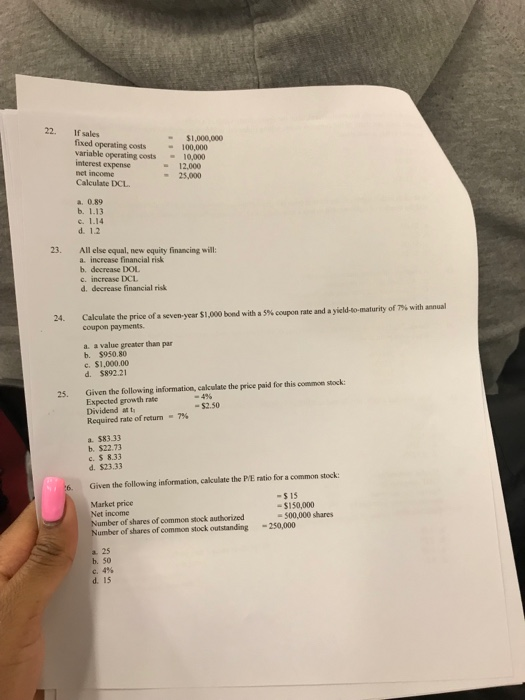

Question: 22. If sales fixed operating costs100,000 variable operating costs10,000 interest expense $1,000,000 12,000 25,000 Calculate DCL a. 0.89 b. 1.13 d. 1.2 23. All else

22. If sales fixed operating costs100,000 variable operating costs10,000 interest expense $1,000,000 12,000 25,000 Calculate DCL a. 0.89 b. 1.13 d. 1.2 23. All else equal, new equity financing will: a. increase financial risk b. decrease DOL c. increase DCL d decrease financial risk 24. Calculate the price of a seven-year $1,000 bond with a S% coupon rate and a yield-to-maturity of 79% with annual coupon payments a a value greater than par b. $950.80 c. $1,000.00 d. $892.21 25. Given the following information, calculate the price paid for this common stock Expected growth rate Dividend a t Required rate of returm7% -$2.50 a. $83.33 b.$22.73 c. $ 8.33 d. $23.33 6 Given the following information, cakculate the PE ratio for a common stock: Market price Net income Number of shares of common stock authorized Number of shares of common stock outstanding250,000 -$ 15 - $150,000 -500,000 shares a. 25 b. 50 . 4% d. 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts