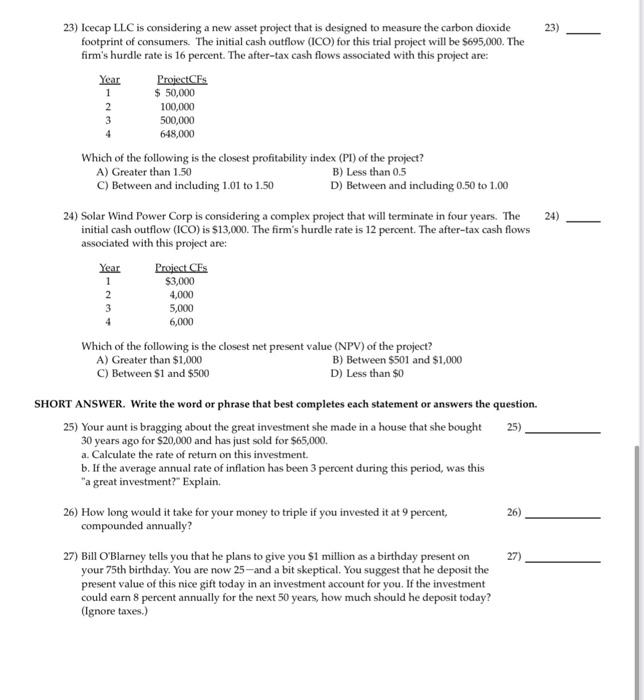

Question: 23) ) 23) Icecap LLC is considering a new asset project that is designed to measure the carbon dioxide footprint of consumers. The initial cash

23) ) 23) Icecap LLC is considering a new asset project that is designed to measure the carbon dioxide footprint of consumers. The initial cash outflow (ICO) for this trial project will be $695,000. The firm's hurdle rate is 16 percent. The after-tax cash flows associated with this project are: Year ProjectCES 1 $ 50,000 2 100,000 500,000 4 648,000 Which of the following is the closest profitability index (PI) of the project? A) Greater than 1.50 B) Less than 0.5 C) Between and including 1.01 to 1.50 D) Between and including 0.50 to 1.00 24) 1 24) Solar Wind Power Corp is considering a complex project that will terminate in four years. The initial cash outflow (ICO) is $13,000. The firm's hurdle rate is 12 percent. The after-tax cash flows associated with this project are: Year Project CES $3,000 2 4,000 3 5,000 4 6,000 Which of the following is the closest net present value (NPV) of the project? A) Greater than $1,000 B) Between $501 and $1,000 C) Between $1 and $500 D) Less than $0 SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 25) Your aunt is bragging about the great investment she made in a house that she bought 25) 30 years ago for $20,000 and has just sold for $65,000. a. Calculate the rate of return on this investment b. If the average annual rate of inflation has been 3 percent during this period, was this "a great investment?" Explain. 26) 26) How long would it take for your money to triple if you invested it at 9 percent, compounded annually? 27) 27) Bill O'Blarney tells you that he plans to give you $1 million as a birthday present on your 75th birthday. You are now 25-and a bit skeptical. You suggest that he deposit the present value of this nice gift today in an investment account for you. If the investment could earn 8 percent annually for the next 50 years, how much should he deposit today? (Ignore taxes.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts