Question: ****2019**** ppl keep answering 2018 Problem 12-49 (LO. 2, 3, 4, 5) Pat is 40, is single, and has no dependents. She received a salary

****2019**** ppl keep answering 2018

****2019**** ppl keep answering 2018

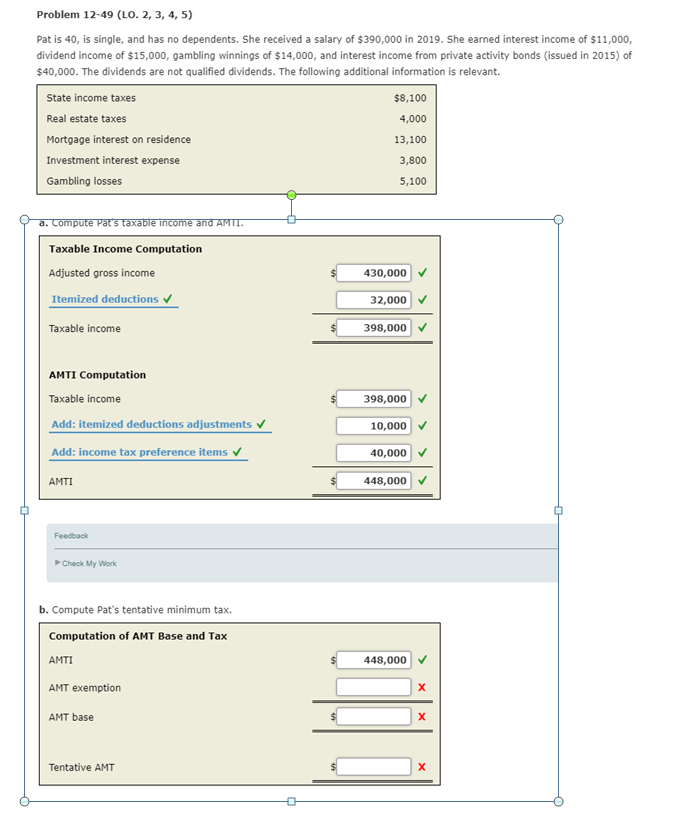

Problem 12-49 (LO. 2, 3, 4, 5) Pat is 40, is single, and has no dependents. She received a salary of $390,000 in 2019. She earned interest income of $11,000, dividend income of $15,000, gambling winnings of $14,000, and interest income from private activity bonds (issued in 2015) of $40,000. The dividends are not qualified dividends. The following additional information is relevant. State income taxes Real estate taxes Mortgage interest on residence Investment interest expense Gambling losses $8,100 4,000 13,100 3,800 5,100 9 a. Compute Pat's taxable income and AMTI. Taxable Income Computation Adjusted gross income 430,000 Itemized deductions 32,000 Taxable income 398,000 AMTI Computation Taxable income 398,000 Add: itemized deductions adjustments 10,000 Add: income tax preference items 40,000 AMTI 448,000 Feedback Check My Work b. Compute Pat's tentative minimum tax. Computation of AMT Base and Tax AMTI 448,000 AMT exemption AMT base Tentative AMT Problem 12-49 (LO. 2, 3, 4, 5) Pat is 40, is single, and has no dependents. She received a salary of $390,000 in 2019. She earned interest income of $11,000, dividend income of $15,000, gambling winnings of $14,000, and interest income from private activity bonds (issued in 2015) of $40,000. The dividends are not qualified dividends. The following additional information is relevant. State income taxes Real estate taxes Mortgage interest on residence Investment interest expense Gambling losses $8,100 4,000 13,100 3,800 5,100 9 a. Compute Pat's taxable income and AMTI. Taxable Income Computation Adjusted gross income 430,000 Itemized deductions 32,000 Taxable income 398,000 AMTI Computation Taxable income 398,000 Add: itemized deductions adjustments 10,000 Add: income tax preference items 40,000 AMTI 448,000 Feedback Check My Work b. Compute Pat's tentative minimum tax. Computation of AMT Base and Tax AMTI 448,000 AMT exemption AMT base Tentative AMT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts