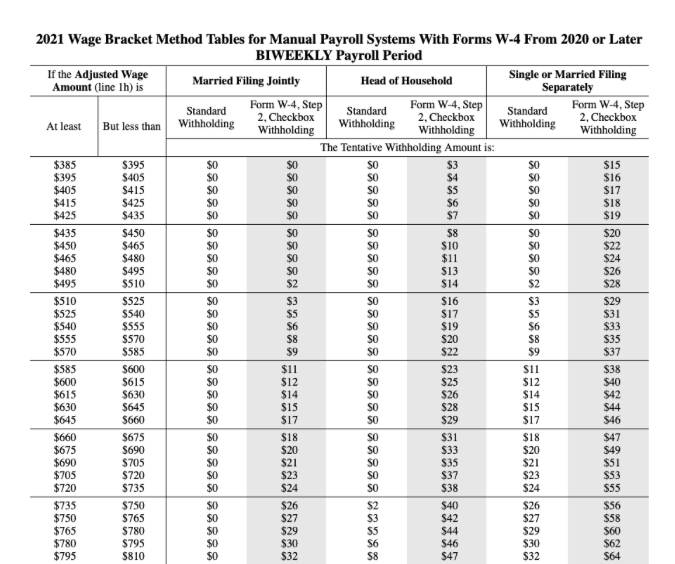

Question: 2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Amount (line

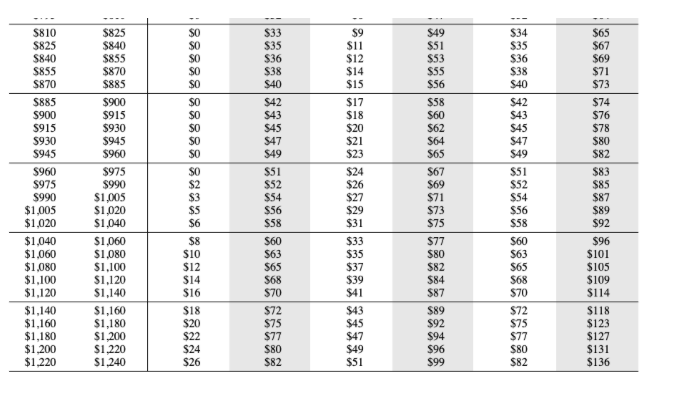

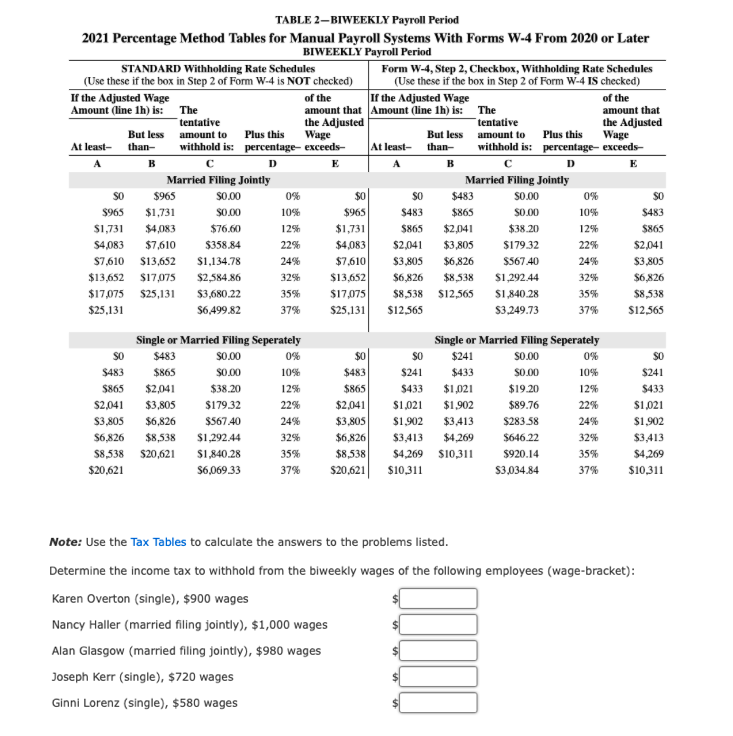

2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Head of Household Single or Married Filing Separately Standard Form W-4, Step Form W-4, Step Withholding 2, Checkbox Standard Withholding 2, Checkbox Standard Form W-4, Step At least But less than Withholding 2, Checkbox Withholding Withholding Withholding The Tentative Withholding Amount is: $385 $395 $0 SO $3 $15 $395 $405 50 $0 SO $4 $0 $16 $405 $415 $0 $5 SO $17 $415 $425 $6 $0 $18 $425 5435 SO $7 SO $19 $435 $450 $0 SO $8 $20 $450 $465 $0 $10 $22 $465 $480 $0 SO $11 SO $24 $480 $495 $0 $0 $26 $495 $510 $0 SO $14 $2 $28 $510 $525 SO $16 $3 $29 $525 $540 SO $17 $5 $31 $540 $555 $0 $6 SO $19 $6 $33 $555 $570 $0 SO $20 $8 $35 $570 $585 SO $22 $9 $37 $585 $600 $0 $11 SO $23 $11 $38 $600 $615 $0 $1 $25 $12 $40 $615 $630 $0 SO $26 $14 $42 $630 $645 $0 $15 SO $28 $15 $44 $645 $660 $0 $17 SO $29 $17 $46 $660 $675 50 $18 SO $31 $18 $47 $675 $690 $0 $20 SO $33 $20 $49 $690 $705 $0 $21 $35 $21 $51 $705 $720 SO $23 SO $37 $23 $53 $720 $735 $24 SO $38 $24 $55 $735 $750 $26 $2 $40 $26 $56 $750 $765 $0 $27 $42 $27 $58 $765 $780 $29 $5 $44 $29 $780 $795 $6 $46 $30 $62 $795 $810 $32 $47 $32 $64\fTABLE 2-BIWEEKLY Payroll Period 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) Use these if the box in Step 2 of Form W-4 IS checked If the Adjusted Wage of the If the Adjusted Wage of the Amount (line 1h) is: The amount that Amount (line 1h) is: The amount that tentative the Adjusted tentative the Adjusted But less amount to Plus this Wage But less amount to Plus this Wage At least- than- withhold is: percentage- exceeds- At least- than- withhold is: percentage- exceeds- E E Married Filing Jointly Married Filing Jointly SO $965 $0.00 0% $483 50.00 0% SO $965 $1,731 10% $965 $483 $865 $0.00 10% $483 $1,731 $4,083 $76.60 12% $1,731 5865 $2,041 $38.20 12% $865 $4.083 $7,610 $358.84 22% $4,083 $2.041 $3,805 $179.32 22% $2.041 $7.610 $13,652 $1,134.78 24% $7.610 $3.805 $6.826 $567.40 24% $3.805 $13.652 $17,075 $2,584.86 32%% $13,652 $6.826 $8.538 $1,292.44 $6.826 $17,075 $25,131 $3,680.22 35% $17,075 $8 538 $12,565 $1,840.28 35% $8,538 $25,131 $6.499.82 37% $25.131 $12,565 53.249.73 37% $12,565 Single or Married Filing Seperately Single or Married Filing Seperately SO $483 $0.00 0% $24 50.00 0% $483 $865 SO.00 10% $483 $241 $433 $0.00 10% $241 $865 $2,041 $38.20 12% $865 $433 $1,021 $19.20 12% $433 $2,041 $3,805 $179.32 2:2% $2,041 $1,021 $1,902 $89.76 22% $1,021 $3.805 $6,826 $567.40 24% $3.805 $1.902 $3.413 $283.58 24% $1,902 56,826 $8,538 $1,292.44 329% $6,826 $3.413 $4.269 $646.22 32% $3.413 $8,538 $20,621 $1,840.28 35% $8 538 $4,269 $10,311 $920.14 35% $4,269 $20.621 $6,069.33 37% $20,621 $10,311 $3,034.84 37% $10,311 Note: Use the Tax Tables to calculate the answers to the problems listed. Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket): Karen Overton (single), $900 wages Nancy Haller (married filing jointly), $1,000 wages Alan Glasgow (married filing jointly), $980 wages Joseph Kerr (single), $720 wages Ginni Lorenz (single), $580 wages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts