Question: 204 a. 2. Using the data from the previous problem: Create a common-size income statement for 2019 and 2020. This statement should be created on

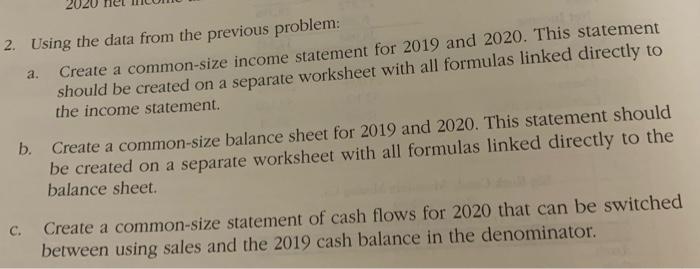

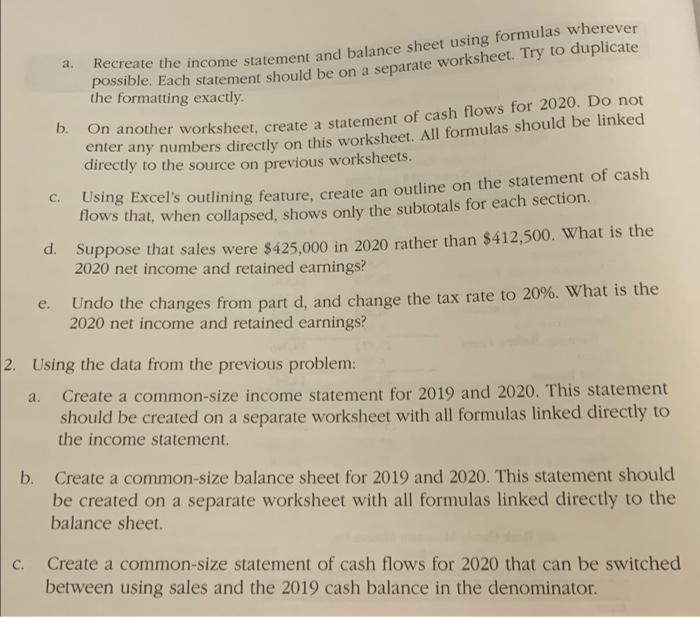

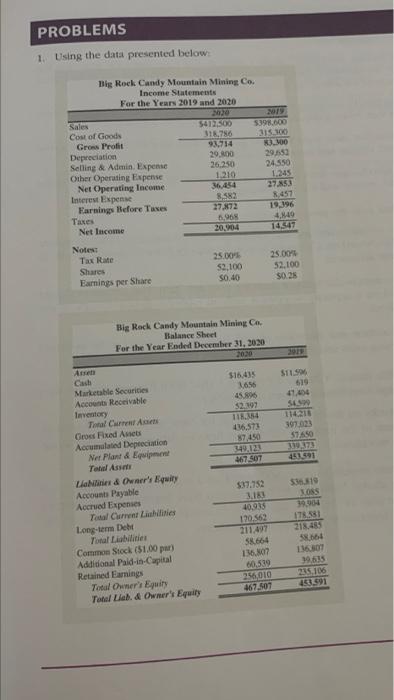

204 a. 2. Using the data from the previous problem: Create a common-size income statement for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the income statement. b. Create a common-size balance sheet for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the balance sheet c. Create a common-size statement of cash flows for 2020 that can be switched between using sales and the 2019 cash balance in the denominator. a. Recreate the income statement and balance sheet using formulas wherever possible. Each statement should be on a separate worksheet. Try to duplicate the formatting exactly. b. On another worksheet, create a statement of cash flows for 2020. Do not enter any numbers directly on this worksheet. All formulas should be linked directly to the source on previous worksheets. Using Excel's outlining feature, create an outline on the statement of cash flows that, when collapsed, shows only the subtotals for each section. d. Suppose that sales were $425,000 in 2020 rather than $412,500. What is the 2020 net income and retained earnings? e. Undo the changes from part d, and change the tax rate to 20%. What is the 2020 net income and retained earnings? c. 2. Using the data from the previous problem: a. Create a common-size income statement for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the income statement. b. Create a common-size balance sheet for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the balance sheet c. Create a common-size statement of cash flows for 2020 that can be switched between using sales and the 2019 cash balance in the denominator. PROBLEMS 1. Using the data presented below: Big Rock Candy Mountain Mining Co. Income Statements For the Year 2019 and 2020 300 019 Sales 54727500 5398.000 Cost of Goods 318,786 315.100 Gross Profit MO Depreciation 29.00 29.5.50 Selling & Admin Expense 26.250 24.550 Other Operating Expense 1210 Net Operating Income Interest Expense 8.52 8457 Earnings Before Taxes 27,872 19,396 Taxes 4,140 Net Income 14547 Notes: Tax Rate 25.00 25.00 Shares $2,100 52.100 Earnings per Share 50.40 SO 25 Big Rack Candy Mountain Mining Co. Balance Sheet For the Year Ended December 31, 2020 20.30 A Cast $16,435 1656 45.896 $2192 DIAS 36.573 87450 $11S 619 41.44 SA 397033 57450 330273 451591 467307 Marketable Securities Accounts Receivable Inventory Total Care Groer Fund Asset Accumulated Depreciation Net Plant & Equipment Total Ass IN & Ohrer's Equity Accounts Payable Accrued Expenses Testa Cheet Laitines Long-term Debt Total abilities Common Stock (51.00 pur) Additional Paid-is-Capital Retained Earnings Total Owner's Equity Total Lel. & Owner's Equity 537.752 3.183 40.913 170.562 211497 58,664 136.07 60,519 256,010 467.507 363519 BOS 34000 178531 218.483 S 116.01 39515 235.106 1591 204 a. 2. Using the data from the previous problem: Create a common-size income statement for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the income statement. b. Create a common-size balance sheet for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the balance sheet c. Create a common-size statement of cash flows for 2020 that can be switched between using sales and the 2019 cash balance in the denominator. a. Recreate the income statement and balance sheet using formulas wherever possible. Each statement should be on a separate worksheet. Try to duplicate the formatting exactly. b. On another worksheet, create a statement of cash flows for 2020. Do not enter any numbers directly on this worksheet. All formulas should be linked directly to the source on previous worksheets. Using Excel's outlining feature, create an outline on the statement of cash flows that, when collapsed, shows only the subtotals for each section. d. Suppose that sales were $425,000 in 2020 rather than $412,500. What is the 2020 net income and retained earnings? e. Undo the changes from part d, and change the tax rate to 20%. What is the 2020 net income and retained earnings? c. 2. Using the data from the previous problem: a. Create a common-size income statement for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the income statement. b. Create a common-size balance sheet for 2019 and 2020. This statement should be created on a separate worksheet with all formulas linked directly to the balance sheet c. Create a common-size statement of cash flows for 2020 that can be switched between using sales and the 2019 cash balance in the denominator. PROBLEMS 1. Using the data presented below: Big Rock Candy Mountain Mining Co. Income Statements For the Year 2019 and 2020 300 019 Sales 54727500 5398.000 Cost of Goods 318,786 315.100 Gross Profit MO Depreciation 29.00 29.5.50 Selling & Admin Expense 26.250 24.550 Other Operating Expense 1210 Net Operating Income Interest Expense 8.52 8457 Earnings Before Taxes 27,872 19,396 Taxes 4,140 Net Income 14547 Notes: Tax Rate 25.00 25.00 Shares $2,100 52.100 Earnings per Share 50.40 SO 25 Big Rack Candy Mountain Mining Co. Balance Sheet For the Year Ended December 31, 2020 20.30 A Cast $16,435 1656 45.896 $2192 DIAS 36.573 87450 $11S 619 41.44 SA 397033 57450 330273 451591 467307 Marketable Securities Accounts Receivable Inventory Total Care Groer Fund Asset Accumulated Depreciation Net Plant & Equipment Total Ass IN & Ohrer's Equity Accounts Payable Accrued Expenses Testa Cheet Laitines Long-term Debt Total abilities Common Stock (51.00 pur) Additional Paid-is-Capital Retained Earnings Total Owner's Equity Total Lel. & Owner's Equity 537.752 3.183 40.913 170.562 211497 58,664 136.07 60,519 256,010 467.507 363519 BOS 34000 178531 218.483 S 116.01 39515 235.106 1591

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts