Question: 20.Consider two securities, A and B. Security A and B have a correlation coefficient of 0.65 Security A has standard deviation of 12, and security

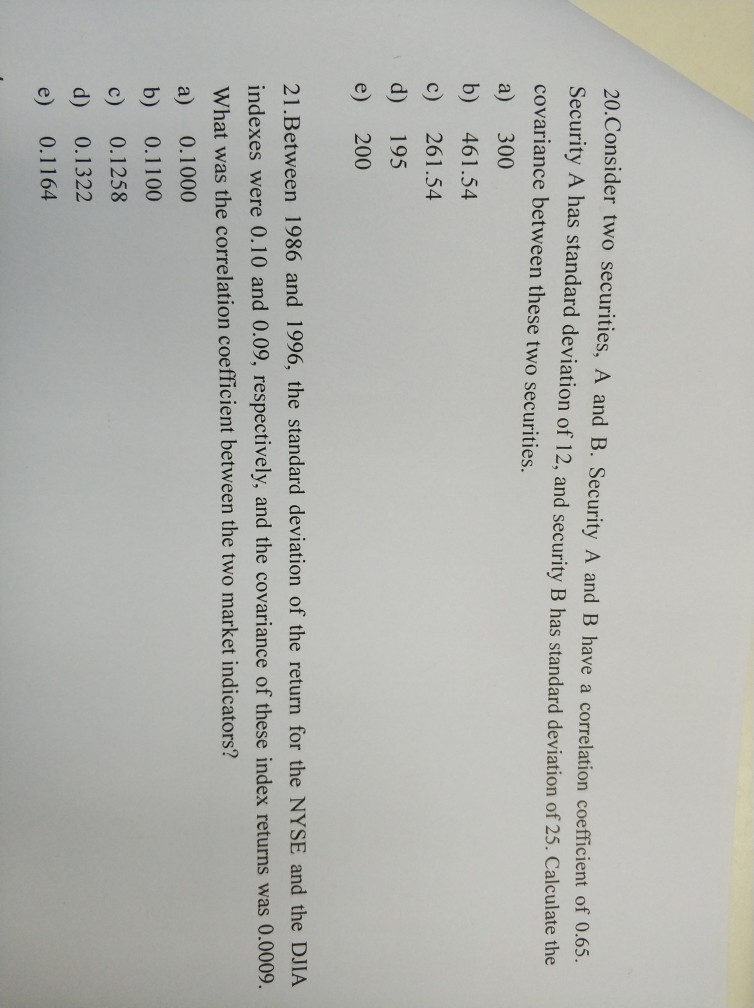

20.Consider two securities, A and B. Security A and B have a correlation coefficient of 0.65 Security A has standard deviation of 12, and security B has standard deviation of 25. Calculate the covariance between these two securities. a) 300 b) 461.54 c) 261.54 d) 195 e) 200 21.Between 1986 and 1996, the standard deviation of the return for the NYSE and the DJIA indexes were 0.10 and 0.09, respectively, and the covariance of these index returns was 0.0009. What was the correlation coefficient between the two market indicators? a) 0.1000 b) 0.1100 c) 0.1258 d) 0.1322 e) 0.1164

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts