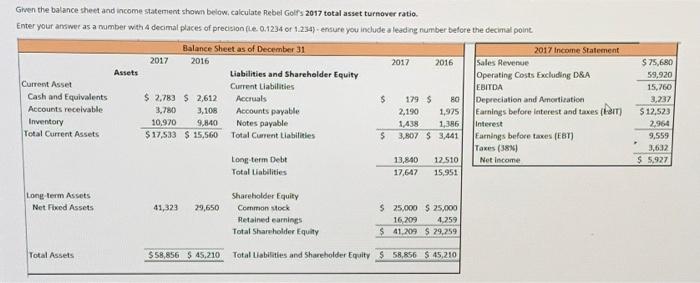

Question: 2016 Given the balance sheet and income statement shown below. calculate Rebel Golf's 2017 total asset turnover ratio. Enter your answer as a number with

2016 Given the balance sheet and income statement shown below. calculate Rebel Golf's 2017 total asset turnover ratio. Enter your answer as a number with 4 decimal places of precision (e. 0.1234 of 1.254) ensure you include a leading number before the decimal point Balance Sheet as of December 31 2017 Income Statement 2017 2017 2016 Sales Revenue Assets Liabilities and Shareholder Equity Operating costs Excluding DRA Current Asset Current Liabilities |EBITDA Cash and Equivalents $ 2,783 2,612 Accruals $ 1795 80 Depreciation and Amortization Accounts receivable 3,780 3.108 Accounts payable 2,190 1,975 Earnings before interest and taxes (ar) Inventory 10.970 9.840 Notes payable 1.438 1,386 Interest Total Current Assets $17,533 S 15,560 Total Current Liabilities $ 3,807 $3,441 Farings before taxes (ET) Taxes (38) Long term Debt 13,840 12510 Net Income Total Liabilities 17,647 15.951 $ 75,680 59.920 15,760 3,237 $12,523 2.964 9.559 3,632 $ 5,927 Long-term Assets Net Fixed Assets 41,323 29,650 Shareholder Equity Common stock Retained earnings Total Share der Equity S 25,000 $ 25,000 16,209 4.259 41.209 S 29,259 Total Assets $58,856 $ 45,210 Total Liabilities and Shareholder Equity $ 58,856 $ 45,210

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts