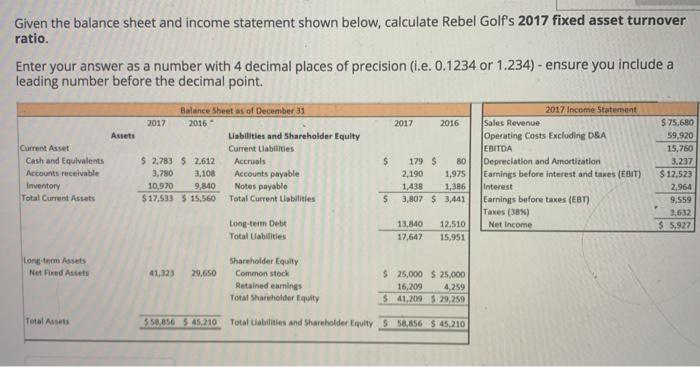

Question: Given the balance sheet and income statement shown below, calculate Rebel Golf's 2017 fixed asset turnover ratio. Enter your answer as a number with 4

Given the balance sheet and income statement shown below, calculate Rebel Golf's 2017 fixed asset turnover ratio. Enter your answer as a number with 4 decimal places of precision (.e. 0.1234 or 1.234) - ensure you include a leading number before the decimal point. 2017 2016 Assets Balance Sheets of December 31 2017 2016 Liabilities and Shareholder Equity Current Liabilities $ 2,783 5 2,612 Accruals 3.780 3.100 Accounts payable 10,970 9,840 Notes payable $ 17,533 5 15,560 Total Current Liabilities Current Asset Cash and Equivalents Accounts receivable Inventory Total Current Assets $ 179 $ 80 2190 1,975 1.438 1,386 3,807 $3,441 2017 Income Statement Sales Revenue Operating costs Excluding DEA EBITDA Depreciation and Amortization Earnings before interest and taxes (EBIT) Interest Earnings before taxes (EBT) Taxes (388) Net Income $75,680 59.920 15.760 3.237 $12.523 2,964 9,559 3.632 $ 5,927 5 Long-term Debt Total abilities 13,840 17,647 12.510 15,951 Long-term Assets Net Fred Assets 41.123 29.650 Shareholder Equity Common stock Retained earnings Total Shareholder Equity $ 25,000 $ 25.000 16,209 4,259 $41,209 S 29,259 Total Assets $ 58,856 5 45,210 Total Liabilities and Shareholder Equity 558,856 $ 45,210

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts