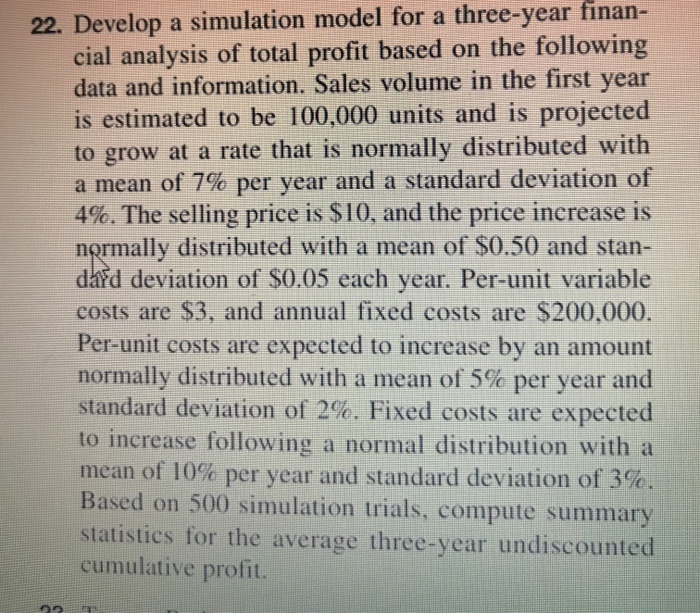

Question: 22. Develop a simulation model for a three-year finan- cial analysis of total profit based on the following data and information. Sales volume in the

22. Develop a simulation model for a three-year finan- cial analysis of total profit based on the following data and information. Sales volume in the first year is estimated to be 100,000 units and is projected to grow at a rate that is normally distributed with a mean of 7% per year and a standard deviation of 4%. The selling price is $10, and the price increase is normally distributed with a mean of $0.50 and stan- dard deviation of $0.05 each year. Per-unit variable costs are $3, and annual fixed costs are $200,000. Per-unit costs are expected to increase by an amount normally distributed with a mean of 5% per year and standard deviation of 2%. Fixed costs are expected to increase following a normal distribution with a mean of 10% per year and standard deviation of 3%. Based on 500 simulation trials, compute summary statistics for the average three-year undiscounted cumulative profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts