Question: 2.1 Solve for the taxable equivalent yields given the fol- lowing municipal bonds yields and marginal tax rates. Once you set up the cell correctly

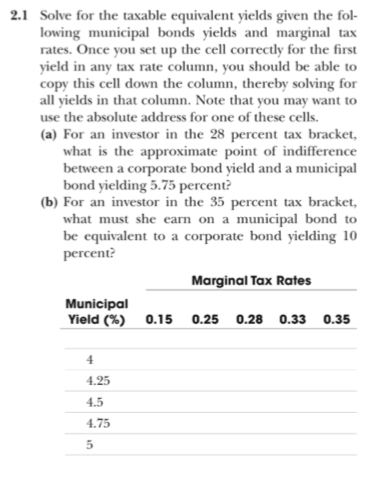

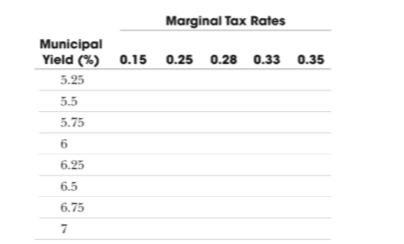

2.1 Solve for the taxable equivalent yields given the fol- lowing municipal bonds yields and marginal tax rates. Once you set up the cell correctly for the first yield in any tax rate column, you should be able to copy this cell down the column, thereby solving for all yields in that column. Note that you may want to use the absolute address for one of these cells. (a) For an investor in the 28 percent tax bracket, what is the approximate point of indifference between a corporate bond yield and a municipal bond yielding 5.75 percent? (b) For an investor in the 35 percent tax bracket, what must she earn on a municipal bond to be equivalent to a corporate bond yielding 10 percent? Marginal Tax Rates Municipal Yield (%) 0.15 0.25 0.28 0.33 0.35 4 4.25 4.5 4.75 5 5 Marginal Tax Rates Municipal Yield (%) 0.15 0.25 0.28 0.33 5.25 5.5 0.35 5.75 6 6.25 6.5 6.75 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts