Question: 20.6 If Jeff had written five 6-month put options on Worthen, what would his profit or loss have been at the maturity of the options

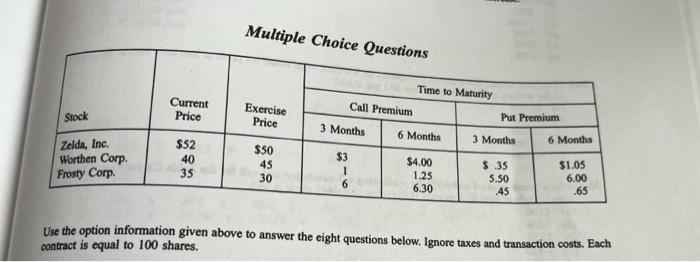

20.6 If Jeff had written five 6-month put options on Worthen, what would his profit or loss have been at the maturity of the options if the stock price was 543 per share? (a) $1,000 (b) $2,000 (c) $1,800 (d) $1,500 (e) -5500 20.7 John Zimmer created a straddle by purchasing a 3-month put and call for the Zelda Corporation. Determine John's profit or loss in 3 months if the price of Zelda's stock is $53. (a) $100 (6) $200 (e) $250 (d) -560 (e) -$35 Multiple Choice Questions Time to Maturity Current Price Call Premium Stock Exercise Price Put Premium 3 Months 6 Months $52 3 Months Zelda, Inc. 6 Months Worthen Corp Frosty Corp. 40 35 $50 45 30 $3 1 6 $4.00 1.25 6.30 $ 35 5.50 .45 $1.05 6.00 .65 Use the option information given above to answer the eight questions below. Ignore taxes and transaction costs. Each contract is equal to 100 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts