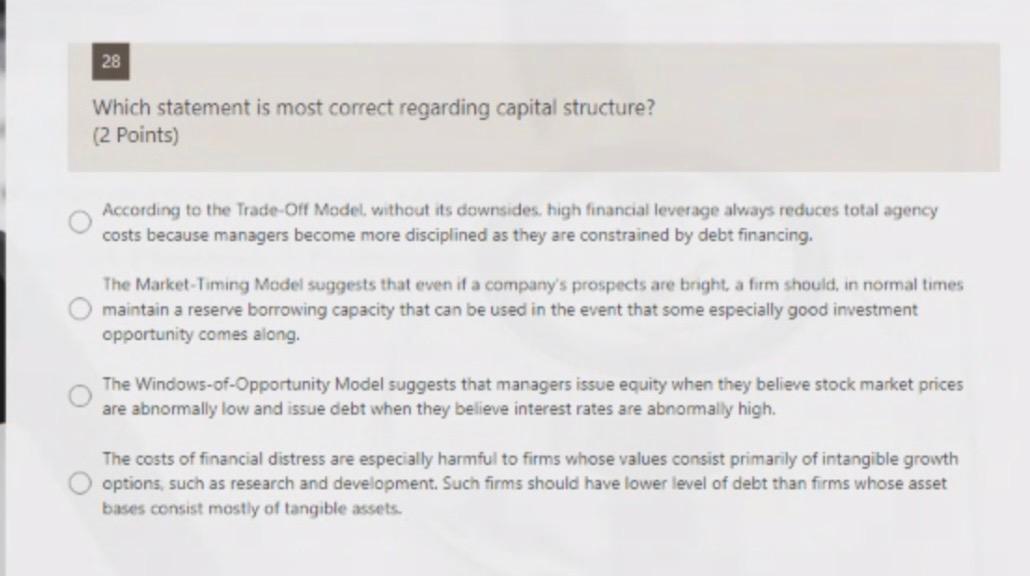

Question: 28 Which statement is most correct regarding capital structure? (2 Points) According to the Trade-Off Model, without its downsides, high financial leverage always reduces total

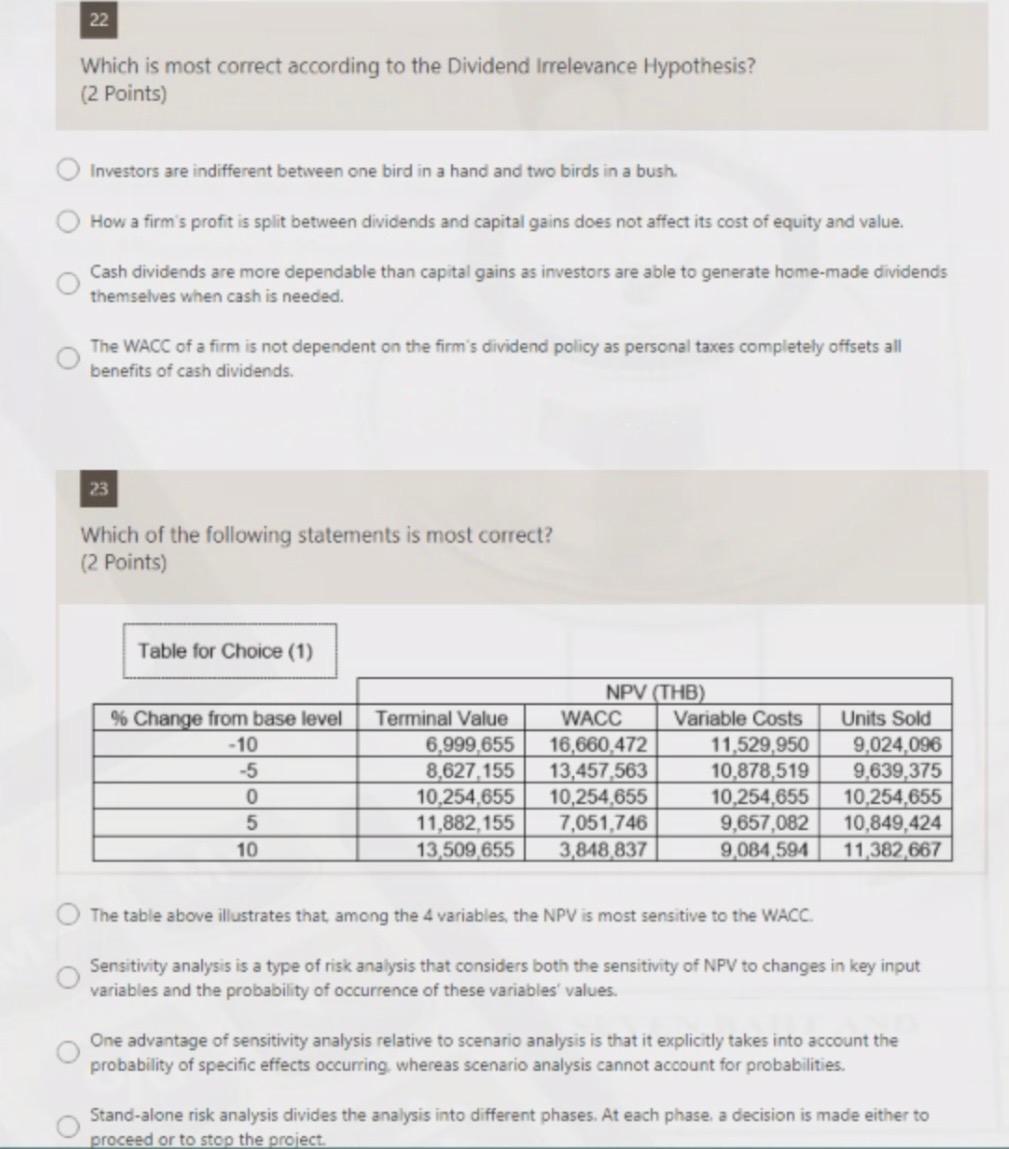

28 Which statement is most correct regarding capital structure? (2 Points) According to the Trade-Off Model, without its downsides, high financial leverage always reduces total agency costs because managers become more disciplined as they are constrained by debt financing. The Market-Timing Model suggests that even if a company's prospects are bright, a firm should, in normal times maintain a reserve borrowing capacity that can be used in the event that some especially good investment opportunity comes along. The Windows-of-Opportunity Model suggests that managers issue equity when they believe stock market prices are abnormally low and issue debt when they believe interest rates are abnormally high. The costs of financial distress are especially harmful to firms whose values consist primarily of intangible growth options, such as research and development. Such firms should have lower level of debt than firms whose asset bases consist mostly of tangible assets. 22 Which is most correct according to the Dividend Irrelevance Hypothesis? (2 Points) Investors are indifferent between one bird in a hand and two birds in a bush. How a firm's profit is split between dividends and capital gains does not affect its cost of equity and value. Cash dividends are more dependable than capital gains as investors are able to generate home-made dividends themselves when cash is needed. The WACC of a firm is not dependent on the firm's dividend policy as personal taxes completely offsets all benefits of cash dividends. 23 Which of the following statements is most correct? (2 Points) Table for Choice (1) NPV (THB) WACC % Change from base level Terminal Value Variable Costs 11,529,950 Units Sold 9,024,096 -10 6,999,655 16,660,472 -5 8,627,155 13,457,563 10,878,519 9,639,375 0 10,254,655 10,254,655 10,254,655 10,254,655 5 11,882,155 7,051,746 9,657,082 10,849,424 10 13,509,655 3,848,837 9,084,594 11,382,667 The table above illustrates that, among the 4 variables, the NPV is most sensitive to the WACC. Sensitivity analysis is a type of risk analysis that considers both the sensitivity of NPV to changes in key input variables and the probability of occurrence of these variables' values. One advantage of sensitivity analysis relative to scenario analysis is that it explicitly takes into account the probability of specific effects occurring, whereas scenario analysis cannot account for probabilities. Stand-alone risk analysis divides the analysis into different phases. At each phase, a decision is made either to proceed or to stop the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts