Answered step by step

Verified Expert Solution

Question

1 Approved Answer

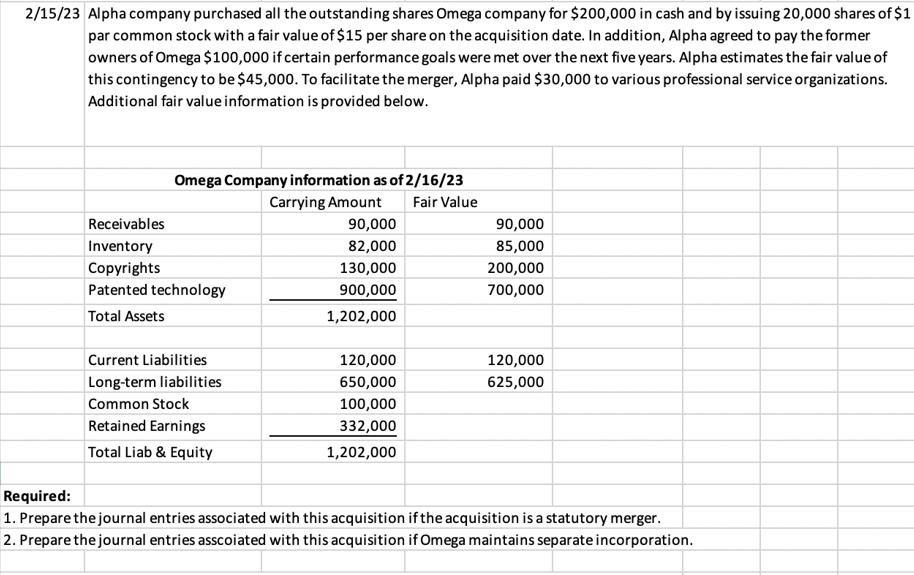

2/15/23 Alpha company purchased all the outstanding shares Omega company for $200,000 in cash and by issuing 20,000 shares of $1 par common stock

2/15/23 Alpha company purchased all the outstanding shares Omega company for $200,000 in cash and by issuing 20,000 shares of $1 par common stock with a fair value of $15 per share on the acquisition date. In addition, Alpha agreed to pay the former owners of Omega $100,000 if certain performance goals were met over the next five years. Alpha estimates the fair value of this contingency to be $45,000. To facilitate the merger, Alpha paid $30,000 to various professional service organizations. Additional fair value information is provided below. Omega Company information as of 2/16/23 Carrying Amount Fair Value Receivables Inventory Copyrights Patented technology Total Assets Current Liabilities Long-term liabilities Common Stock Retained Earnings Total Liab & Equity 90,000 82,000 130,000 900,000 1,202,000 120,000 650,000 100,000 332,000 1,202,000 90,000 85,000 200,000 700,000 120,000 625,000 Required: 1. Prepare the journal entries associated with this acquisition if the acquisition is a statutory merger. 2. Prepare the journal entries asscoiated with this acquisition if Omega maintains separate incorporation.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Journal Entries for Statutory Merger a To record the purchase of Omega Company Account Debi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started