Question: 211 . T Normal 1 No Spac... Heading 1 Heading 2 Subtitle Subtle Em... Emphasis Title Intense oh Styles .edu so we can verify your

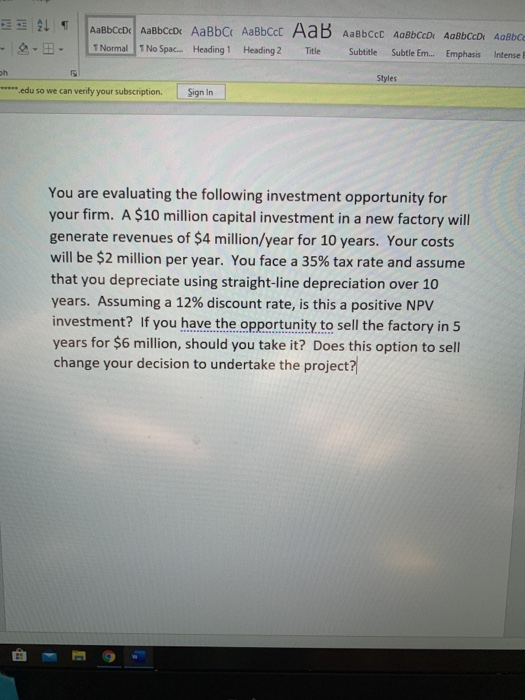

211 . T Normal 1 No Spac... Heading 1 Heading 2 Subtitle Subtle Em... Emphasis Title Intense oh Styles .edu so we can verify your subscription. Sign In You are evaluating the following investment opportunity for your firm. A $10 million capital investment in a new factory will generate revenues of $4 million/year for 10 years. Your costs will be $2 million per year. You face a 35% tax rate and assume that you depreciate using straight-line depreciation over 10 years. Assuming a 12% discount rate, is this a positive NPV investment? If you have the opportunity to sell the factory in 5 years for $6 million, should you take it? Does this option to sell change your decision to undertake the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts