Question: 23. In Question 1, we explored the bond price sensitivity when bonds with a low initial market rate changes [from 3% to 4%]. In this

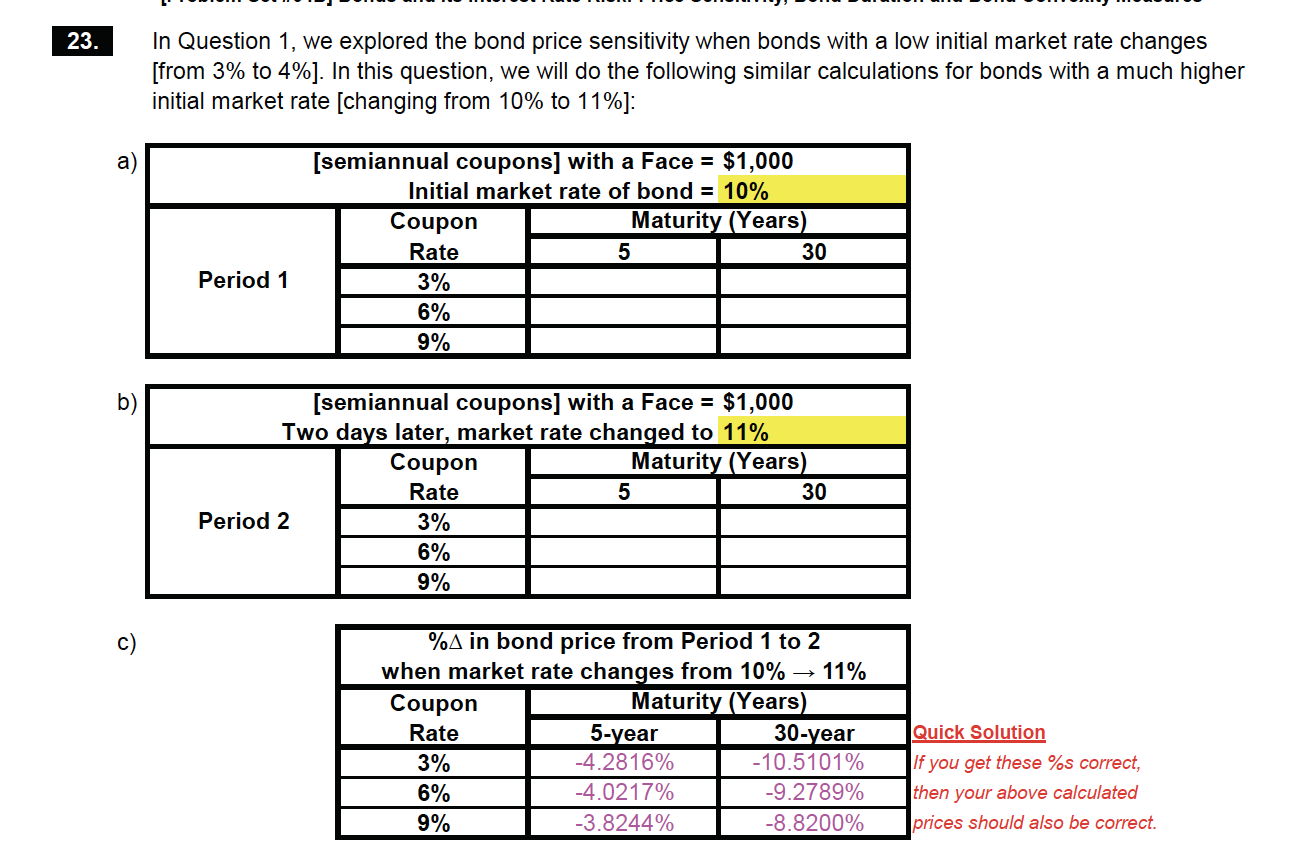

23. In Question 1, we explored the bond price sensitivity when bonds with a low initial market rate changes [from 3% to 4%]. In this question, we will do the following similar calculations for bonds with a much higher initial market rate [changing from 10% to 11%): a) [semiannual coupons] with a Face = $1,000 Initial market rate of bond = 10% Coupon Maturity (Years) Rate 5 30 Period 1 3% 6% 9% b) [semiannual coupons] with a Face = $1,000 Two days later, market rate changed to 11% Coupon Mat (Years) Rate 5 30 Period 2 3% 6% 9% c) %A in bond price from Period 1 to 2 when market rate changes from 10% 11% Coupon Maturity (Years Rate 5-year 30-year 3% -4.2816% -10.5101% 6% -4.0217% -9.2789% 9% -3.8244% -8.8200% Quick Solution If you get these %s correct, then your above calculated prices should also be correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts