Question: 2.3 A VC firm is considering two different structures for its new $250M fund. Both structures would have management fees of 2 percent per year

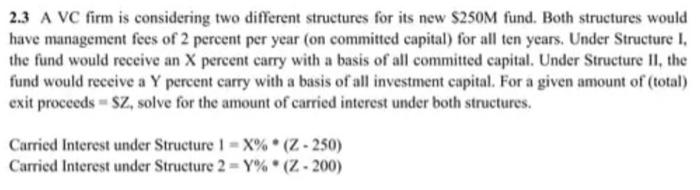

2.3 A VC firm is considering two different structures for its new $250M fund. Both structures would have management fees of 2 percent per year (on committed capital) for all ten years. Under Structure I, the fund would receive an X pereent carry with a basis of all committed capital. Under Structure II, the fund would receive a Y percent carry with a basis of all investment capital. For a given amount of (total) exit proceeds =$SZ, solve for the amount of carried interest under both structures. Carried Interest under Structure 1=X%(Z250) Carried Interest under Structure 2=Y%(Z200)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts