Question: 21 Open question PROBLEM 1. The company DIAMOND is a joint stock company. Net profit for its shareholders is the basic measure of evaluating its

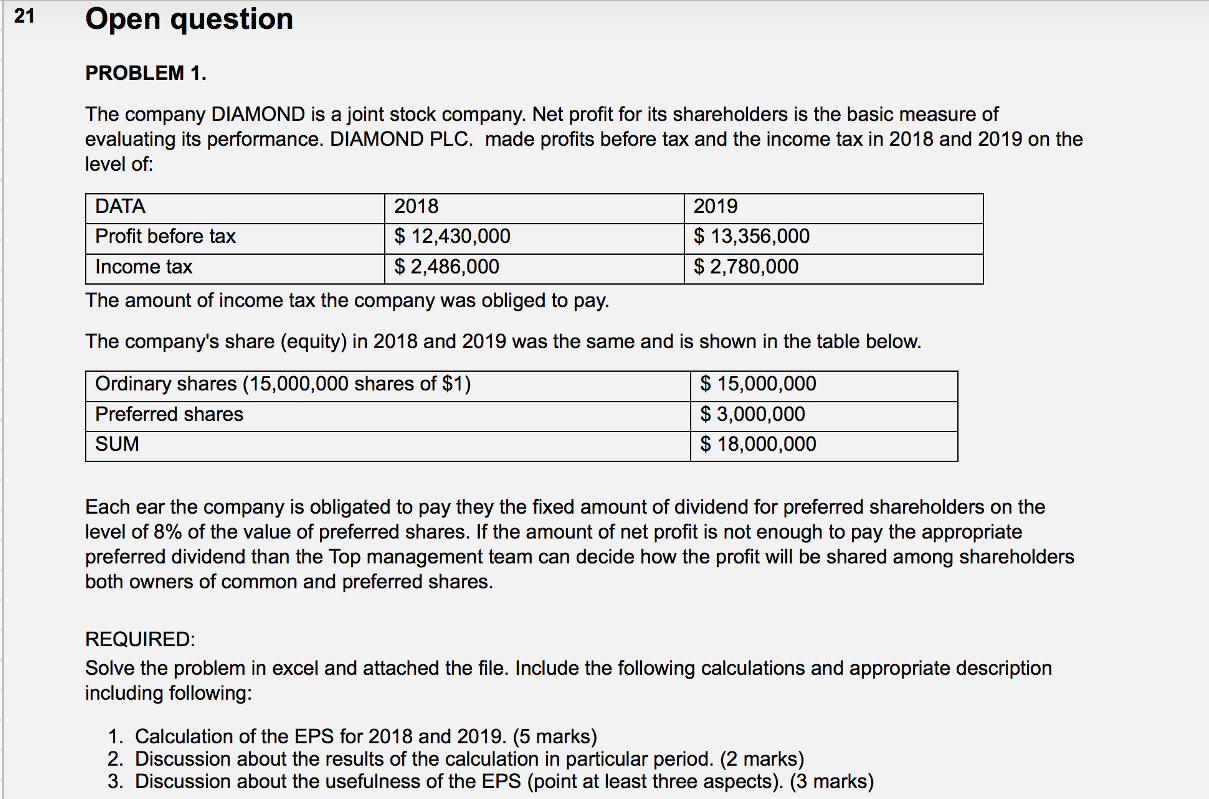

21 Open question PROBLEM 1. The company DIAMOND is a joint stock company. Net profit for its shareholders is the basic measure of evaluating its performance. DIAMOND PLC. made profits before tax and the income tax in 2018 and 2019 on the level of: 2018 $ 12,430,000 $ 2,486,000 The amount of income tax the company was obliged to pay. The company's share (equity) in 2018 and 2019 was the same and is shown in the table below. Ordinary shares (15,000,000 shares of $1) $ 15,000,000 Preferred shares $ 3,000,000 $ 18,000,000 SUM DATA Profit before tax Income tax 2019 $ 13,356,000 $ 2,780,000 Each ear the company is obligated to pay they the fixed amount of dividend for preferred shareholders on the level of 8% of the value of preferred shares. If the amount of net profit is not enough to pay the appropriate preferred dividend than the Top management team can decide how the profit will be shared among shareholders both owners of common and preferred shares. REQUIRED: Solve the problem in excel and attached the file. Include the following calculations and appropriate description including following: 1. Calculation of the EPS for 2018 and 2019. (5 marks) 2. Discussion about the results of the calculation in particular period. (2 marks) 3. Discussion about the usefulness of the EPS (point at least three aspects). (3 marks) 21 Open question PROBLEM 1. The company DIAMOND is a joint stock company. Net profit for its shareholders is the basic measure of evaluating its performance. DIAMOND PLC. made profits before tax and the income tax in 2018 and 2019 on the level of: 2018 $ 12,430,000 $ 2,486,000 The amount of income tax the company was obliged to pay. The company's share (equity) in 2018 and 2019 was the same and is shown in the table below. Ordinary shares (15,000,000 shares of $1) $ 15,000,000 Preferred shares $ 3,000,000 $ 18,000,000 SUM DATA Profit before tax Income tax 2019 $ 13,356,000 $ 2,780,000 Each ear the company is obligated to pay they the fixed amount of dividend for preferred shareholders on the level of 8% of the value of preferred shares. If the amount of net profit is not enough to pay the appropriate preferred dividend than the Top management team can decide how the profit will be shared among shareholders both owners of common and preferred shares. REQUIRED: Solve the problem in excel and attached the file. Include the following calculations and appropriate description including following: 1. Calculation of the EPS for 2018 and 2019. (5 marks) 2. Discussion about the results of the calculation in particular period. (2 marks) 3. Discussion about the usefulness of the EPS (point at least three aspects)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts