Question: 2014 40,000 3-19 Start with the partial model in the file Ch03 Build a Model.xlsx from the textbook's website Model: Joshua & White (J&W) Technologies's

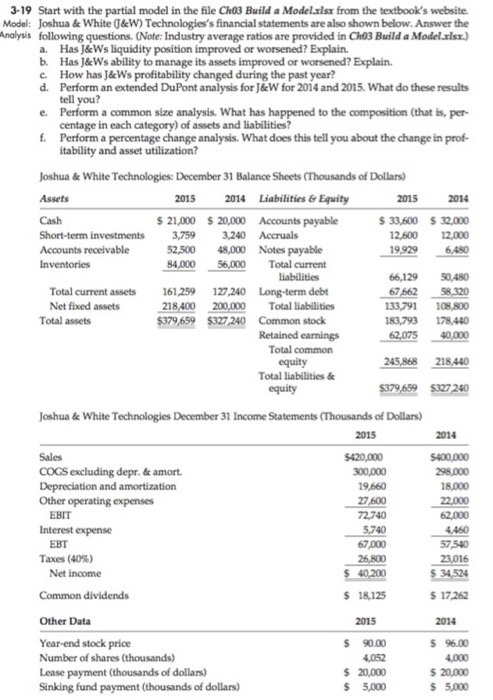

2014 40,000 3-19 Start with the partial model in the file Ch03 Build a Model.xlsx from the textbook's website Model: Joshua & White (J&W) Technologies's financial statements are also shown below. Answer the Analysis following questions. (Note: Industry average ratios are provided in Cho3 Build a Model.xlsx.) a. Has J&Ws liquidity position improved or worsened? Explain. b. Has J&Ws ability to manage its assets improved or worsened? Explain. c. How has J&Ws profitability changed during the past year? d. Perform an extended DuPont analysis for J&W for 2014 and 2015. What do these results tell you? e Perform a common size analysis. What has happened to the composition (that is, per- centage in each category) of assets and liabilities f. Perform a percentage change analysis. What does this tell you about the change in prof- itability and asset utilization? Joshua & White Technologies: December 31 Balance Sheets (Thousands of Dollars) Assets 2015 2014 Liabilities & Equity 2015 Cash $ 21,000 $ 20,000 Accounts payable $ 33,600 $ 32,000 Short-term investments 3,759 3,240 Accruals 12,600 12.000 Accounts receivable 52,500 48,000 Notes payable 19,929 6,450 Inventories 84,000 56,000 Total current liabilities 66,129 50,480 Total current assets 161,259 127,240 Long-term debt 67 662 58,320 Net fixed assets 218,400 200,000 Total liabilities 133,791 108,800 Total assets $379,659 $327,240 Common stock 183,793 178,440 Retained earnings 62,075 Total common equity 245,868 218,440 Total liabilities & equity $379,659 $327 240 Joshua & White Technologies December 31 Income Statements (Thousands of Dollars) 2015 Sales S420,000 $400,000 COGS excluding depr. & amort. 300,000 298,000 Depreciation and amortization 19,660 18.000 Other operating expenses 27,600 22.000 EBIT 72,740 62.000 Interest expense 5,740 67.000 57,540 Taxes (40%) 26,800 23,016 Net income $ 40,200 $ 34,524 Common dividends $ 18,125 $ 17,262 Other Data Year-end stock price $ 90.00 $ 96.00 Number of shares (thousands) 4,052 4,000 Lease payment (thousands of dollars) $ 20,000 $ 20,000 Sinking fund payment (thousands of dollars) $ 5,000 $5,000 2014 2015 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts