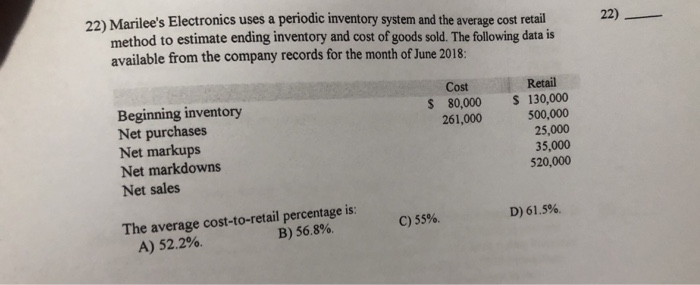

Question: 22) 22) Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The

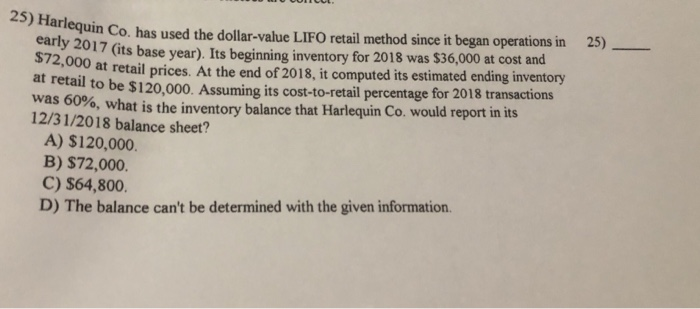

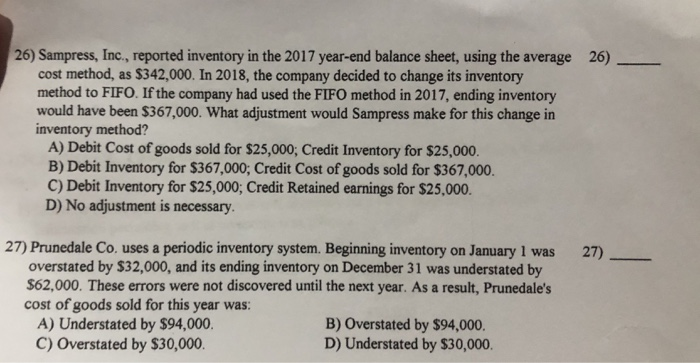

22) 22) Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of June 2018: $ Cost 80,000 261,000 Beginning inventory Net purchases Net markups Net markdowns Net sales Retail $ 130,000 500,000 25,000 35,000 520,000 D) 61.5% C) 55% The average cost-to-retail percentage is: A) 52.2% B) 56.8% early 2017 (its base year) 25) marlequin Co. has used the dollar-value LIFO retail method since it began operations in 2017 (its base year). Its beginning inventory for 2018 was $36,000 at cost and at retail prices. At the end of 2018, it computed its estimated ending inventory all to be $120,000. Assuming its cost-to-retail percentage for 2018 transactions was 60%, what is the inventory balance that Harlequin Co. would report in its 12/31/2018 balance sheet? A) $120,000 B) $72,000. C) $64,800 D) The balance can't be determined with the given information 26) 26) Sampress, Inc., reported inventory in the 2017 year-end balance sheet, using the average cost method, as $342,000. In 2018, the company decided to change its inventory method to FIFO. If the company had used the FIFO method in 2017, ending inventory would have been $367,000. What adjustment would Sampress make for this change in inventory method? A) Debit Cost of goods sold for $25,000; Credit Inventory for $25,000. B) Debit Inventory for $367,000; Credit Cost of goods sold for $367,000. C) Debit Inventory for $25,000; Credit Retained earnings for $25,000. D) No adjustment is necessary. 27). 27) Prunedale Co. uses a periodic inventory system. Beginning inventory on January I was overstated by $32,000, and its ending inventory on December 31 was understated by $62,000. These errors were not discovered until the next year. As a result, Prunedale's cost of goods sold for this year was: A) Understated by $94,000. B) Overstated by $94,000. C) Overstated by $30,000. D) Understated by $30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts