Question: Mostly need help with the formulas. This format helps me a lot. ny work mode : This shows what is correct or incorrect for the

Mostly need help with the formulas. This format helps me a lot.

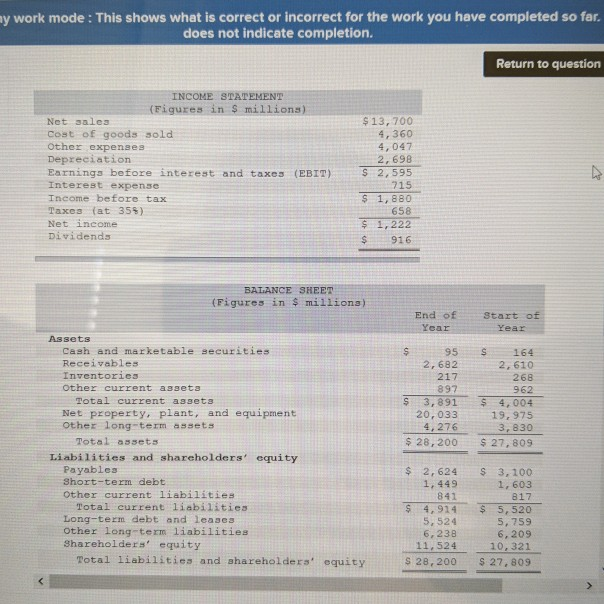

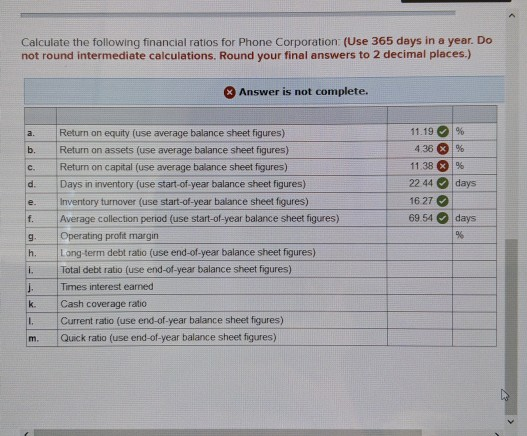

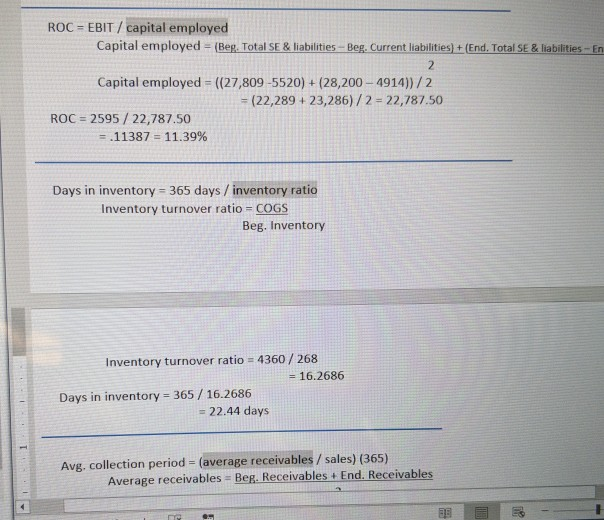

ny work mode : This shows what is correct or incorrect for the work you have completed so far. does not indicate completion. Return to question INCOME STATEMENT (Figures in $ millions) Net sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 359) Net income Dividends V $ 13,700 4, 360 4,047 2,698 $ 2,595 715 $ 1,880 658 $ 1,222 $ 916 BALANCE SHEET (Figures in $ milliona) End of Year Start of Year $ 95 2,682 217 897 $ 3,891 20,033 4,276 $ 28, 200 S 164 2, 610 268 962 $4,004 19,975 3,830 $ 27,809 Assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Net property, plant, and equipment Other long-term assets Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 2,624 1,449 841 $ 4,914 5,524 6, 238 11,524 $ 28, 200 $ 3, 100 1,603 817 $ 5,520 5,759 6,209 10,321 $ 27, 809 > Calculate the following financial ratios for Phone Corporation (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.) Answer is not complete. a. b. C. d. 11.19 % 4 38 % % 11.38 X % 22.44 days 16 27 69.54 days % e. >S f. Return on equity (use average balance sheet figures) Return on assets (use average balance sheet figures) Return on capital (use average balance sheet figures) Days in inventory (use start-of-year balance sheet figures) Inventory turnover (use start-of-year balance sheet figures) Average collection period (use start-of-year balance sheet figures) Operating profit margin Long term debt ratio (use end-of-year balance sheet figures) Total debt ratio (use end-of-year balance sheet figures) Times interest earned Cash coverage ratio Current ratio (use end-of-year balance sheet figures) Quick ratio (use end-of-year balance sheet figures) g h. 1. k. 1. m. ROC = EBIT / capital employed Capital employed = (Beg. Total SE & liabilities - Beg. Current liabilities) + (End. Total SE & liabilities - En 2 Capital employed = ((27,809-5520) + (28,200 - 4914))/2 = (22,289 +23,286)/2 = 22,787.50 ROC = 2595/ 22,787.50 = .11387 = 11.39% Days in inventory = 365 days / inventory ratio Inventory turnover ratio = COGS Beg. Inventory Inventory turnover ratio = 4360 / 268 = 16.2686 Days in inventory = 365 / 16.2686 = 22.44 days Avg. collection period = (average receivables / sales) (365) Average receivables = Beg. Receivables + End. Receivables ELE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts