Question: 23 On January 1, 2021, a company had an existing deferred tax liability attributable to a temporary difference of $20,000. The tax rate at

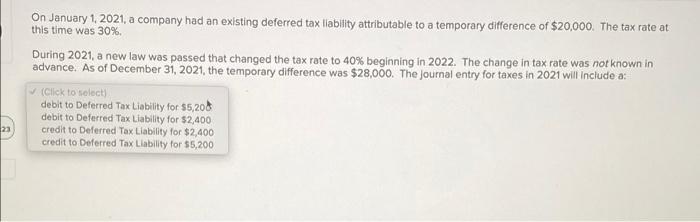

23 On January 1, 2021, a company had an existing deferred tax liability attributable to a temporary difference of $20,000. The tax rate at this time was 30%. During 2021, a new law was passed that changed the tax rate to 40% beginning in 2022. The change in tax rate was not known in advance. As of December 31, 2021, the temporary difference was $28,000. The journal entry for taxes in 2021 will include a: (Click to select) debit to Deferred Tax Liability for $5,20 debit to Deferred Tax Liability for $2,400 credit to Deferred Tax Liability for $2,400 credit to Deferred Tax Liability for $5,200

Step by Step Solution

3.26 Rating (155 Votes )

There are 3 Steps involved in it

Credit to deffered tax liabilty 5200 Info given Temporary Difference 2800... View full answer

Get step-by-step solutions from verified subject matter experts