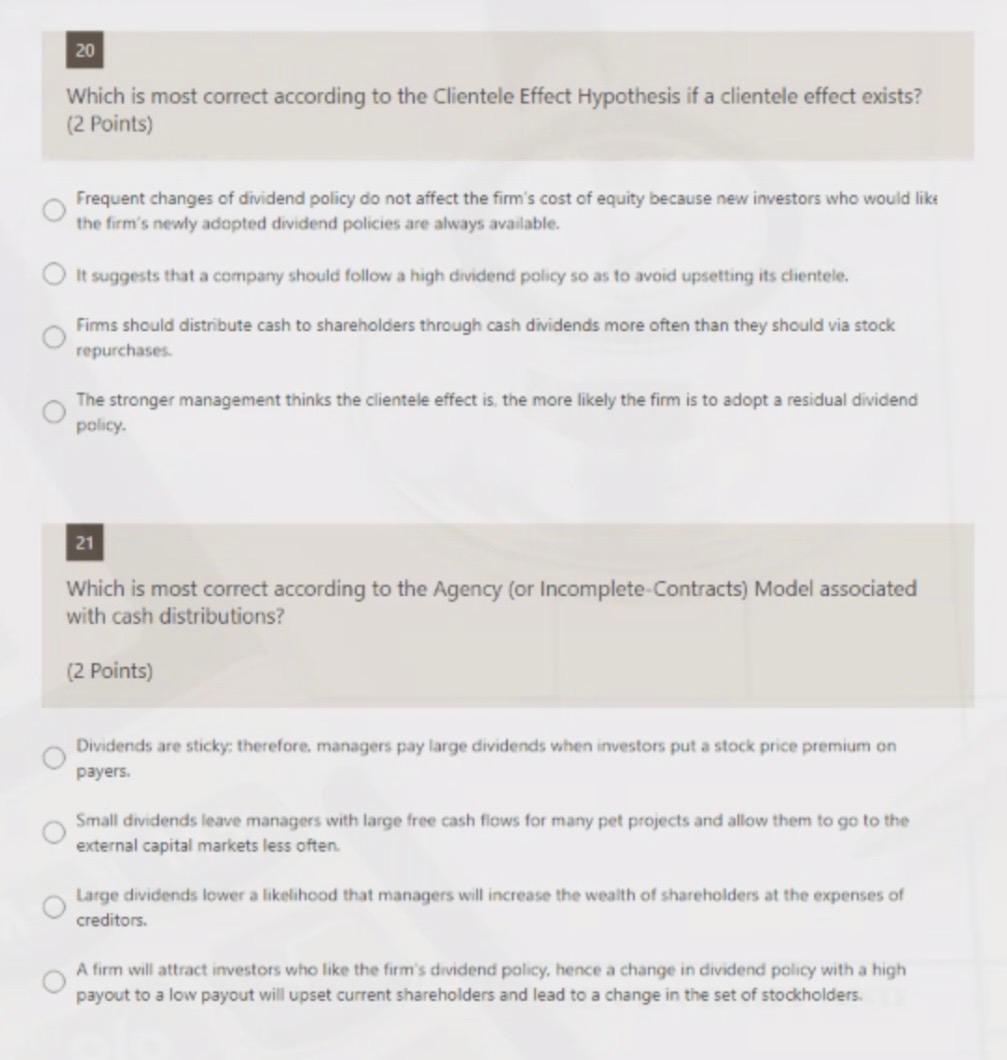

Question: 20 Which is most correct according to the Clientele Effect Hypothesis if a clientele effect exists? (2 Points) Frequent changes of dividend policy do not

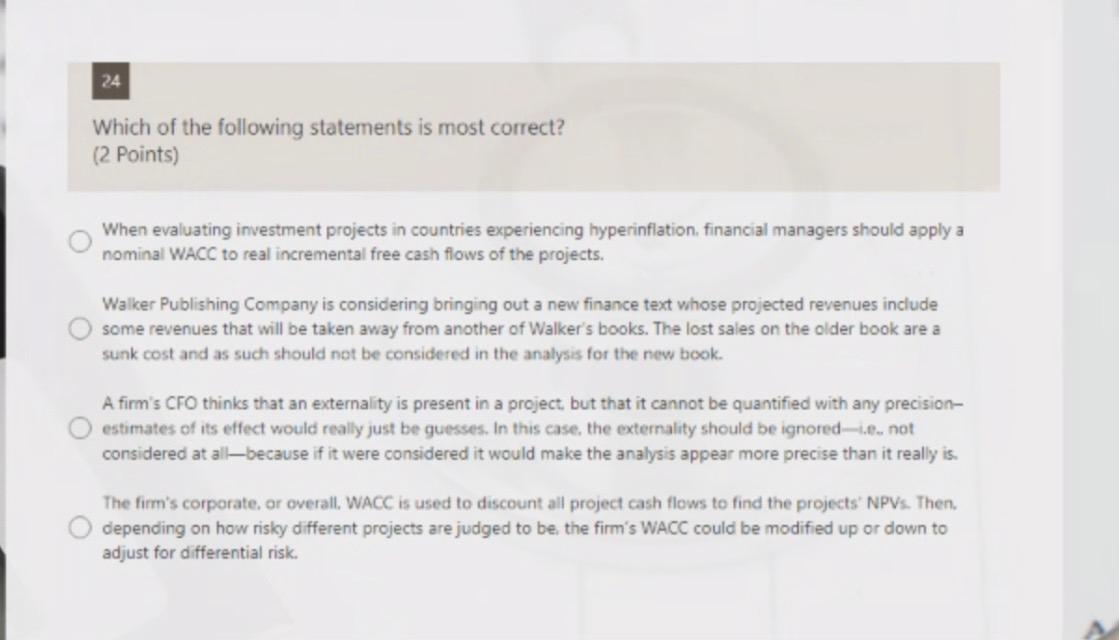

20 Which is most correct according to the Clientele Effect Hypothesis if a clientele effect exists? (2 Points) Frequent changes of dividend policy do not affect the firm's cost of equity because new investors who would like the firm's newly adopted dividend policies are always available. It suggests that a company should follow a high dividend policy so as to avoid upsetting its clientele. Firms should distribute cash to shareholders through cash dividends more often than they should via stock repurchases. The stronger management thinks the clientele effect is, the more likely the firm is to adopt a residual dividend policy. 21 Which is most correct according to the Agency (or Incomplete Contracts) Model associated with cash distributions? (2 Points) Dividends are sticky: therefore, managers pay large dividends when investors put a stock price premium on payers. Small dividends leave managers with large free cash flows for many pet projects and allow them to go to the external capital markets less often. Large dividends lower a likelihood that managers will increase the wealth of shareholders at the expenses of creditors. A firm will attract investors who like the firm's dividend policy, hence a change in dividend policy with a high payout to a low payout will upset current shareholders and lead to a change in the set of stockholders. 24 Which of the following statements is most correct? (2 Points) When evaluating investment projects in countries experiencing hyperinflation, financial managers should apply a nominal WACC to real incremental free cash flows of the projects. Walker Publishing Company is considering bringing out a new finance text whose projected revenues include some revenues that will be taken away from another of Walker's books. The lost sales on the older book are a sunk cost and as such should not be considered in the analysis for the new book. A firm's CFO thinks that an externality is present in a project, but that it cannot be quantified with any precision- estimates of its effect would really just be guesses. In this case, the externality should be ignored-i.. not considered at all-because if it were considered it would make the analysis appear more precise than it really is. The firm's corporate, or overall, WACC is used to discount all project cash flows to find the projects' NPVs. Then, depending on how risky different projects are judged to be the firm's WACC could be modified up or down to adjust for differential risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts