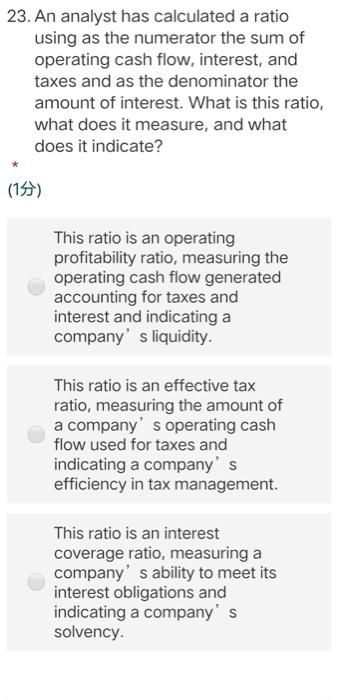

Question: 23. An analyst has calculated a ratio using as the numerator the sum of operating cash flow, interest, and taxes and as the denominator the

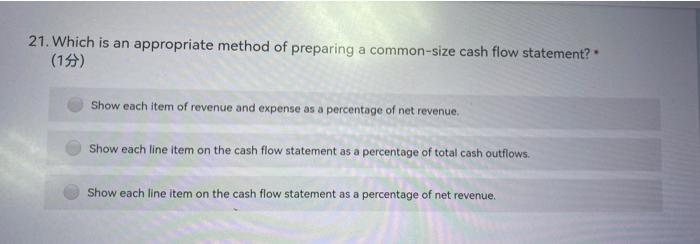

23. An analyst has calculated a ratio using as the numerator the sum of operating cash flow, interest, and taxes and as the denominator the amount of interest. What is this ratio, what does it measure, and what does it indicate? (13) This ratio is an operating profitability ratio, measuring the operating cash flow generated accounting for taxes and interest and indicating a company's liquidity This ratio is an effective tax ratio, measuring the amount of a company's operating cash flow used for taxes and indicating a company's efficiency in tax management. This ratio is an interest coverage ratio, measuring a company's ability to meet its interest obligations and indicating a company's solvency. 21. Which is an appropriate method of preparing a common-size cash flow statement? (19) Show each item of revenue and expense as a percentage of net revenue. Show each line item on the cash flow statement as a percentage of total cash outflows. Show each line item on the cash flow statement as a percentage of net revenue. 21. Which is an appropriate method of preparing a common-size cash flow statement? (19) Show each item of revenue and expense as a percentage of net revenue. Show each line item on the cash flow statement as a percentage of total cash outflows. Show each line item on the cash flow statement as a percentage of net revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts