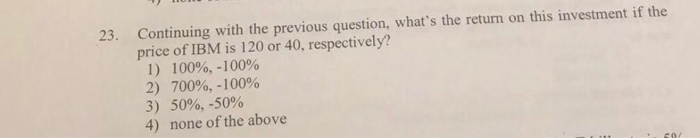

Question: 23. Continuing with the previous question, what's the return on this investment if the price of IBM is 120 or 40, respectively? 1) 100%, -100%

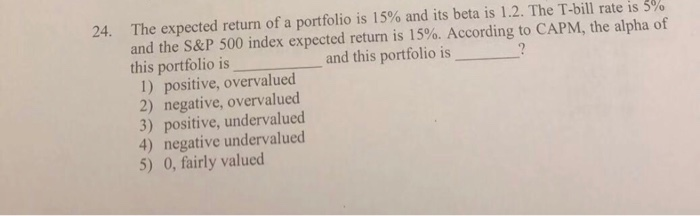

23. Continuing with the previous question, what's the return on this investment if the price of IBM is 120 or 40, respectively? 1) 100%, -100% 2) 700%, -100% 3) 50%, -50% 4) none of the above 24. The expected return of a portfolio is 15% and its beta is 1.2. The T-bill rate is 5% and the S&P 500 index expected return is 15%. According to CAPM, the alpha of this portfolio is and this portfolio is 1) positive, overvalued 2) negative, overvalued 3) positive, undervalued 4) negative undervalued 5) 0, fairly valued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts