Question: Using the provided template complete the Payroll Register for the week of Oct 4-17 for Bonneau Enterprises, All employees are paid on a biweekly basis

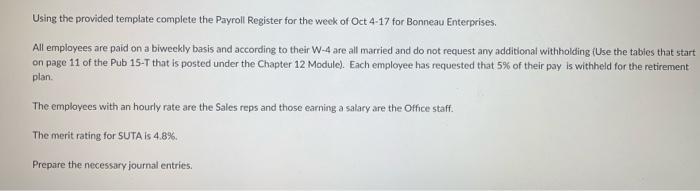

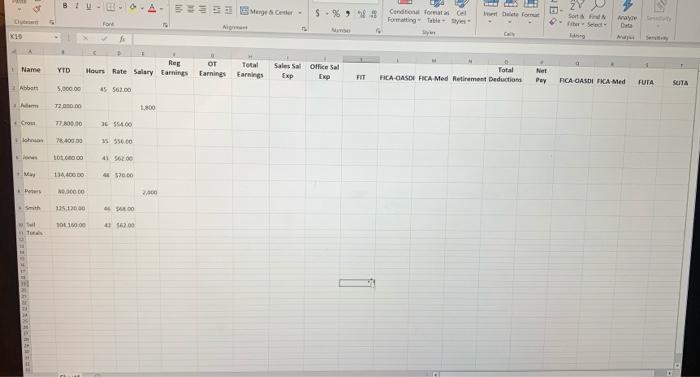

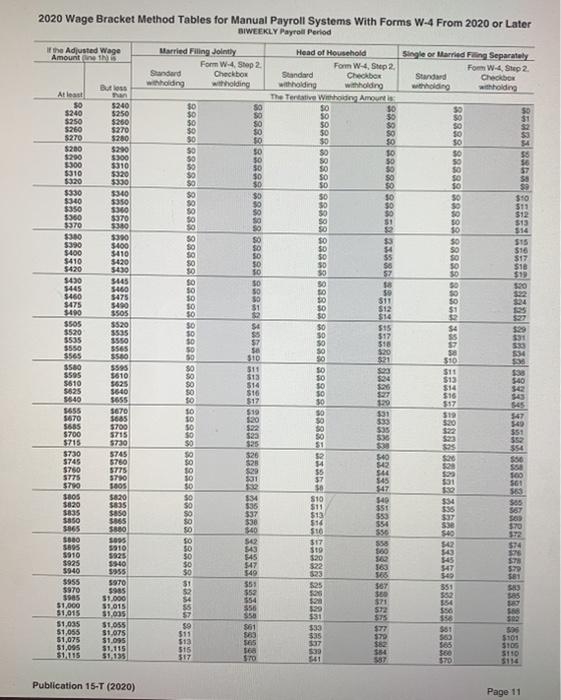

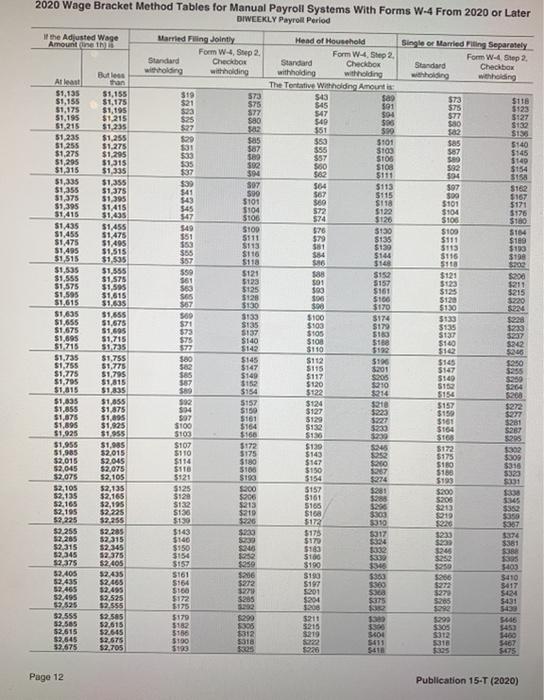

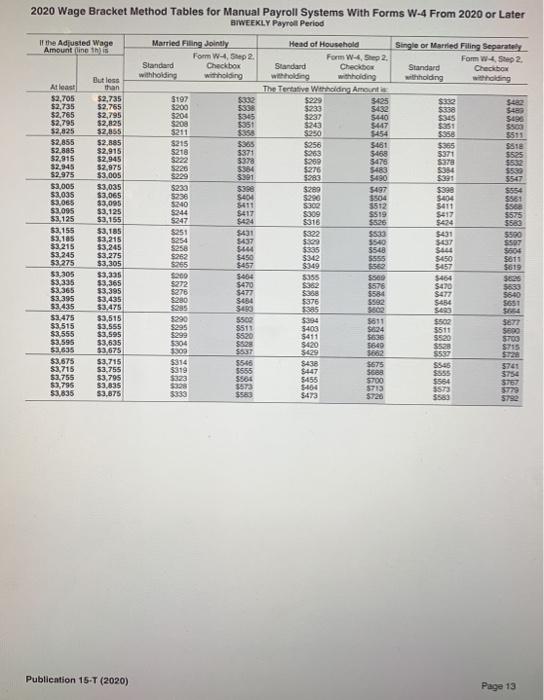

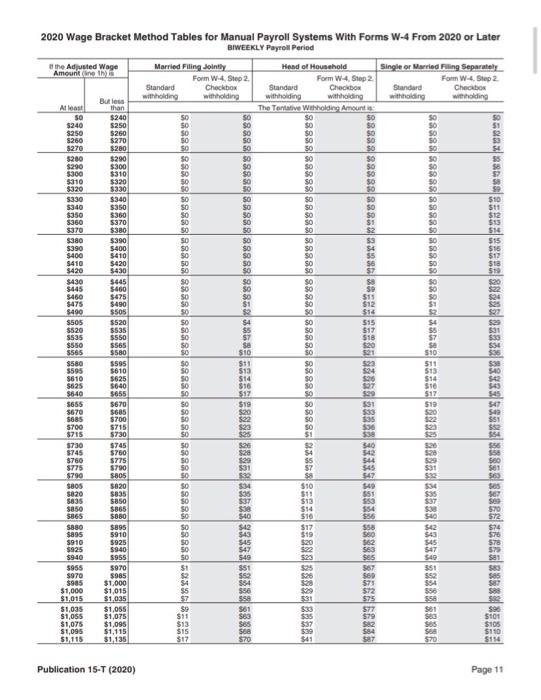

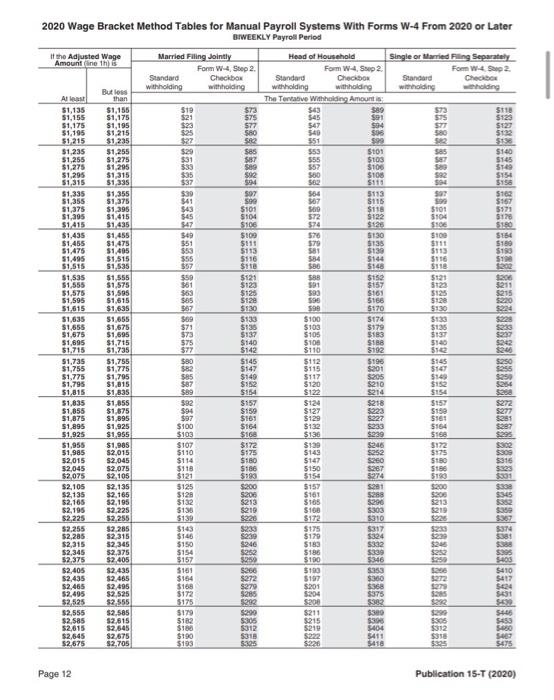

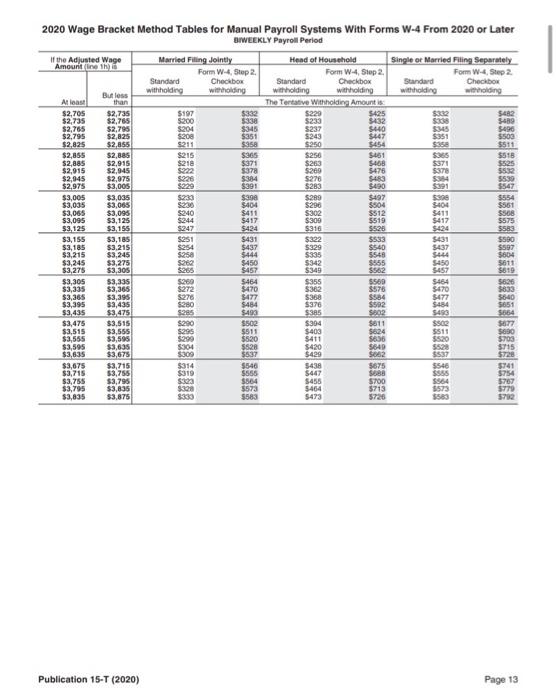

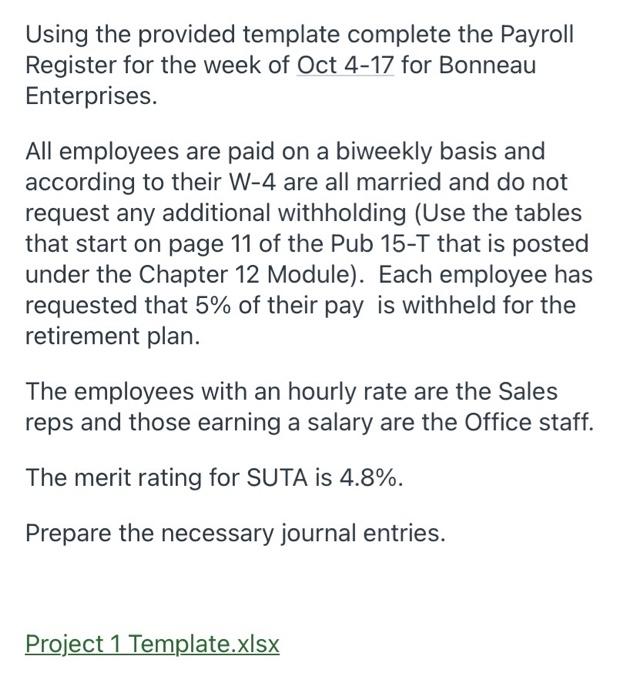

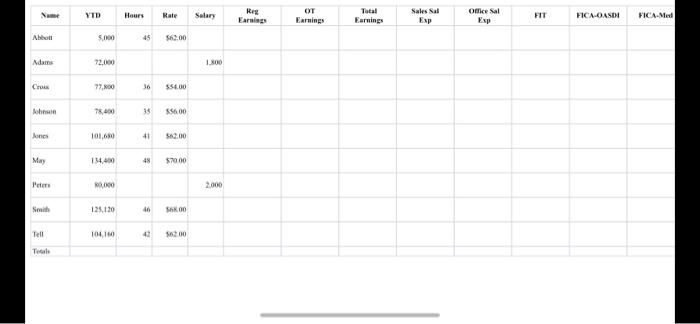

Using the provided template complete the Payroll Register for the week of Oct 4-17 for Bonneau Enterprises, All employees are paid on a biweekly basis and according to their W-4 are all married and do not request any additional withholding (Use the tables that start on page 11 of the Pub 15-T that is posted under the Chapter 12 Module). Each employee has requested that 5% of their pay is withheld for the retirement plan. The employees with an hourly rate are the sales reps and those earning a salary are the Office staff. The merit rating for SUTA is 4.8% Prepare the necessary journal entries. BISA- ZY Mange the $% # Condition format el but fort Sortid See Ikone w Det KI Name YTD Reg OT TOM Hours Rate Salary Earnings Earnings Earnings Sales Sal Exp Office Sal Exp FIT Total RICA-CASDE FICA Med Retirement Deduction Net Pey FICA-CASDI TKA Med FUTA SUITA Abban 5,000.00 45 562.00 Nam T2.000.00 1.800 Cro T1000 $5400 2000 56.00 tot0 41 A2 +M 134,100.00 $70.00 NDO 2,000 Smith 125,130.00 tul 1010000 6200 os 05 OS OS Os 0$ 0$ 5430 03 0 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Larried Filing Jointly Head of Household Amount this Single or Married Filing Separately Form W-4. Step 2 Form W-4, Step 2 FomW-4Step 2 Standard Checkbox Standard Checkbox Standard Checkbox withholding But witholding withholding withholding withholding withholding At least than The Tentative With Amounts $0 5240 SO 5240 10 $250 SO $250 $260 $0 $260 $270 $270 5280 $200 $2.00 $0 $200 10 $$ $300 3300 SO 50 56 3310 $310 $320 S7 $320 $0 $0 SO 55 3330 $0 SO $0 SO $9 $330 $340 $340 $350 $10 $350 $300 $13 5360 $370 $12 3370 $380 $13 5.14 $3:00 $390 $390 $400 $400 $410 $10 $410 $420 $17 $420 S18 50 $19 1430 34445 50 1445 5460 18 520 $460 $9 $475 $475 $11 5490 $490 $1 $12 $505 $2 SO $14 $505 $520 $4 $520 $29 15 3535 $535 $17 3560 $550 530 3565 518 $565 SS80 20 534 $10 $21 510 3560 $595 $0 $11 538 $595 3610 SO $13 5610 $40 5625 $14 $13 $20 5625 3640 $16 5540 $16 $655 10 $17 $17 $45 5655 5670 10 $19 5670 5665 520 $33 5685 $700 149 $22 5700 5715 $51 $23 $715 $730 $25 $730 5745 $26 $40 3745 5780 $50 525 942 $ $750 5775 $29 544 5775 100 5790 391 $700 SOS 561 350 3805 $820 $34 $820 5835 $34 549 $85 $11 $36 5835 $850 337 $ $35 587 $13 $ 5865 $37 $38 $ 554 5865 5880 $3e 570 $40 $40 S600 3005 SO $02 $17 5895 5910 558 $74 $43 5910 5925 500 543 376 $45 20 $925 1940 ST $47 22 $940 3955 563 570 $49 568 $955 5970 $1 553 $25 5985 $970 SAS 52 $52 3905 51.000 $60 585 54 $54 $1,000 554 31.015 $71 556 51,015 $5.35 $58 SS S7 $58 $31 58 592 51,035 51,055 $9 $61 $33 51,055 $1.075 $81 sos $ SA $1,075 $1.095 550 $101 $13 SES $1.095 51.115 $65 3100 $15 TER 51,115 $1.155 $60 5110 $17 BES98309 8888888888888888888888888888888888888888888888888888888 24 1998333333333333333 8983628888 88888888888888888888888888888888888 SE599 998595588 SESSEEEEE2829939328293283 28644 888888888888888 SEBE SEEEEEEEEEE82 B930088383 382 E84269888 88888888888888888888 OS 225 15$ 0$ set SES SCS GES Publication 15-T (2020) Page 11 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later DIWEEKLY Payroll Period If the Adjusted Wage Amount II Married Filling Jointly Form W-4, Sep 2 Standard Checkbox witholding withholding Single or Married Filling Separately Form W-4 Step 2 Standard Checibox withholding withholding But less $19 $21 523 $25 573 $75 577 580 573 $75 577 $80 $92 $20 131 533 $35 At least $1,135 $1,155 $1,175 $1,195 $1,215 51.235 $1,255 $1,275 $1,295 $1315 $1,335 $1,355 31,375 $1,395 $1,415 51.435 $1,455 $1,475 $1.495 $1,515 $1.535 $1.555 $1.575 $1,595 $1.615 $1,635 $1.65 $1.675 $1.695 51 715 51.735 $1.755 $1.775 $1,795 $1.815 $1,835 $1.855 $1,675 $1.895 $1,925 $1.955 $1,985 $2,015 $2.045 $2.075 $2,105 52,135 52.165 52,195 $118 $123 $127 $132 $18 5140 $145 $149 $154 S18 $162 $167 $171 $176 $160 $184 $189 $190 $190 $39 $41 $43 $45 547 549 $51 553 $55 $57 559 561 $63 sos $1,155 $1,175 $1,195 $1.215 $1,235 $1,255 $1.275 $1.295 $1,315 $1,335 51.355 51.375 $1.395 $1.415 51.435 $1,455 $1,475 $1,495 $1,515 $1.535 $1,555 $1.575 $1.595 $1,615 $1.635 $1,655 51.675 $1.695 51,715 51 735 $1.755 51.775 $1,795 $1,815 $1.835 $1.455 $1.875 $1,895 $1.925 $1.955 $1,085 52.015 $2.045 $2.075 $2,105 $2,135 $2,165 $2,195 $2.225 $2.255 $2.285 $2.315 $2.345 52375 $2405 32.435 $2165 52.495 52,525 32.555 52585 52.615 $2.645 52.675 $2.705 $85 587 $80 $92 $14 597 $90 5101 $104 Stod 5100 5511 $113 $116 $118 $121 $123 $125 $126 $130 3130 $135 $137 $140 5142 $145 $147 $149 $152 $154 5157 $150 $161 $164 Head of Household Form W4. Step 2 Standard Checkbox withholding withholding The Tentative Witholding Amount is $43 Sao $45 501 347 504 $40 595 551 5.90 $50 5101 $55 $100 $57 STOS $50 $108 $82 564 $113 567 $115 $60 $118 572 $122 $74 $120 $26 3130 $79 $135 581 $139 $144 S6 $14 588 $152 $91 3157 $93 $161 500 $100 $90 $170 $100 $174 $100 $179 $105 $100 $180 $110 5192 $112 $105 $115 $200 $117 $205 $120 Sao $122 $214 $124 $210 $127 $223 $129 5227 $132 $200 $10 5230 $130 Sus $143 252 $167 $200 $150 1967 $274 5157 $281 $161 $288 5165 $2.00 $100 $300 $310 $175 $317 $170 $324 $180 312 $100 3330 $190 $190 $350 $197 $300 5201 Si $204 $85 587 SO 592 $944 $97 300 $100 $104 $100 $100 $111 $115 $116 $118 $123 $123 $120 5130 3133 $135 $137 $140 $14 $140 $147 $149 1211 $215 3.220 $224 $228 $233 5237 5242 $2.05 5000 560 $71 $73 $75 972 580 582 $85 387 $80 599 $94 $07 $100 5103 $107 $110 $114 SITO 5121 $125 $152 $150 $150 $164 5175 $172 $175 $180 $105 $190 $180 $150 5193 $200 $200 $213 219 900 1900 $123 $264 $200 $272 $277 $281 $267 $295 $302 $300 $3:10 $323 $131 1333 SMS $552 $350 $357 $374 $381 $38 1995 3402 $410 $417 $424 5431 5-130 $2255 52.265 $2.315 52,345 52.375 52.405 52.435 52.465 52525 52,555 52.585 52.615 $2.645 52.575 $132 $130 $130 $143 $140 $150 3154 $157 $161 $164 $160 5172 $175 $170 $182 5186 $190 5215 $219 $326 $230 246 3252 $959 $206 $272 3279 5285 5233 $30 1205 5252 $250 5206 $273 SANS $299 305 $312 5318 $325 $211 5215 $219 222 $920 $300 SOU $415 $299 $305 5312 5318 5453 1460 $467 $075 Page 12 Publication 15-T (2020) $300 $35+ 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Amount (line 1 Head of Household Single or Married Filing Separately Form W-4 Sep 2 Form W-4 Sep 2 Form W-4 S 2 Standard Checkbox Standard Checko Standard Checkbox But loss withholding witholding withholding withholding withholding wholding At least than The Tentative Wholding Amount $2,705 $2,735 $197 $332 $229 3425 $2,735 $300 52.765 $200 $40 $233 suse $398 $2.765 $2,795 5204 5345 5237 $40 5440 $345 $2,795 $2,825 5208 $243 $447 5494 52,825 52,855 $350 $250 3511 $2,855 52.885 5215 3365 5256 3481 $355 52.885 $2,915 SSTE 5210 5371 $263 5468 $2,915 $371 $2.945 $378 $525 $289 $2,945 3476 Sata $2,975 5220 $384 5532 $276 $2.975 $483 $354 $3,005 $530 5220 $091 5283 $490 $391 $3,005 5547 $3,035 5230 $398 $280 5497 $390 $3.035 $3,065 5236 $3.065 $404 5290 $504 $404 $3,095 $3,095 $411 S302 3512 $411 $3,125 5244 $417 $566 $3,125 $3,155 S309 S519 $417 5575 $247 $424 $316 5424 $3,155 $3,18 5560 $251 $431 $322 5533 $3,185 $431 5500 $3,215 5254 $437 33.215 $3,245 $300 5258 5540 3437 $444 $507 $3,245 $335 5548 $3,275 $262 $450 $3.275 $3,305 $265 5342 SSSS $457 5611 $349 5457 $3,305 $619 $3,335 $3,335 $200 $464 $355 $500 $3,365 5464 5272 $3,395 $470 $362 $3.365 5576 $40 5278 5639 $477 8388 5584 $3.395 $3,435 $280 $477 $684 $376 $3.435 5640 5592 $3,475 $295 $40 5454 5651 SO $3.475 $3.515 5290 5529 $3,515 $3.555 $894 5611 $295 $511 $3.555 5677 5403 S824 $3,595 5511 5690 $3,595 $3,635 5520 5411 $636 5520 $304 $529 $4420 5640 $700 $520 53,675 3300 SU $429 STIS 5662 5580 $3,675 53.715 014 ST20 5546 $438 $3,715 5675 $3.755 5319 5845 $447 3741 $3.755 $3.795 $323 SSSS S688 $584 $455 $700 3750 $2.795 53.835 sion $564 $573 3-44 $780 ST13 $3,835 $3,875 $333 $583 SS3 $473 $720 5580 5792 200 $450 $555 3779 Publication 15-T (2020) Page 13 8803 3340 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period the Adjusted Wage Married Filing Jointly Head of Household Amount (non Single or Married Filing Separately FormW-4. Step 2 FormW-4. Step 2 FormW-4. Step 2 Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding withholding withholding withholding witholding At least than The Tentative Wahholding Amount is SO $240 $ SO $240 $250 SO $250 $260 $0 5260 5270 SO 5270 $200 $200 $290 SO $290 $300 $0 $300 $310 SO $310 $320 SO $320 $330 $330 $340 $350 $350 $360 SO $350 $12 $370 50 $13 $370 $380 $14 $380 $390 $390 $400 $400 $410 5410 $420 $420 $430 $430 $445 $445 SO $460 S460 $475 $475 $490 $12 $490 $505 14 $505 5520 $4 515 $4 5520 $535 SS $17 5535 $550 18 $550 $565 se $20 $565 $580 $0 $10 SO 521 $10 $580 $595 $11 SO 523 $595 511 5610 $13 $24 $13 $610 $625 $14 5625 07 5640 5655 20 517 5655 5670 $19 $0 $31 $10 $670 5685 $20 5685 $700 22 5700 5715 $23 $715 $730 5730 $745 540 $745 $760 $760 S775 $775 5790 $31 5790 5805 547 $ S805 5820 $10 549 5820 534 5835 5835 $35 $850 8.50 $865 $865 SBBO $40 $40 S880 $895 $42 $42 $895 5910 343 5910 $925 $82 $925 $940 563 $940 5955 549 5955 5970 59 $970 $985 $52 560 sas $985 $1.000 $4 $54 $1,000 $1,015 5 $56 SS SA $1.015 $1.035 $7 SS8 558 $1,035 $1,055 577 SI OSS $1,075 81,075 $1,095 $13 $1,095 $105 $1,115 $15 sed $110 51.115 $1,135 $17 $70 570 $114 999888888888888888888888888888888888888888888888888888888 2888888888EEE 88982189858 1888232323988484288888888888888888888888 8888888888888888888888888888888888888888 ===== | z Ba| 3 | 8888888888888888888888850303 EEEBURU 1885 388 888888888888888 16:40 288888888889339 3388888888888888888 as a & B & a b s Publication 15-T (2020) Page 11 $1.215 $1235 8889333333 GEERSTE $1.435 $144 5116 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period It the Adjusted Wage Married Filing Jointly Head of Household Amount in this Single or Married Filing Separately FormW-4, Step 2 Form W-4 Sep 2 Fom W-4 Sep 2 Standard Checkbox Standard Checkbox Standard Checkbox But loss withholding withholding withholding withholding withholding holding Alt than The Tentative Withholding Amount is: $1,135 $1,155 573 $43 $89 $110 51,155 $1,175 $21 575 $45 $91 51,175 $1,195 577 $47 $123 $1,195 S04 STT $80 540 5527 51 215 Se 5132 551 $1.235 $1.255 585 $53 $101 $140 51.255 $1.275 587 $55 $105 $1,275 STA $1.295 Se 557 $100 $1.295 ST $1315 $92 580 $100 51.315 $1335 $154 $94 562 $94 $158 $1,335 $1,355 $30 $07 564 51.355 $1,375 5113 ST $162 590 567 $1,395 $115 $43 $90 $1,375 $167 $101 989 $118 $101 $1.395 $1.415 $45 5971 5104 572 $122 $104 $1415 547 $106 $74 $125 $1.435 $1,455 $49 $100 5130 $100 $1,455 $164 $1,475 $51 $111 579 $135 $111 51.475 $1.495 $53 5189 5113 $81 5130 $113 51,495 $1.515 $55 5116 $190 51 51.515 $1,535 $57 $110 $ $143 $1,535 $1.555 $50 $121 BB $1,555 $1.575 $51 $150 591 $121 $123 $157 $123 $1,575 81 Sos 363 $125 $93 $161 51.595 $1.615 $85 $120 590 5160 $120 51.615 $1 635 5220 $87 $130 599 5170 $130 51.635 $1,655 $89 5133 $100 5174 $130 $1,655 $1,675 5135 103 $179 51.675 $1,695 $135 5137 $105 $183 $1,695 $137 $1,715 $140 5100 $188 $140 $1.715 51.735 $77 $142 $110 51,735 $1.755 $80 $145 5112 5190 $145 $1,755 $82 $1,775 $147 $115 5201 $147 $1,775 $1,795 585 $140 $117 5205 $149 $1,795 $1.815 $87 $152 $120 $210 $152 $1.815 $1 835 $89 $154 $122 $214 $154 51.835 $1,855 $92 $157 $124 5218 51,855 $1.875 $94 $150 $127 51.875 $1.895 597 $150 $161 $120 5227 $161 51.895 $1.925 $100 $164 $132 51.925 $1.955 $164 $168 $136 See $1,955 $1,905 $107 $172 $130 5246 51,985 $172 $2.015 $110 $175 $143 52.015 $2,045 $114 $180 $147 52.045 $2.075 $118 $180 $186 5150 $2.075 $150 $2,105 $121 $180 5274 $2,105 $2.135 $125 5200 5157 5291 5200 52.135 $2,165 $128 5200 5161 528 52,165 52,195 $132 $213 $165 $296 $213 $2,195 52.225 5136 $210 $168 5303 $219 52.225 52 255 $139 $123 $310 $225 $2,255 $2,285 $145 5233 $175 $317 $2,285 52.315 $146 $314 5239 $120 $230 $2,315 52,345 $150 5246 5332 52,345 52.375 $154 5002 5339 52.375 $2 405 $157 $0950 $100 30 $2.405 $2.435 5181 $266 $180 3353 sage $2.435 $2,465 $164 $272 $197 $360 $272 52,465 $2,495 $168 $279 $200 $368 $2,495 $2.525 $172 $270 5204 $64 5285 $375 $2,525 3285 $2 555 $431 3292 $200 $382 $2,555 $2.585 $179 $200 $211 $300 $2.585 $2,615 3162 546 $305 $215 52.615 $2,645 $300 $305 5453 $180 $210 5404 $38 $2,645 $2,675 $100 5222 52.675 52.705 5411 $35 540 $193 5305 5226 $410 $305 5495 1923 $100 239 529 $180 Se See 5318 Page 12 Publication 15-T (2020) 30 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period of the Adjusted Wago Married Filling Jointly Hand of Household Amountinho Single or Married Filing Separately FormW-4. Step 2 Form W-4, Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding witholding withholding withholding withholding witholding At least than The Tentative Withholding Amount is: $2,705 $2.735 $197 $332 5220 5425 $2,735 $2,765 $482 $200 5233 5432 So $2,795 $489 $2.765 S204 $345 5237 $440 $2,795 $2,825 5200 $351 5243 5490 $447 $2,825 $2,855 $211 $958 $250 $511 $2,855 $2,385 $215 $365 $256 5451 $365 $518 $2,085 $2.915 $218 $371 $263 5468 $2,915 5371 5222 $525 $2,945 $378 $200 5476 5378 5532 $2,045 $2,975 5226 $384 5278 $483 31 5539 $2,975 $3,005 $229 $391 $283 $490 $191 $547 $3,005 $3,035 5230 $390 $200 $497 $3,035 $3.065 $300 $554 5404 $290 $504 $3,065 $3,095 3404 5240 $561 $411 S302 5512 $3,095 $3,125 SSGB $244 $411 $417 $300 $417 $575 $247 $434 $310 SSR $3,155 $3,185 $251 $431 $322 $533 $431 $3,185 $3.215 $254 $437 5329 $3,245 $540 3437 $3,215 5258 5444 5335 5548 $3,245 $3,275 5444 $450 $342 $450 $3275 $3,305 $457 $349 $562 5457 $3.305 $260 $355 $589 $3.335 $454 $3,365 $272 $470 $362 $576 $470 $3.365 53.as $276 $477 $368 $584 $3,395 $477 $3,435 $280 $484 $376 $454 $3,435 $502 $3,475 $95 $493 SSS SAOB $433 $3,515 $200 $502 $304 $811 ssce $3.515 $3,555 $295 5511 $403 $624 $3,555 $3,595 $200 $511 5520 $411 5636 $3,595 $3.635 5304 5520 5528 $420 5640 $3,635 $3,675 5522 $300 $537 $429 S2 $537 $3,675 $3,715 $314 5540 5438 5675 $3,715 $546 $310 $141 $3,755 $555 5447 SOBA $S55 $3,755 $75 $3,795 $123 $564 $455 $3,835 5700 $3,795 $300 5573 5564 5767 5464 5713 5573 $3,835 $779 $3.875 5583 $493 5726 $583 5519 $3125 53.155 $424 $555 53.335 5464 $3,475 Publication 15-T (2020) Page 13 Using the provided template complete the Payroll Register for the week of Oct 4-17 for Bonneau Enterprises. All employees are paid on a biweekly basis and according to their W-4 are all married and do not request any additional withholding (Use the tables that start on page 11 of the Pub 15-T that is posted under the Chapter 12 Module). Each employee has requested that 5% of their pay is withheld for the retirement plan. The employees with an hourly rate are the Sales reps and those earning a salary are the Office staff. The merit rating for SUTA is 4.8%. Prepare the necessary journal entries. Project 1 Template.xlsx N YTD Hours Rate Salary Reg Earnings OT Earnings Total Earnings Office Sal Exp FIT FICA-OASDI FICA-Med Exp Abbott 5.000 45 $69.00 Adams 72.000 1.DO 77.00 36 35400 78.400 35 550.00 101,600 41 May 134,400 48 $70.00 Peters 000 2.000 Smith 125, 120 16 600 Tell 104.160 42 200 Tecale Ole Sal Exp FIT FICADASDI FICA-Med Retirement Total Deductions NI Pay FICA-QASDI FICA-Med FUTA SUTA Using the provided template complete the Payroll Register for the week of Oct 4-17 for Bonneau Enterprises, All employees are paid on a biweekly basis and according to their W-4 are all married and do not request any additional withholding (Use the tables that start on page 11 of the Pub 15-T that is posted under the Chapter 12 Module). Each employee has requested that 5% of their pay is withheld for the retirement plan. The employees with an hourly rate are the sales reps and those earning a salary are the Office staff. The merit rating for SUTA is 4.8% Prepare the necessary journal entries. BISA- ZY Mange the $% # Condition format el but fort Sortid See Ikone w Det KI Name YTD Reg OT TOM Hours Rate Salary Earnings Earnings Earnings Sales Sal Exp Office Sal Exp FIT Total RICA-CASDE FICA Med Retirement Deduction Net Pey FICA-CASDI TKA Med FUTA SUITA Abban 5,000.00 45 562.00 Nam T2.000.00 1.800 Cro T1000 $5400 2000 56.00 tot0 41 A2 +M 134,100.00 $70.00 NDO 2,000 Smith 125,130.00 tul 1010000 6200 os 05 OS OS Os 0$ 0$ 5430 03 0 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Larried Filing Jointly Head of Household Amount this Single or Married Filing Separately Form W-4. Step 2 Form W-4, Step 2 FomW-4Step 2 Standard Checkbox Standard Checkbox Standard Checkbox withholding But witholding withholding withholding withholding withholding At least than The Tentative With Amounts $0 5240 SO 5240 10 $250 SO $250 $260 $0 $260 $270 $270 5280 $200 $2.00 $0 $200 10 $$ $300 3300 SO 50 56 3310 $310 $320 S7 $320 $0 $0 SO 55 3330 $0 SO $0 SO $9 $330 $340 $340 $350 $10 $350 $300 $13 5360 $370 $12 3370 $380 $13 5.14 $3:00 $390 $390 $400 $400 $410 $10 $410 $420 $17 $420 S18 50 $19 1430 34445 50 1445 5460 18 520 $460 $9 $475 $475 $11 5490 $490 $1 $12 $505 $2 SO $14 $505 $520 $4 $520 $29 15 3535 $535 $17 3560 $550 530 3565 518 $565 SS80 20 534 $10 $21 510 3560 $595 $0 $11 538 $595 3610 SO $13 5610 $40 5625 $14 $13 $20 5625 3640 $16 5540 $16 $655 10 $17 $17 $45 5655 5670 10 $19 5670 5665 520 $33 5685 $700 149 $22 5700 5715 $51 $23 $715 $730 $25 $730 5745 $26 $40 3745 5780 $50 525 942 $ $750 5775 $29 544 5775 100 5790 391 $700 SOS 561 350 3805 $820 $34 $820 5835 $34 549 $85 $11 $36 5835 $850 337 $ $35 587 $13 $ 5865 $37 $38 $ 554 5865 5880 $3e 570 $40 $40 S600 3005 SO $02 $17 5895 5910 558 $74 $43 5910 5925 500 543 376 $45 20 $925 1940 ST $47 22 $940 3955 563 570 $49 568 $955 5970 $1 553 $25 5985 $970 SAS 52 $52 3905 51.000 $60 585 54 $54 $1,000 554 31.015 $71 556 51,015 $5.35 $58 SS S7 $58 $31 58 592 51,035 51,055 $9 $61 $33 51,055 $1.075 $81 sos $ SA $1,075 $1.095 550 $101 $13 SES $1.095 51.115 $65 3100 $15 TER 51,115 $1.155 $60 5110 $17 BES98309 8888888888888888888888888888888888888888888888888888888 24 1998333333333333333 8983628888 88888888888888888888888888888888888 SE599 998595588 SESSEEEEE2829939328293283 28644 888888888888888 SEBE SEEEEEEEEEE82 B930088383 382 E84269888 88888888888888888888 OS 225 15$ 0$ set SES SCS GES Publication 15-T (2020) Page 11 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later DIWEEKLY Payroll Period If the Adjusted Wage Amount II Married Filling Jointly Form W-4, Sep 2 Standard Checkbox witholding withholding Single or Married Filling Separately Form W-4 Step 2 Standard Checibox withholding withholding But less $19 $21 523 $25 573 $75 577 580 573 $75 577 $80 $92 $20 131 533 $35 At least $1,135 $1,155 $1,175 $1,195 $1,215 51.235 $1,255 $1,275 $1,295 $1315 $1,335 $1,355 31,375 $1,395 $1,415 51.435 $1,455 $1,475 $1.495 $1,515 $1.535 $1.555 $1.575 $1,595 $1.615 $1,635 $1.65 $1.675 $1.695 51 715 51.735 $1.755 $1.775 $1,795 $1.815 $1,835 $1.855 $1,675 $1.895 $1,925 $1.955 $1,985 $2,015 $2.045 $2.075 $2,105 52,135 52.165 52,195 $118 $123 $127 $132 $18 5140 $145 $149 $154 S18 $162 $167 $171 $176 $160 $184 $189 $190 $190 $39 $41 $43 $45 547 549 $51 553 $55 $57 559 561 $63 sos $1,155 $1,175 $1,195 $1.215 $1,235 $1,255 $1.275 $1.295 $1,315 $1,335 51.355 51.375 $1.395 $1.415 51.435 $1,455 $1,475 $1,495 $1,515 $1.535 $1,555 $1.575 $1.595 $1,615 $1.635 $1,655 51.675 $1.695 51,715 51 735 $1.755 51.775 $1,795 $1,815 $1.835 $1.455 $1.875 $1,895 $1.925 $1.955 $1,085 52.015 $2.045 $2.075 $2,105 $2,135 $2,165 $2,195 $2.225 $2.255 $2.285 $2.315 $2.345 52375 $2405 32.435 $2165 52.495 52,525 32.555 52585 52.615 $2.645 52.675 $2.705 $85 587 $80 $92 $14 597 $90 5101 $104 Stod 5100 5511 $113 $116 $118 $121 $123 $125 $126 $130 3130 $135 $137 $140 5142 $145 $147 $149 $152 $154 5157 $150 $161 $164 Head of Household Form W4. Step 2 Standard Checkbox withholding withholding The Tentative Witholding Amount is $43 Sao $45 501 347 504 $40 595 551 5.90 $50 5101 $55 $100 $57 STOS $50 $108 $82 564 $113 567 $115 $60 $118 572 $122 $74 $120 $26 3130 $79 $135 581 $139 $144 S6 $14 588 $152 $91 3157 $93 $161 500 $100 $90 $170 $100 $174 $100 $179 $105 $100 $180 $110 5192 $112 $105 $115 $200 $117 $205 $120 Sao $122 $214 $124 $210 $127 $223 $129 5227 $132 $200 $10 5230 $130 Sus $143 252 $167 $200 $150 1967 $274 5157 $281 $161 $288 5165 $2.00 $100 $300 $310 $175 $317 $170 $324 $180 312 $100 3330 $190 $190 $350 $197 $300 5201 Si $204 $85 587 SO 592 $944 $97 300 $100 $104 $100 $100 $111 $115 $116 $118 $123 $123 $120 5130 3133 $135 $137 $140 $14 $140 $147 $149 1211 $215 3.220 $224 $228 $233 5237 5242 $2.05 5000 560 $71 $73 $75 972 580 582 $85 387 $80 599 $94 $07 $100 5103 $107 $110 $114 SITO 5121 $125 $152 $150 $150 $164 5175 $172 $175 $180 $105 $190 $180 $150 5193 $200 $200 $213 219 900 1900 $123 $264 $200 $272 $277 $281 $267 $295 $302 $300 $3:10 $323 $131 1333 SMS $552 $350 $357 $374 $381 $38 1995 3402 $410 $417 $424 5431 5-130 $2255 52.265 $2.315 52,345 52.375 52.405 52.435 52.465 52525 52,555 52.585 52.615 $2.645 52.575 $132 $130 $130 $143 $140 $150 3154 $157 $161 $164 $160 5172 $175 $170 $182 5186 $190 5215 $219 $326 $230 246 3252 $959 $206 $272 3279 5285 5233 $30 1205 5252 $250 5206 $273 SANS $299 305 $312 5318 $325 $211 5215 $219 222 $920 $300 SOU $415 $299 $305 5312 5318 5453 1460 $467 $075 Page 12 Publication 15-T (2020) $300 $35+ 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Amount (line 1 Head of Household Single or Married Filing Separately Form W-4 Sep 2 Form W-4 Sep 2 Form W-4 S 2 Standard Checkbox Standard Checko Standard Checkbox But loss withholding witholding withholding withholding withholding wholding At least than The Tentative Wholding Amount $2,705 $2,735 $197 $332 $229 3425 $2,735 $300 52.765 $200 $40 $233 suse $398 $2.765 $2,795 5204 5345 5237 $40 5440 $345 $2,795 $2,825 5208 $243 $447 5494 52,825 52,855 $350 $250 3511 $2,855 52.885 5215 3365 5256 3481 $355 52.885 $2,915 SSTE 5210 5371 $263 5468 $2,915 $371 $2.945 $378 $525 $289 $2,945 3476 Sata $2,975 5220 $384 5532 $276 $2.975 $483 $354 $3,005 $530 5220 $091 5283 $490 $391 $3,005 5547 $3,035 5230 $398 $280 5497 $390 $3.035 $3,065 5236 $3.065 $404 5290 $504 $404 $3,095 $3,095 $411 S302 3512 $411 $3,125 5244 $417 $566 $3,125 $3,155 S309 S519 $417 5575 $247 $424 $316 5424 $3,155 $3,18 5560 $251 $431 $322 5533 $3,185 $431 5500 $3,215 5254 $437 33.215 $3,245 $300 5258 5540 3437 $444 $507 $3,245 $335 5548 $3,275 $262 $450 $3.275 $3,305 $265 5342 SSSS $457 5611 $349 5457 $3,305 $619 $3,335 $3,335 $200 $464 $355 $500 $3,365 5464 5272 $3,395 $470 $362 $3.365 5576 $40 5278 5639 $477 8388 5584 $3.395 $3,435 $280 $477 $684 $376 $3.435 5640 5592 $3,475 $295 $40 5454 5651 SO $3.475 $3.515 5290 5529 $3,515 $3.555 $894 5611 $295 $511 $3.555 5677 5403 S824 $3,595 5511 5690 $3,595 $3,635 5520 5411 $636 5520 $304 $529 $4420 5640 $700 $520 53,675 3300 SU $429 STIS 5662 5580 $3,675 53.715 014 ST20 5546 $438 $3,715 5675 $3.755 5319 5845 $447 3741 $3.755 $3.795 $323 SSSS S688 $584 $455 $700 3750 $2.795 53.835 sion $564 $573 3-44 $780 ST13 $3,835 $3,875 $333 $583 SS3 $473 $720 5580 5792 200 $450 $555 3779 Publication 15-T (2020) Page 13 8803 3340 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period the Adjusted Wage Married Filing Jointly Head of Household Amount (non Single or Married Filing Separately FormW-4. Step 2 FormW-4. Step 2 FormW-4. Step 2 Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding withholding withholding withholding witholding At least than The Tentative Wahholding Amount is SO $240 $ SO $240 $250 SO $250 $260 $0 5260 5270 SO 5270 $200 $200 $290 SO $290 $300 $0 $300 $310 SO $310 $320 SO $320 $330 $330 $340 $350 $350 $360 SO $350 $12 $370 50 $13 $370 $380 $14 $380 $390 $390 $400 $400 $410 5410 $420 $420 $430 $430 $445 $445 SO $460 S460 $475 $475 $490 $12 $490 $505 14 $505 5520 $4 515 $4 5520 $535 SS $17 5535 $550 18 $550 $565 se $20 $565 $580 $0 $10 SO 521 $10 $580 $595 $11 SO 523 $595 511 5610 $13 $24 $13 $610 $625 $14 5625 07 5640 5655 20 517 5655 5670 $19 $0 $31 $10 $670 5685 $20 5685 $700 22 5700 5715 $23 $715 $730 5730 $745 540 $745 $760 $760 S775 $775 5790 $31 5790 5805 547 $ S805 5820 $10 549 5820 534 5835 5835 $35 $850 8.50 $865 $865 SBBO $40 $40 S880 $895 $42 $42 $895 5910 343 5910 $925 $82 $925 $940 563 $940 5955 549 5955 5970 59 $970 $985 $52 560 sas $985 $1.000 $4 $54 $1,000 $1,015 5 $56 SS SA $1.015 $1.035 $7 SS8 558 $1,035 $1,055 577 SI OSS $1,075 81,075 $1,095 $13 $1,095 $105 $1,115 $15 sed $110 51.115 $1,135 $17 $70 570 $114 999888888888888888888888888888888888888888888888888888888 2888888888EEE 88982189858 1888232323988484288888888888888888888888 8888888888888888888888888888888888888888 ===== | z Ba| 3 | 8888888888888888888888850303 EEEBURU 1885 388 888888888888888 16:40 288888888889339 3388888888888888888 as a & B & a b s Publication 15-T (2020) Page 11 $1.215 $1235 8889333333 GEERSTE $1.435 $144 5116 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period It the Adjusted Wage Married Filing Jointly Head of Household Amount in this Single or Married Filing Separately FormW-4, Step 2 Form W-4 Sep 2 Fom W-4 Sep 2 Standard Checkbox Standard Checkbox Standard Checkbox But loss withholding withholding withholding withholding withholding holding Alt than The Tentative Withholding Amount is: $1,135 $1,155 573 $43 $89 $110 51,155 $1,175 $21 575 $45 $91 51,175 $1,195 577 $47 $123 $1,195 S04 STT $80 540 5527 51 215 Se 5132 551 $1.235 $1.255 585 $53 $101 $140 51.255 $1.275 587 $55 $105 $1,275 STA $1.295 Se 557 $100 $1.295 ST $1315 $92 580 $100 51.315 $1335 $154 $94 562 $94 $158 $1,335 $1,355 $30 $07 564 51.355 $1,375 5113 ST $162 590 567 $1,395 $115 $43 $90 $1,375 $167 $101 989 $118 $101 $1.395 $1.415 $45 5971 5104 572 $122 $104 $1415 547 $106 $74 $125 $1.435 $1,455 $49 $100 5130 $100 $1,455 $164 $1,475 $51 $111 579 $135 $111 51.475 $1.495 $53 5189 5113 $81 5130 $113 51,495 $1.515 $55 5116 $190 51 51.515 $1,535 $57 $110 $ $143 $1,535 $1.555 $50 $121 BB $1,555 $1.575 $51 $150 591 $121 $123 $157 $123 $1,575 81 Sos 363 $125 $93 $161 51.595 $1.615 $85 $120 590 5160 $120 51.615 $1 635 5220 $87 $130 599 5170 $130 51.635 $1,655 $89 5133 $100 5174 $130 $1,655 $1,675 5135 103 $179 51.675 $1,695 $135 5137 $105 $183 $1,695 $137 $1,715 $140 5100 $188 $140 $1.715 51.735 $77 $142 $110 51,735 $1.755 $80 $145 5112 5190 $145 $1,755 $82 $1,775 $147 $115 5201 $147 $1,775 $1,795 585 $140 $117 5205 $149 $1,795 $1.815 $87 $152 $120 $210 $152 $1.815 $1 835 $89 $154 $122 $214 $154 51.835 $1,855 $92 $157 $124 5218 51,855 $1.875 $94 $150 $127 51.875 $1.895 597 $150 $161 $120 5227 $161 51.895 $1.925 $100 $164 $132 51.925 $1.955 $164 $168 $136 See $1,955 $1,905 $107 $172 $130 5246 51,985 $172 $2.015 $110 $175 $143 52.015 $2,045 $114 $180 $147 52.045 $2.075 $118 $180 $186 5150 $2.075 $150 $2,105 $121 $180 5274 $2,105 $2.135 $125 5200 5157 5291 5200 52.135 $2,165 $128 5200 5161 528 52,165 52,195 $132 $213 $165 $296 $213 $2,195 52.225 5136 $210 $168 5303 $219 52.225 52 255 $139 $123 $310 $225 $2,255 $2,285 $145 5233 $175 $317 $2,285 52.315 $146 $314 5239 $120 $230 $2,315 52,345 $150 5246 5332 52,345 52.375 $154 5002 5339 52.375 $2 405 $157 $0950 $100 30 $2.405 $2.435 5181 $266 $180 3353 sage $2.435 $2,465 $164 $272 $197 $360 $272 52,465 $2,495 $168 $279 $200 $368 $2,495 $2.525 $172 $270 5204 $64 5285 $375 $2,525 3285 $2 555 $431 3292 $200 $382 $2,555 $2.585 $179 $200 $211 $300 $2.585 $2,615 3162 546 $305 $215 52.615 $2,645 $300 $305 5453 $180 $210 5404 $38 $2,645 $2,675 $100 5222 52.675 52.705 5411 $35 540 $193 5305 5226 $410 $305 5495 1923 $100 239 529 $180 Se See 5318 Page 12 Publication 15-T (2020) 30 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period of the Adjusted Wago Married Filling Jointly Hand of Household Amountinho Single or Married Filing Separately FormW-4. Step 2 Form W-4, Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding witholding withholding withholding withholding witholding At least than The Tentative Withholding Amount is: $2,705 $2.735 $197 $332 5220 5425 $2,735 $2,765 $482 $200 5233 5432 So $2,795 $489 $2.765 S204 $345 5237 $440 $2,795 $2,825 5200 $351 5243 5490 $447 $2,825 $2,855 $211 $958 $250 $511 $2,855 $2,385 $215 $365 $256 5451 $365 $518 $2,085 $2.915 $218 $371 $263 5468 $2,915 5371 5222 $525 $2,945 $378 $200 5476 5378 5532 $2,045 $2,975 5226 $384 5278 $483 31 5539 $2,975 $3,005 $229 $391 $283 $490 $191 $547 $3,005 $3,035 5230 $390 $200 $497 $3,035 $3.065 $300 $554 5404 $290 $504 $3,065 $3,095 3404 5240 $561 $411 S302 5512 $3,095 $3,125 SSGB $244 $411 $417 $300 $417 $575 $247 $434 $310 SSR $3,155 $3,185 $251 $431 $322 $533 $431 $3,185 $3.215 $254 $437 5329 $3,245 $540 3437 $3,215 5258 5444 5335 5548 $3,245 $3,275 5444 $450 $342 $450 $3275 $3,305 $457 $349 $562 5457 $3.305 $260 $355 $589 $3.335 $454 $3,365 $272 $470 $362 $576 $470 $3.365 53.as $276 $477 $368 $584 $3,395 $477 $3,435 $280 $484 $376 $454 $3,435 $502 $3,475 $95 $493 SSS SAOB $433 $3,515 $200 $502 $304 $811 ssce $3.515 $3,555 $295 5511 $403 $624 $3,555 $3,595 $200 $511 5520 $411 5636 $3,595 $3.635 5304 5520 5528 $420 5640 $3,635 $3,675 5522 $300 $537 $429 S2 $537 $3,675 $3,715 $314 5540 5438 5675 $3,715 $546 $310 $141 $3,755 $555 5447 SOBA $S55 $3,755 $75 $3,795 $123 $564 $455 $3,835 5700 $3,795 $300 5573 5564 5767 5464 5713 5573 $3,835 $779 $3.875 5583 $493 5726 $583 5519 $3125 53.155 $424 $555 53.335 5464 $3,475 Publication 15-T (2020) Page 13 Using the provided template complete the Payroll Register for the week of Oct 4-17 for Bonneau Enterprises. All employees are paid on a biweekly basis and according to their W-4 are all married and do not request any additional withholding (Use the tables that start on page 11 of the Pub 15-T that is posted under the Chapter 12 Module). Each employee has requested that 5% of their pay is withheld for the retirement plan. The employees with an hourly rate are the Sales reps and those earning a salary are the Office staff. The merit rating for SUTA is 4.8%. Prepare the necessary journal entries. Project 1 Template.xlsx N YTD Hours Rate Salary Reg Earnings OT Earnings Total Earnings Office Sal Exp FIT FICA-OASDI FICA-Med Exp Abbott 5.000 45 $69.00 Adams 72.000 1.DO 77.00 36 35400 78.400 35 550.00 101,600 41 May 134,400 48 $70.00 Peters 000 2.000 Smith 125, 120 16 600 Tell 104.160 42 200 Tecale Ole Sal Exp FIT FICADASDI FICA-Med Retirement Total Deductions NI Pay FICA-QASDI FICA-Med FUTA SUTA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts