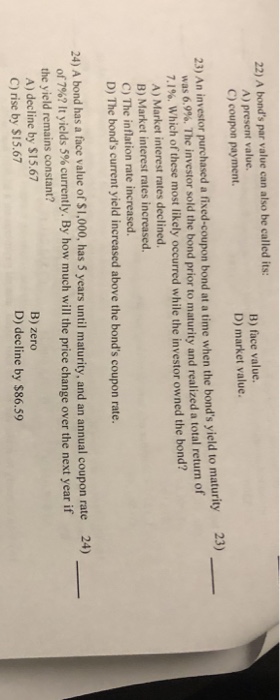

Question: 22) A bond's par value can also be called its: A) present value. C) coupon payment. B) face value. D) market value. 23) An investor

22) A bond's par value can also be called its: A) present value. C) coupon payment. B) face value. D) market value. 23) An investor purchased a fixed-coupon bond at a time when the bond's yield to maturity 23) was 6.9%. The investor sold the bond prior to maturity and realized a total return of 7.1%, which of these most likely occurred while the investor owned the bond? A) Market interest rates declined. B) Market interest rates increased. C) The inflation rate increased D) The bond's current yield increased above the bond's coupon rate. 24) A bond has a face value of S1.000, has 5 years until maturity, and an annual coupon rate 24) of 7%? It yields 5% currently. By how much will the price change over the next year if the yield remains constant? A) decline by $15.67 C) rise by S15.67 B) zero D) decline by $86.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts