Question: (21 Mark QUESTION 1.3 (Solution at end of chapter) 5:20 Manufacturing Limited (the company) intends purchasing a new machine...for use is manufacturing process. The machine

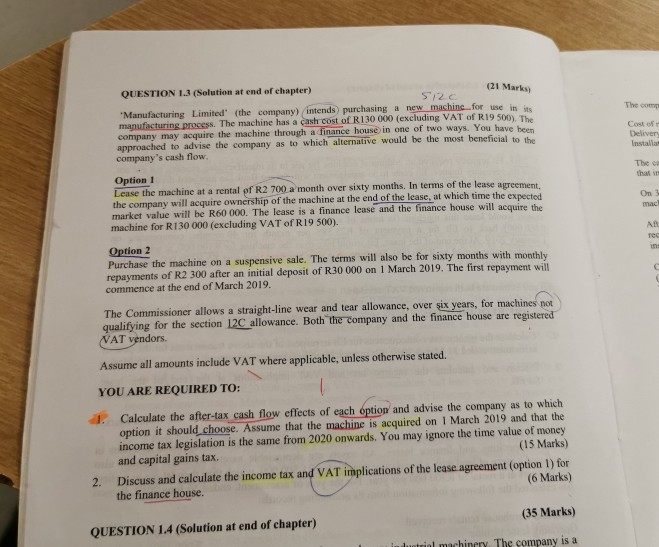

(21 Mark QUESTION 1.3 (Solution at end of chapter) 5:20 "Manufacturing Limited" (the company) intends purchasing a new machine...for use is manufacturing process. The machine has a cash cost of R130 000 (excluding VAT of R19 500) company may acquire the machine through a finance house in one of two ways. You have be approached to advise the company as to which alternative would be the most beneficial to the company's cash flow Cost of Delive Option 1 Lease the machine at a rental of R2 700 a month over sixty months. In terms of the lease agreement the company will acquire ownership of the machine at the end of the lease, at which time the expected market value will be R60 000. The lease is a finance lease and the finance house will acquire the machine for R130 000 (excluding VAT of R19 500). Om Option 2 Purchase the machine on a suspensive sale. The terms will also be for sixty months with monthly repayments of R2 300 after an initial deposit of R30 000 on 1 March 2019. The first repayment will commence at the end of March 2019, The Commissioner allows a straight-line wear and tear allowance, over six years, for machines not qualifying for the section 12C allowance. Both the company and the finance house are registered VAT vendors. Assume all amounts include VAT where applicable, unless otherwise stated. YOU ARE REQUIRED TO: Calculate the after-tax cash flow effects of each option and advise the company as to which option it should choose. Assume that the machine is acquired on 1 March 2019 and that the income tax legislation is the same from 2020 onwards. You may ignore the time value of money and capital gains tax. (15 Marks) Discuss and calculate the income tax and VAT implications of the lease agreement (option ) for the finance house. (6 Marks) 2. QUESTION 1.4 (Solution at end of chapter) (35 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts