Question: The second picture is not a different question. Just used as a reference. Will Rate! Thank You! no additional information is needed. Worldwide United Corporation,

The second picture is not a different question. Just used as a reference.

Will Rate! Thank You!

no additional information is needed.

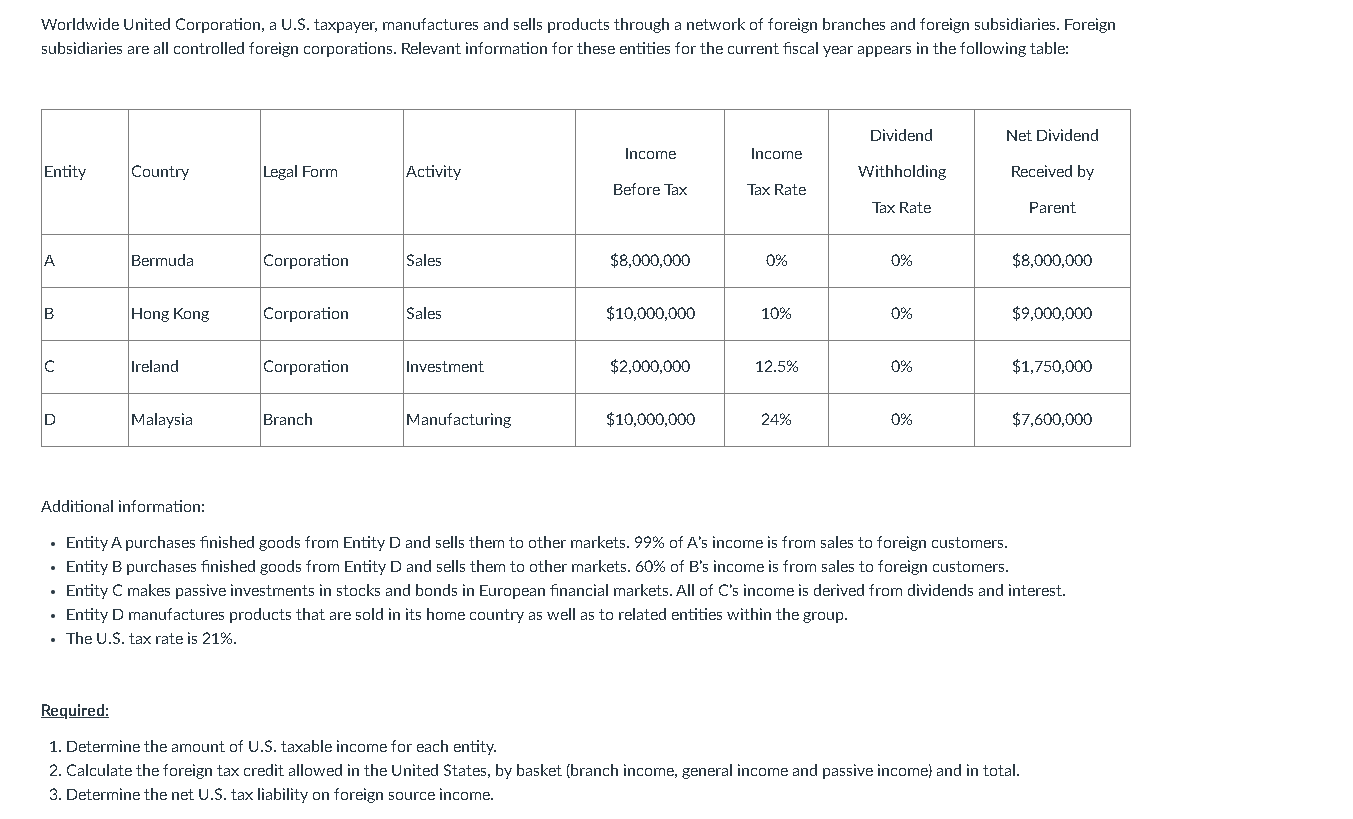

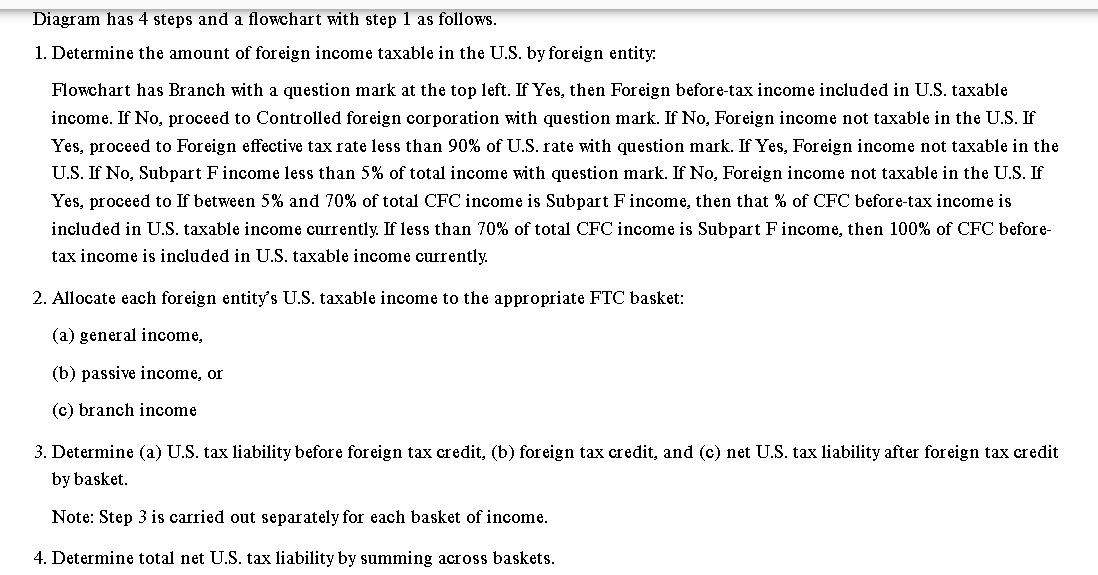

Worldwide United Corporation, a U.S. taxpayer, manufactures and sells products through a network of foreign branches and foreign subsidiaries. Foreign subsidiaries are all controlled foreign corporations. Relevant information for these entities for the current fiscal year appears in the following table: Additional information: - Entity A purchases finished goods from Entity D and sells them to other markets. \99 of A's income is from sales to foreign customers. - Entity B purchases finished goods from Entity D and sells them to other markets. 60\\% of B's income is from sales to foreign customers. - Entity \\( \\mathrm{C} \\) makes passive investments in stocks and bonds in European financial market5. All of C's income is derived from dividend5 and interest. - Entity D manufactures products that are sold in its home country as well as to related entities within the group. - The U.S. tax rate is \21. Required: 1. Determine the amount of U.S. taxable income for each entity. 2. Calculate the foreign tax credit allowed in the United States, by basket (branch income, general income and passive income) and in total. 3. Determine the net U.S. tax liability on foreign source income. Diagram has 4 steps and a flowchart with step 1 as follows. 1. Determine the amount of foreign income taxable in the U.S. by foreign entity. Flowchart has Branch with a question mark at the top left. If Yes, then Foreign before-tax income included in U.S. taxable income. If No, proceed to Controlled foreign corporation with question mark. If No, Foreign income not taxable in the U.S. If Yes, proceed to Foreign effective tax rate less than \90 of U.S. rate with question mark. If Yes, Foreign income not taxable in the U.S. If No, Subpart \\( \\mathrm{F} \\) income less than \5 of total income with question mark. If No, Foreign income not taxable in the U.S. If Yes, proceed to If between \5 and \70 of total CFC income is Subpart F income, then that \\% of CFC before-tax income is included in U.S. taxable income currently. If less than \70 of total CFC income is Subpart F income, then \100 of CFC beforetax income is included in U.S. taxable income currently. 2. Allocate each foreign entity's U.S. taxable income to the appropriate FTC basket: (a) general income, (b) passive income, or (c) branch income 3. Determine (a) U.S. tax liability before foreign tax credit, (b) foreign tax credit, and (c) net U.S. tax liability after foreign tax credit by basket. Note: Step 3 is carried out separately for each basket of income. 4. Determine total net U.S. tax liability by summing across baskets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts