Question: Problem 3: Expected returns vs. yields to maturity (3 points) A zero-coupon bond maturing in 2 years with a face value of $1,000 has a

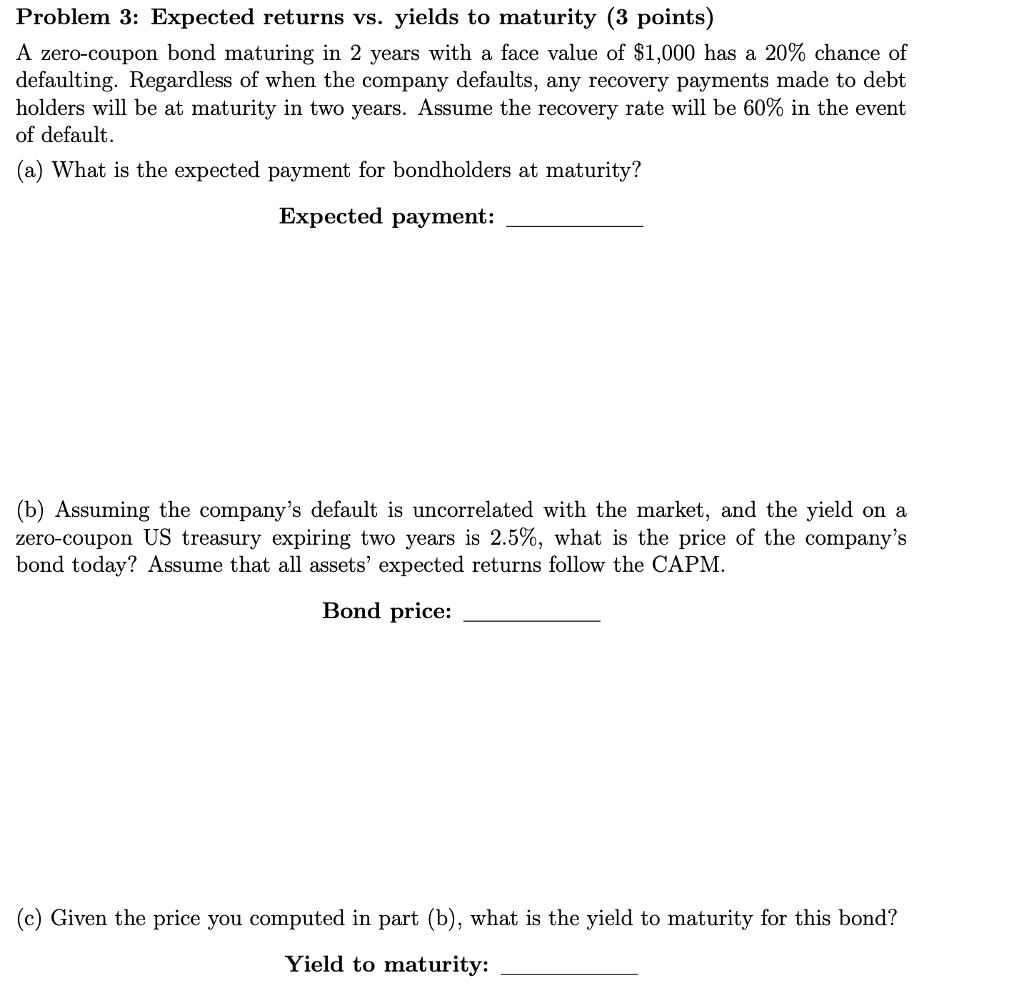

Problem 3: Expected returns vs. yields to maturity (3 points) A zero-coupon bond maturing in 2 years with a face value of $1,000 has a 20% chance of defaulting. Regardless of when the company defaults, any recovery payments made to debt holders will be at maturity in two years. Assume the recovery rate will be 60% in the event of default. (a) What is the expected payment for bondholders at maturity? Expected payment: (b) Assuming the company's default is uncorrelated with the market, and the yield on a pon US treasury expiring two years is 2.5%, what is the price of the company's bond today? Assume that all assets' expected returns follow the CAPM. Bond price: (c) Given the price you computed in part (b), what is the yield to maturity for this bond? Yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts