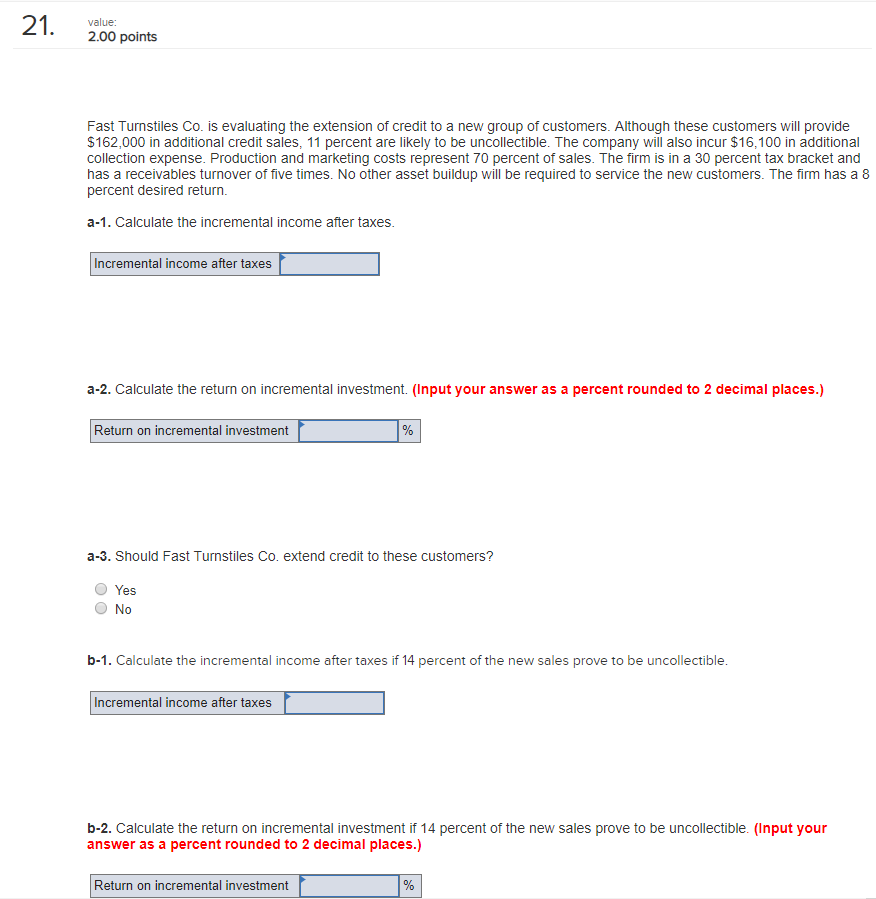

Question: 21. value: 2.00 points Fast Turnstiles Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide $162,000

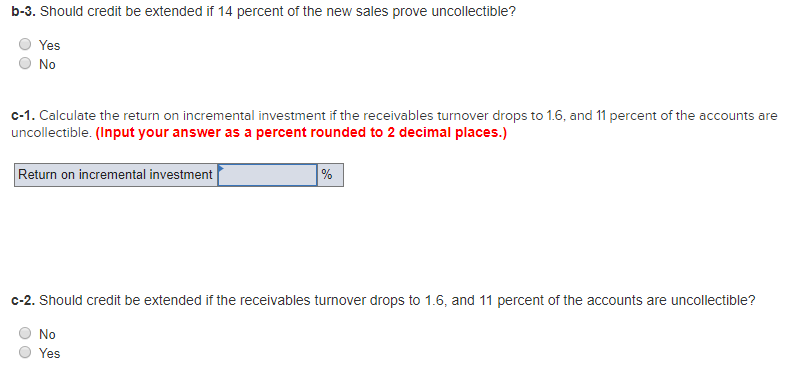

21. value: 2.00 points Fast Turnstiles Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide $162,000 in additional credit sales, 11 percent are likely to be uncollectible. The company will also incur $16,100 in additional collection expense. Production and marketing costs represent 70 percent of sales. The firm is in a 30 percent tax bracket and has a receivables turnover of five times. No other asset buildup will be required to service the new customers. The fim has a 8 percent desired return a-1. Calculate the incremental income after taxes. Incremental income after taxes a-2. Calculate the return on incremental investment. (Input your answer as a percent rounded to 2 decimal places.) Return on incremental investment % a-3. Should Fast Turnstiles Co. extend credit to these customers? Yes No b-1. Calculate the incremental income after taxes if 14 percent of the new sales prove to be uncollectible. Incremental income after taxes b-2. Calculate the return on incremental investment if 14 percent of the new sales prove to be uncollectible. (Input your percent rounded to 2 decimal places.) answer as a Return on incremental investment b-3. Should credit be extended if 14 percent of the new sales prove uncollectible? Yes No c-1. Calculate the return on incremental investment if the receivables turnover drops to 1.6, and 11 percent of the accounts are uncollectible. (Input your answer as a percent rounded to 2 decimal places.) Return on incremental investment c-2. Should credit be extended if the receivables turnover drops to 1.6, and 11 percent of the accounts are uncollectible? No Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts