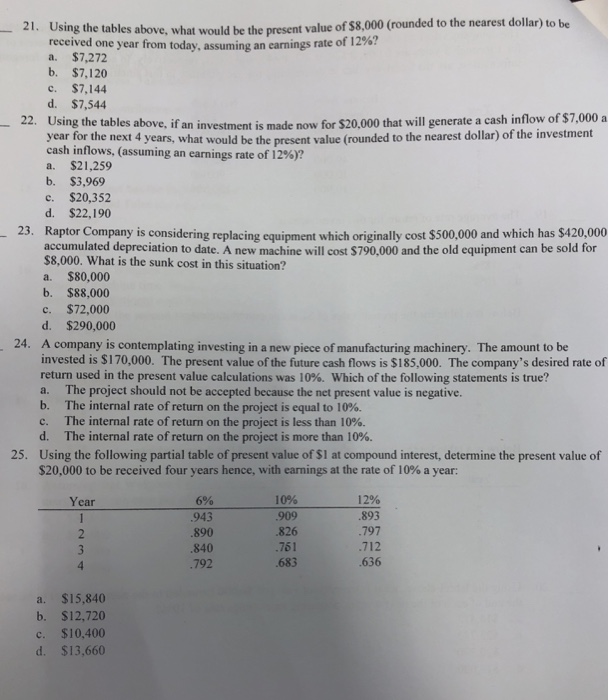

Question: 21. Using the tables above, what would be the present value of $8,000 (rounded to the nearest dollar) to be received one year a. $7,272

21. Using the tables above, what would be the present value of $8,000 (rounded to the nearest dollar) to be received one year a. $7,272 b. $7,120 from today, assuming an earnings rate of 12%? c. $7,144 d. $7,544 Using the tables above, if an investment is made now for $20,000 that will generate a cash inflow of $7,000 a cash ins 22. years, what would be the present value (rounded to the nearest dollar) of the investment cash inflows, (assuming an earnings rate of 12%)? a. $21,259 b. $3,969 c. $20,352 d. $22,190 23. Raptor Company is considering replacing equipment which originally cost $500,000 and which has $420,000 accumulated depreciation to date. A new machine will cost $790,000 and the old equipment can be sold for $8,000. What is the sunk cost in this situation? a. $80,000 b. $88,000 c. $72,000 d. $290,000 24. A company is contemplating investing in a new piece of manufacturing machinery. The amount to be invested is S170,000. The present value of the future cash flows is $185,000. The company's desired rate of return used in the present value calculations was 10%. Which of the following statements is true? a. The project should not be accepted because the net present value is negative. b, The internal rate of return on the project is equal to 10%. C. The internal rate of return on the project is less than 10%. d. The internal rate of return on the project is more than 10%. 25. Using the following partial table of present value of SI at compound interest, determine the present value of $20,000 to be received four years hence, with earnings at the rate of 10% a year: 10% 909 .826 761 683 12% 893 797 712 .636 Year 6% .943 .890 840 792 4 a. $15,840 b. $12,720 c. $10,400 d. $13,660

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts