Question: 23) Consider two risky securities. The correlation between their returns is 0.09. The first security's expected rate of return is 21%. Its standard deviation is

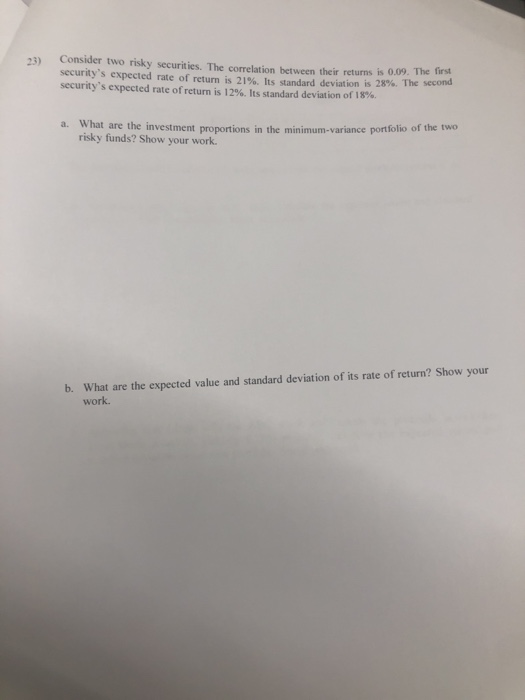

23) Consider two risky securities. The correlation between their returns is 0.09. The first security's expected rate of return is 21%. Its standard deviation is 28%. The security's expected rate of return is 12%. Its standard deviation of 18%. second a. What are the investment proportions in the minimum-variance portfolio of the two risky funds? Show your work b. What are the expected value and standard deviation of its rate of return? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts