Question: 21. Consider two hypothetical savers, Bert and Ernie. Bert puts $1,500 per year into a retirement account with an estimated 7.5% rate of return starting

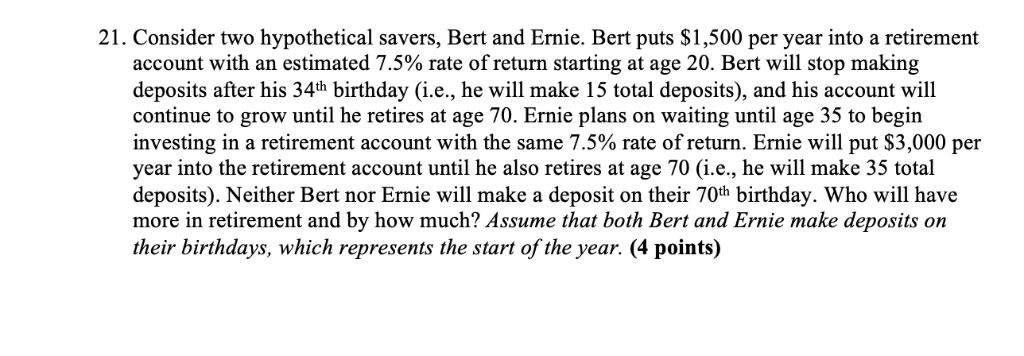

21. Consider two hypothetical savers, Bert and Ernie. Bert puts $1,500 per year into a retirement account with an estimated 7.5% rate of return starting at age 20, Bert will stop making deposits after his 34th birthday (i.e., he will make 15 total deposits), and his account will continue to grow until he retires at age 70. Ernie plans on waiting until age 35 to begin investing in a retirement account with the same 7.5% rate of return. Ernie will put $3,000 per year into the retirement account until he also retires at age 70 (i.e., he will make 35 total deposits). Neither Bert nor Ernie will make a deposit on their 70th birthday. Who will have more in retirement and by how much? Assume that both Bert and Ernie make deposits on their birthdays, which represents the start of the year. (4 points) 21. Consider two hypothetical savers, Bert and Ernie. Bert puts $1,500 per year into a retirement account with an estimated 7.5% rate of return starting at age 20, Bert will stop making deposits after his 34th birthday (i.e., he will make 15 total deposits), and his account will continue to grow until he retires at age 70. Ernie plans on waiting until age 35 to begin investing in a retirement account with the same 7.5% rate of return. Ernie will put $3,000 per year into the retirement account until he also retires at age 70 (i.e., he will make 35 total deposits). Neither Bert nor Ernie will make a deposit on their 70th birthday. Who will have more in retirement and by how much? Assume that both Bert and Ernie make deposits on their birthdays, which represents the start of the year. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts