Question: 23. (4 points) Consider a zero-coupon bond maturing in 2 years with a face value of $1,000 and a yield to maturity of 2%. Assume

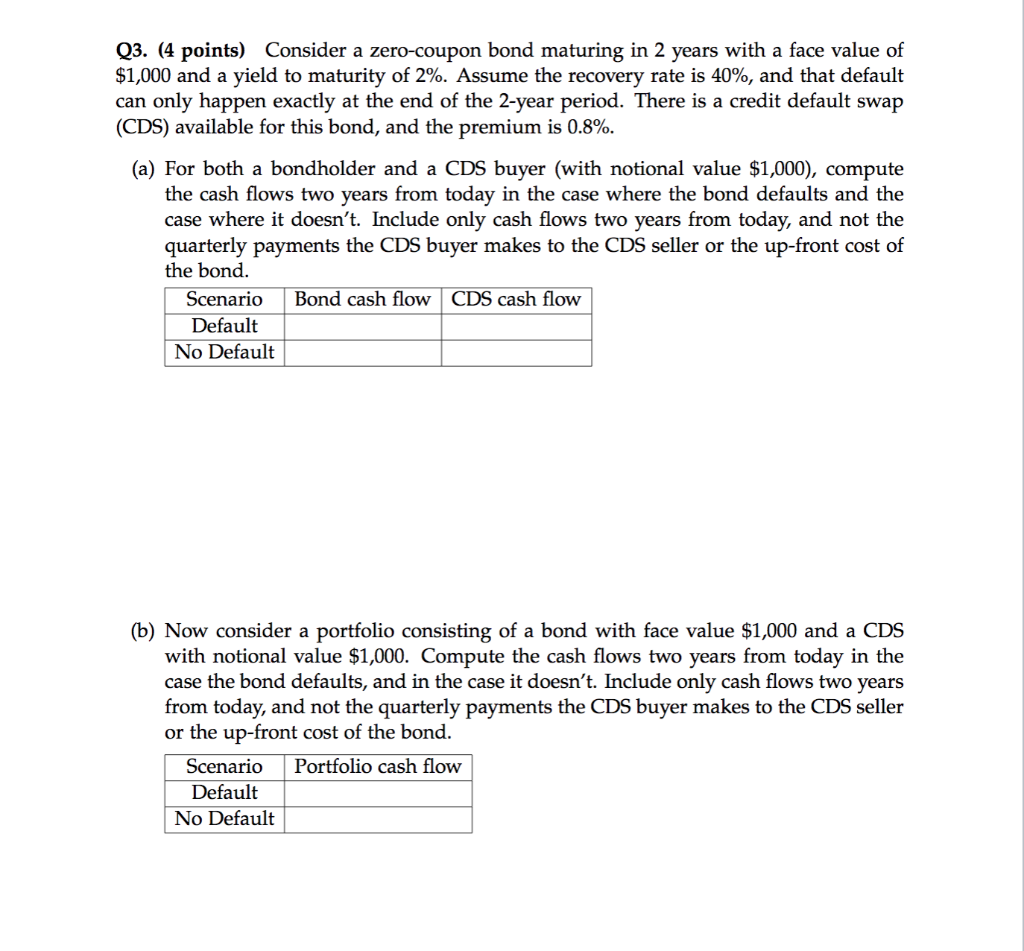

23. (4 points) Consider a zero-coupon bond maturing in 2 years with a face value of $1,000 and a yield to maturity of 2%. Assume the recovery rate is 40%, and that default can only happen exactly at the end of the 2-year period. There is a credit default swap (CDS) available for this bond, and the premium is 0.8%. (a) For both a bondholder and a CDS buyer (with notional value $1,000), compute the cash flows two years from today in the case where the bond defaults and the case where it doesn't. Include only cash flows two years from today, and not the quarterly payments the CDS buyer makes to the CDS seller or the up-front cost of the bond. Scenario Bond cash flow Default CDS cash flow No Default (b) Now consider a portfolio consisting of a bond with face value $1,000 and a CDS with notional value $1,000. Compute the cash flows two years from today in the case the bond defaults, and in the case it doesn't. Include only cash flows two years from today, and not the quarterly payments the CDS buyer makes to the CDS selleir or the up-front cost of the bond. Scenario Default No Default Portfolio cash flow 23. (4 points) Consider a zero-coupon bond maturing in 2 years with a face value of $1,000 and a yield to maturity of 2%. Assume the recovery rate is 40%, and that default can only happen exactly at the end of the 2-year period. There is a credit default swap (CDS) available for this bond, and the premium is 0.8%. (a) For both a bondholder and a CDS buyer (with notional value $1,000), compute the cash flows two years from today in the case where the bond defaults and the case where it doesn't. Include only cash flows two years from today, and not the quarterly payments the CDS buyer makes to the CDS seller or the up-front cost of the bond. Scenario Bond cash flow Default CDS cash flow No Default (b) Now consider a portfolio consisting of a bond with face value $1,000 and a CDS with notional value $1,000. Compute the cash flows two years from today in the case the bond defaults, and in the case it doesn't. Include only cash flows two years from today, and not the quarterly payments the CDS buyer makes to the CDS selleir or the up-front cost of the bond. Scenario Default No Default Portfolio cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts